Market Participants Recognise Wens Foodstuff Group Co., Ltd.'s (SZSE:300498) Revenues

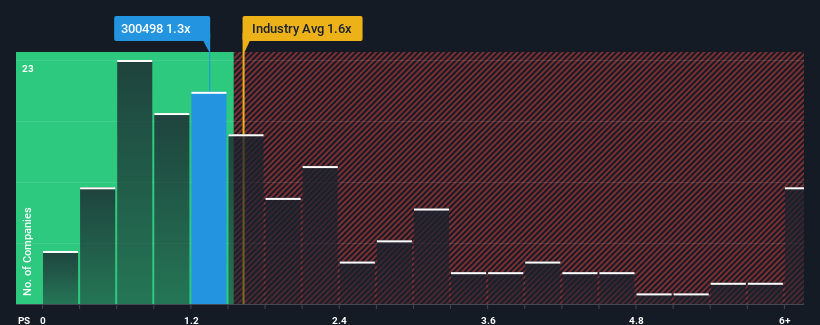

With a median price-to-sales (or "P/S") ratio of close to 1.6x in the Food industry in China, you could be forgiven for feeling indifferent about Wens Foodstuff Group Co., Ltd.'s (SZSE:300498) P/S ratio of 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Wens Foodstuff Group

How Wens Foodstuff Group Has Been Performing

Wens Foodstuff Group's revenue growth of late has been pretty similar to most other companies. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Wens Foodstuff Group will help you uncover what's on the horizon.How Is Wens Foodstuff Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wens Foodstuff Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 37% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 18% over the next year. With the industry predicted to deliver 16% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Wens Foodstuff Group's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Wens Foodstuff Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Wens Foodstuff Group with six simple checks.

If you're unsure about the strength of Wens Foodstuff Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wens Foodstuff Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300498

Wens Foodstuff Group

Operates as a livestock and poultry farming company in China.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives