Global markets have shown resilience, with U.S. stocks climbing on easing trade concerns and better-than-expected earnings, while Europe and Japan also posted gains amid positive economic indicators. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing opportunities for investors seeking growth at lower price points. Despite being a somewhat outdated term, these stocks can still provide significant upside potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.82 | SEK286.44M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.89 | MYR1.39B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.335 | MYR972.23M | ✅ 4 ⚠️ 3 View Analysis > |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.39 | MYR666.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$45.79B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$687.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.875 | £437.9M | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.46 | A$71.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,651 stocks from our Global Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Beijing Jingyuntong Technology (SHSE:601908)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beijing Jingyuntong Technology Co., Ltd. and its subsidiaries focus on the research, development, production, and sale of monocrystalline silicon products both in China and internationally, with a market cap of CN¥6.33 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for Beijing Jingyuntong Technology Co., Ltd.

Market Cap: CN¥6.33B

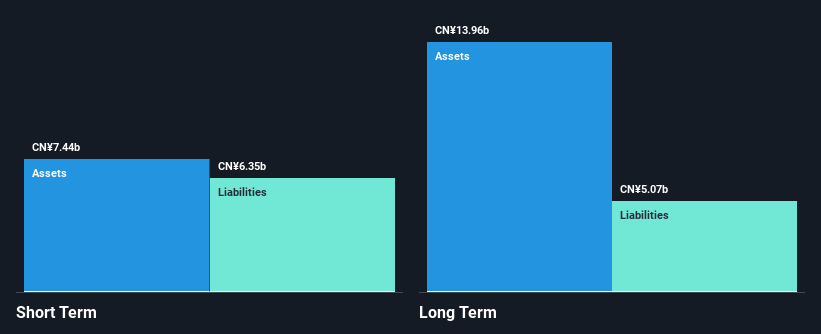

Beijing Jingyuntong Technology Co., Ltd. faces significant challenges, with recent earnings showing a substantial decline in sales to CN¥683.09 million and a net loss of CN¥91.41 million for Q1 2025. Despite short-term assets exceeding liabilities, the company struggles with profitability and cash flow issues, as its debt is not well-covered by operating cash flow. The auditor's going concern doubts further highlight financial instability. However, the company's debt-to-equity ratio has improved over five years, and shares have not been diluted recently, offering some stability amidst volatility in this high-risk investment category.

- Click here to discover the nuances of Beijing Jingyuntong Technology with our detailed analytical financial health report.

- Assess Beijing Jingyuntong Technology's previous results with our detailed historical performance reports.

Nanfang Zhongjin Environment (SZSE:300145)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanfang Zhongjin Environment Co., Ltd., with a market cap of CN¥6.83 billion, operates in the general equipment manufacturing sector through its subsidiaries.

Operations: Nanfang Zhongjin Environment Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥6.83B

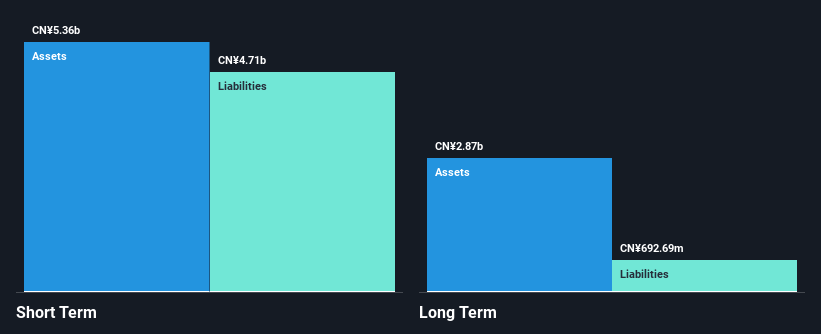

Nanfang Zhongjin Environment Co., Ltd. demonstrates a mix of strengths and challenges typical for its category. The company reported annual sales of CN¥5.05 billion, with net income rising to CN¥218.25 million, indicating profitability despite a decline in revenue from the previous year. Its financial stability is supported by short-term assets exceeding liabilities and satisfactory debt management, with operating cash flow covering 42.2% of its debt. However, earnings growth has slowed compared to historical averages, and recent profits were bolstered by a significant one-off gain of CN¥70.4 million, suggesting potential volatility in future results.

- Dive into the specifics of Nanfang Zhongjin Environment here with our thorough balance sheet health report.

- Gain insights into Nanfang Zhongjin Environment's future direction by reviewing our growth report.

Hainan Shennong Seed Industry Technology (SZSE:300189)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan Shennong Seed Industry Technology Co., Ltd. operates in the agricultural sector focusing on seed production and development, with a market cap of CN¥4.21 billion.

Operations: Hainan Shennong Seed Industry Technology Co., Ltd. has not reported any specific revenue segments at this time.

Market Cap: CN¥4.21B

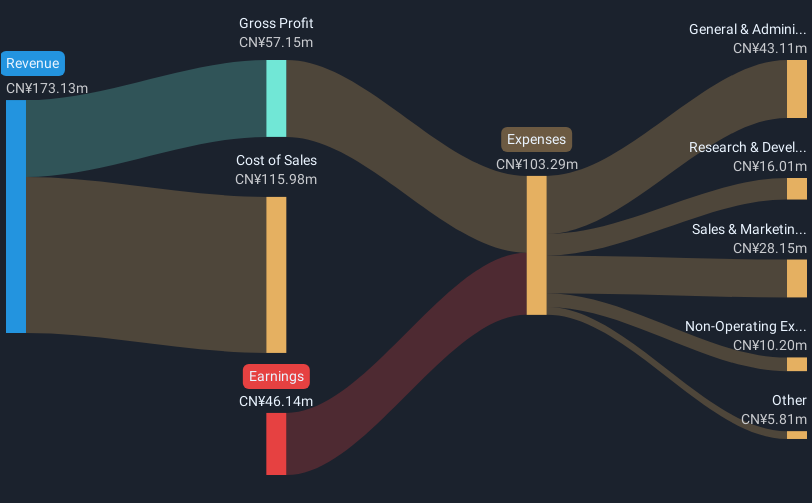

Hainan Shennong Seed Industry Technology Co., Ltd. presents a nuanced profile with both opportunities and challenges. The company reported first-quarter sales of CN¥38.97 million, showing a decrease from the previous year, while reducing its net loss significantly to CN¥0.98 million from CN¥8.25 million. Despite being unprofitable, it has reduced losses over the past five years at a notable rate and maintains short-term assets exceeding liabilities, indicating financial resilience. However, its cash runway is limited to less than one year based on current free cash flow trends, and it experiences high share price volatility relative to most Chinese stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Hainan Shennong Seed Industry Technology.

- Gain insights into Hainan Shennong Seed Industry Technology's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Embark on your investment journey to our 5,651 Global Penny Stocks selection here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanfang Zhongjin Environment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300145

Nanfang Zhongjin Environment

Through its subsidiaries, engages in the general equipment manufacturing business.

Flawless balance sheet and fair value.

Market Insights

Community Narratives