Further Upside For Zhejiang Huatong Meat Products Co., Ltd. (SZSE:002840) Shares Could Introduce Price Risks After 29% Bounce

The Zhejiang Huatong Meat Products Co., Ltd. (SZSE:002840) share price has done very well over the last month, posting an excellent gain of 29%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

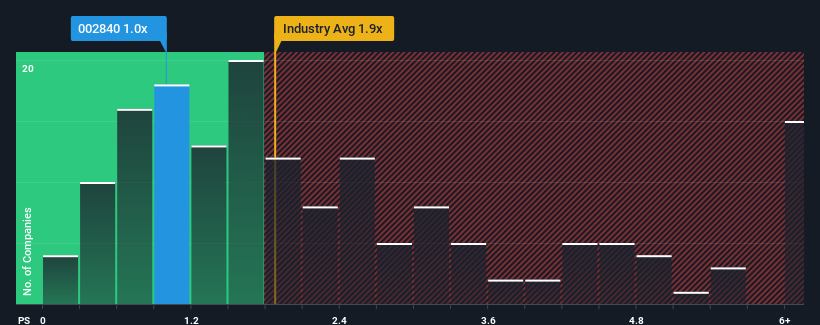

Even after such a large jump in price, Zhejiang Huatong Meat Products may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Food industry in China have P/S ratios greater than 1.9x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Zhejiang Huatong Meat Products

How Has Zhejiang Huatong Meat Products Performed Recently?

Zhejiang Huatong Meat Products could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Huatong Meat Products will help you uncover what's on the horizon.How Is Zhejiang Huatong Meat Products' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Zhejiang Huatong Meat Products' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.2%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 59% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 16% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Zhejiang Huatong Meat Products' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Zhejiang Huatong Meat Products' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Zhejiang Huatong Meat Products currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Zhejiang Huatong Meat Products with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huatong Meat Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002840

Zhejiang Huatong Meat Products

Engages in the livestock and poultry slaughtering business.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives