Zhejiang Huatong Meat Products Co., Ltd. (SZSE:002840) Screens Well But There Might Be A Catch

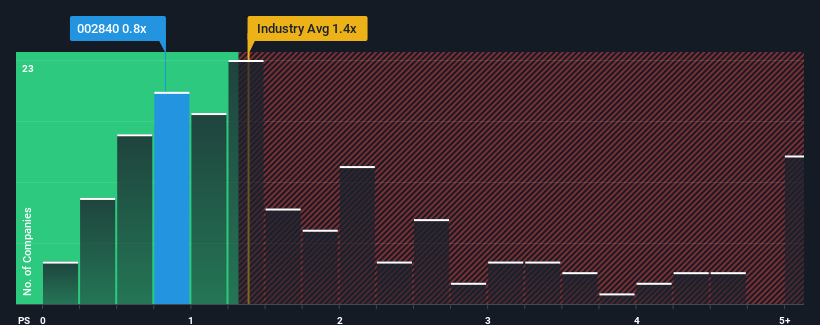

When close to half the companies operating in the Food industry in China have price-to-sales ratios (or "P/S") above 1.4x, you may consider Zhejiang Huatong Meat Products Co., Ltd. (SZSE:002840) as an attractive investment with its 0.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Zhejiang Huatong Meat Products

What Does Zhejiang Huatong Meat Products' P/S Mean For Shareholders?

Zhejiang Huatong Meat Products hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Huatong Meat Products.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Zhejiang Huatong Meat Products' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. As a result, revenue from three years ago have also fallen 8.6% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 87% over the next year. With the industry only predicted to deliver 16%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Zhejiang Huatong Meat Products' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Zhejiang Huatong Meat Products' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Zhejiang Huatong Meat Products currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Zhejiang Huatong Meat Products with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huatong Meat Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002840

Zhejiang Huatong Meat Products

Engages in the livestock and poultry slaughtering business.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives