- China

- /

- Consumer Durables

- /

- SZSE:002351

Undiscovered Gems with Potential for January 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by inflation concerns and political uncertainties, small-cap stocks have faced particular challenges, with the Russell 2000 Index recently dipping into correction territory. Despite these headwinds, opportunities can still be found by identifying companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

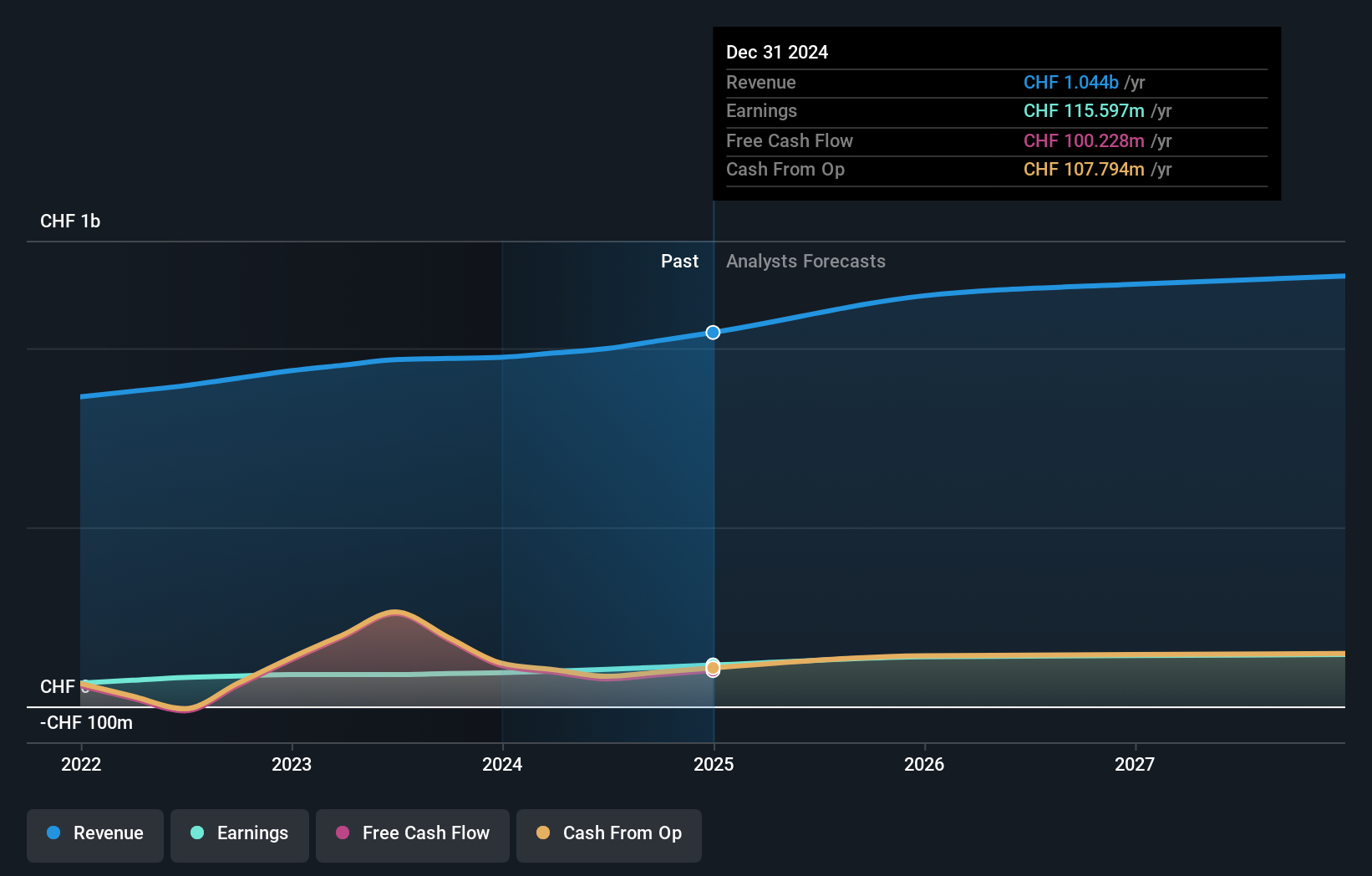

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF1.44 billion.

Operations: The company's revenue is primarily derived from three regions: Europe, Middle East and Africa (CHF452.85 million), Americas (CHF352.67 million), and Asia-Pacific (CHF273.16 million).

Compagnie Financière Tradition, a smaller player in the financial sector, has shown impressive earnings growth of 16.1% over the past year, outpacing the Capital Markets industry’s -3.3%. This growth is supported by high-quality earnings and a debt-to-equity ratio that has improved from 75.7% to 47.1% in five years, indicating prudent financial management. The company trades at 13.5% below its estimated fair value, suggesting potential undervaluation for investors seeking opportunities in this space. However, shareholder dilution occurred recently, which might concern some investors despite its strong cash position exceeding total debt levels.

Edifier Technology (SZSE:002351)

Simply Wall St Value Rating: ★★★★★★

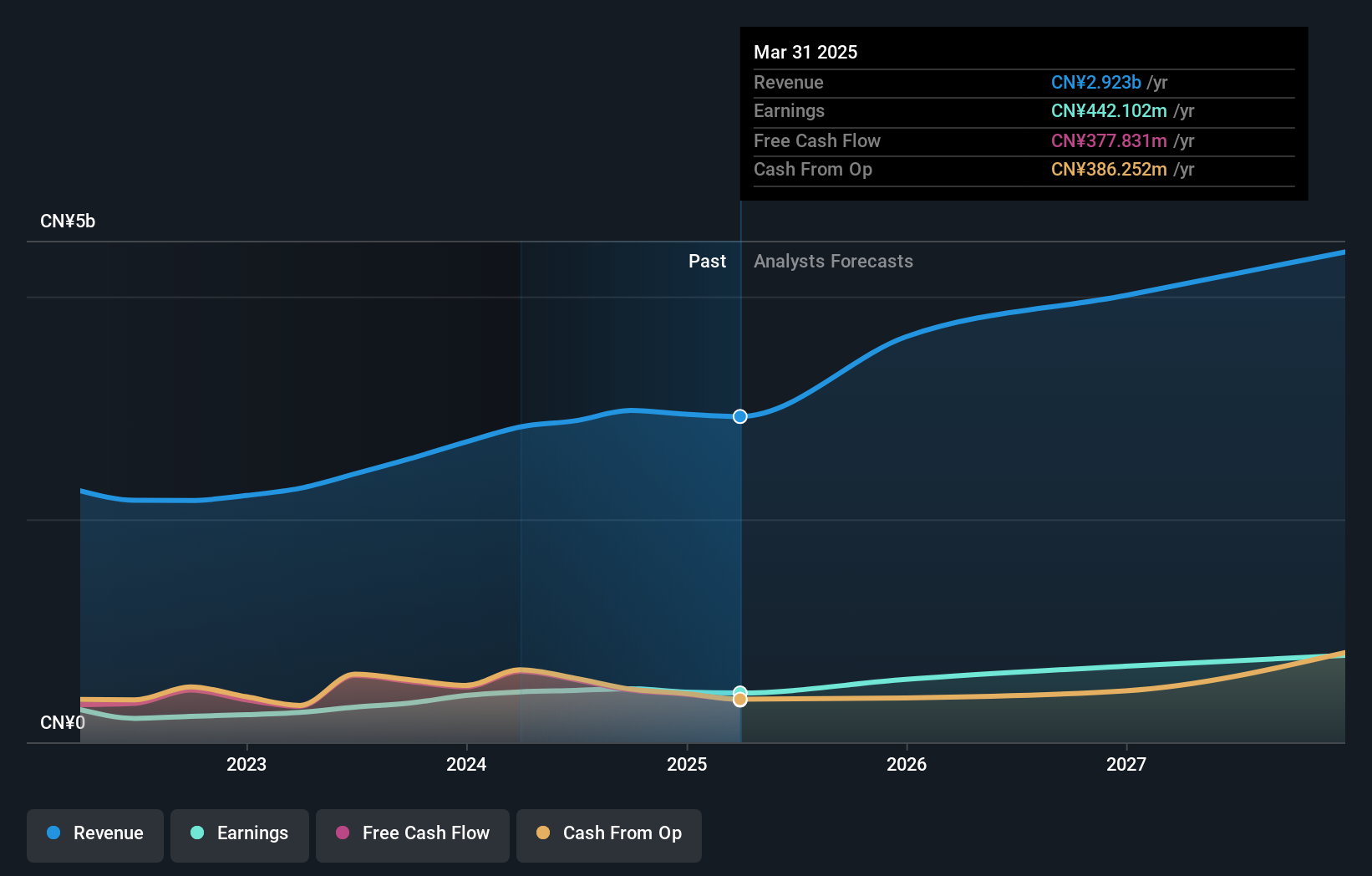

Overview: Edifier Technology Co., Ltd. designs, produces, and sells audio equipment in China with a market cap of CN¥13.64 billion.

Operations: Edifier Technology generates revenue primarily from its E-Pneumatic segment, which amounted to CN¥2.98 billion.

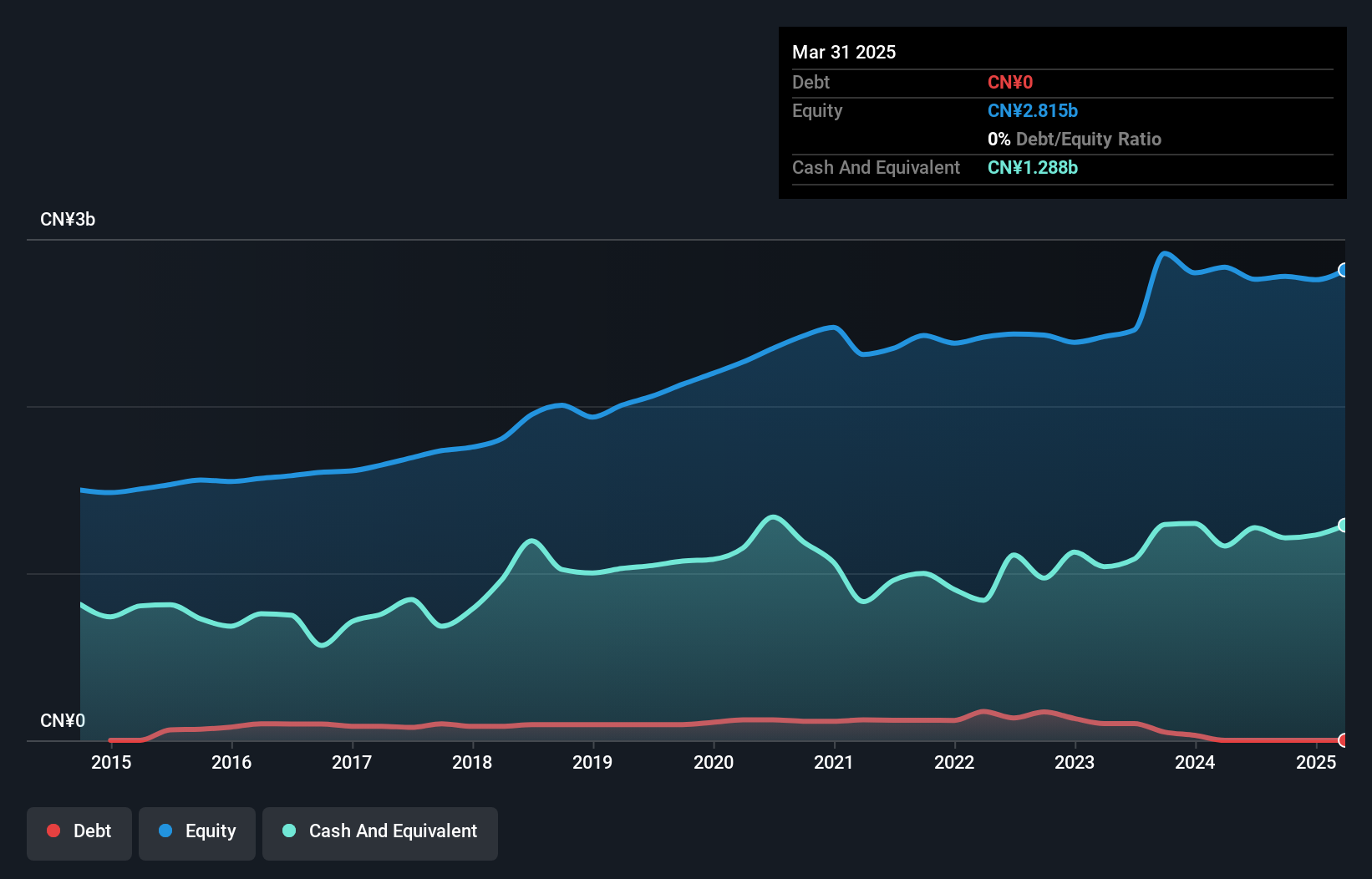

Edifier Technology, a nimble player in the audio space, has shown promising growth with earnings rising 36.4% last year, outpacing the Consumer Durables industry. The company's price-to-earnings ratio of 28.4x is attractively below the CN market average of 33.4x, suggesting potential value for investors. Financially sound, Edifier holds more cash than its total debt and enjoys a reduced debt-to-equity ratio from 0.7% to 0.4% over five years. Recent product launches like the M60 Hi-Res Multimedia Speakers highlight its innovation streak and could further bolster its market position and revenue prospects moving forward.

Jiangxi Huangshanghuang Group Food (SZSE:002695)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Huangshanghuang Group Food Co., Ltd. develops, produces, and sells braised meat products in China with a market capitalization of CN¥4.77 billion.

Operations: The company generates revenue primarily from the sale of braised meat products. It focuses on optimizing its cost structure to enhance profitability. The net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

Jiangxi Huangshanghuang Group Food, a smaller player in the food sector, recently experienced a dip in its financial performance. Over the past nine months, sales reached CN¥1.45 billion, down from CN¥1.58 billion last year. Net income also fell to CN¥78.56 million from CN¥100.88 million previously, with basic earnings per share dropping to CNY 0.141 from CNY 0.197 a year ago. Despite these challenges, the company remains debt-free and has seen its earnings grow by 2% over the past year compared to an industry decline of -4%. However, recent removal from the S&P Global BMI Index might impact investor sentiment moving forward.

Next Steps

- Click through to start exploring the rest of the 4565 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edifier Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002351

Edifier Technology

Designs, produces, and sells audio equipment in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives