Winall Hi-tech Seed Co., Ltd.'s (SZSE:300087) 30% Jump Shows Its Popularity With Investors

Winall Hi-tech Seed Co., Ltd. (SZSE:300087) shareholders have had their patience rewarded with a 30% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

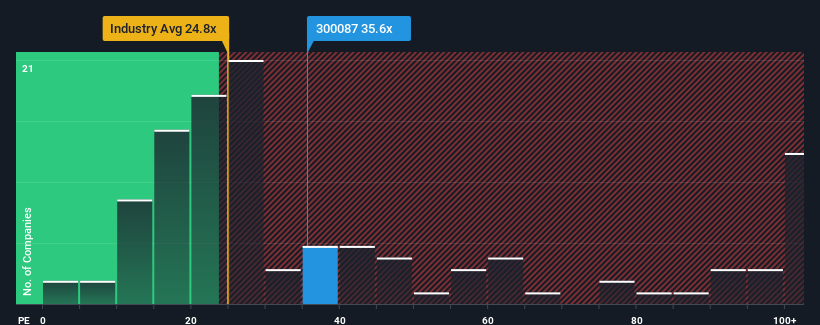

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Winall Hi-tech Seed as a stock to potentially avoid with its 35.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings that are retreating more than the market's of late, Winall Hi-tech Seed has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Winall Hi-tech Seed

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Winall Hi-tech Seed's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. Still, the latest three year period has seen an excellent 66% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 37% each year during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that Winall Hi-tech Seed's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Winall Hi-tech Seed's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Winall Hi-tech Seed's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Winall Hi-tech Seed (of which 1 is potentially serious!) you should know about.

If you're unsure about the strength of Winall Hi-tech Seed's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Winall Hi-tech Seed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300087

Winall Hi-tech Seed

Engages in the research and development, breeding, promotion, and service of various crop seeds in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives