Investors Still Aren't Entirely Convinced By Zhejiang Huatong Meat Products Co., Ltd.'s (SZSE:002840) Revenues Despite 30% Price Jump

Zhejiang Huatong Meat Products Co., Ltd. (SZSE:002840) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

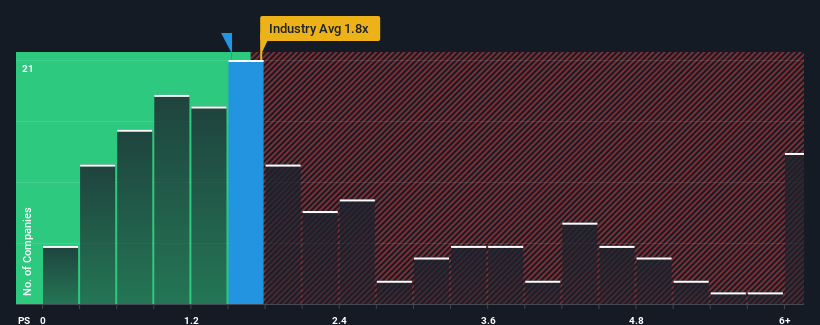

Although its price has surged higher, there still wouldn't be many who think Zhejiang Huatong Meat Products' price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in China's Food industry is similar at about 1.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Zhejiang Huatong Meat Products

What Does Zhejiang Huatong Meat Products' P/S Mean For Shareholders?

Zhejiang Huatong Meat Products could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Huatong Meat Products.What Are Revenue Growth Metrics Telling Us About The P/S?

Zhejiang Huatong Meat Products' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.0% last year. Revenue has also lifted 8.8% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 85% as estimated by the four analysts watching the company. With the industry only predicted to deliver 16%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Zhejiang Huatong Meat Products' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Zhejiang Huatong Meat Products' P/S Mean For Investors?

Zhejiang Huatong Meat Products' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Zhejiang Huatong Meat Products' P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zhejiang Huatong Meat Products you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huatong Meat Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002840

Zhejiang Huatong Meat Products

Engages in the livestock and poultry slaughtering business.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives