As global markets navigate rising U.S. Treasury yields and a cautious economic outlook, small-cap stocks have faced increased pressure compared to their large-cap counterparts. Despite these challenges, identifying stocks with strong fundamentals can provide opportunities for investors seeking value in an uncertain environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Baida GroupLtd (SHSE:600865)

Simply Wall St Value Rating: ★★★★★★

Overview: Baida Group Co., Ltd operates department stores in China and has a market capitalization of approximately CN¥3.94 billion.

Operations: Baida Group Co., Ltd generates revenue through its department store operations in China. The company has a market capitalization of approximately CN¥3.94 billion.

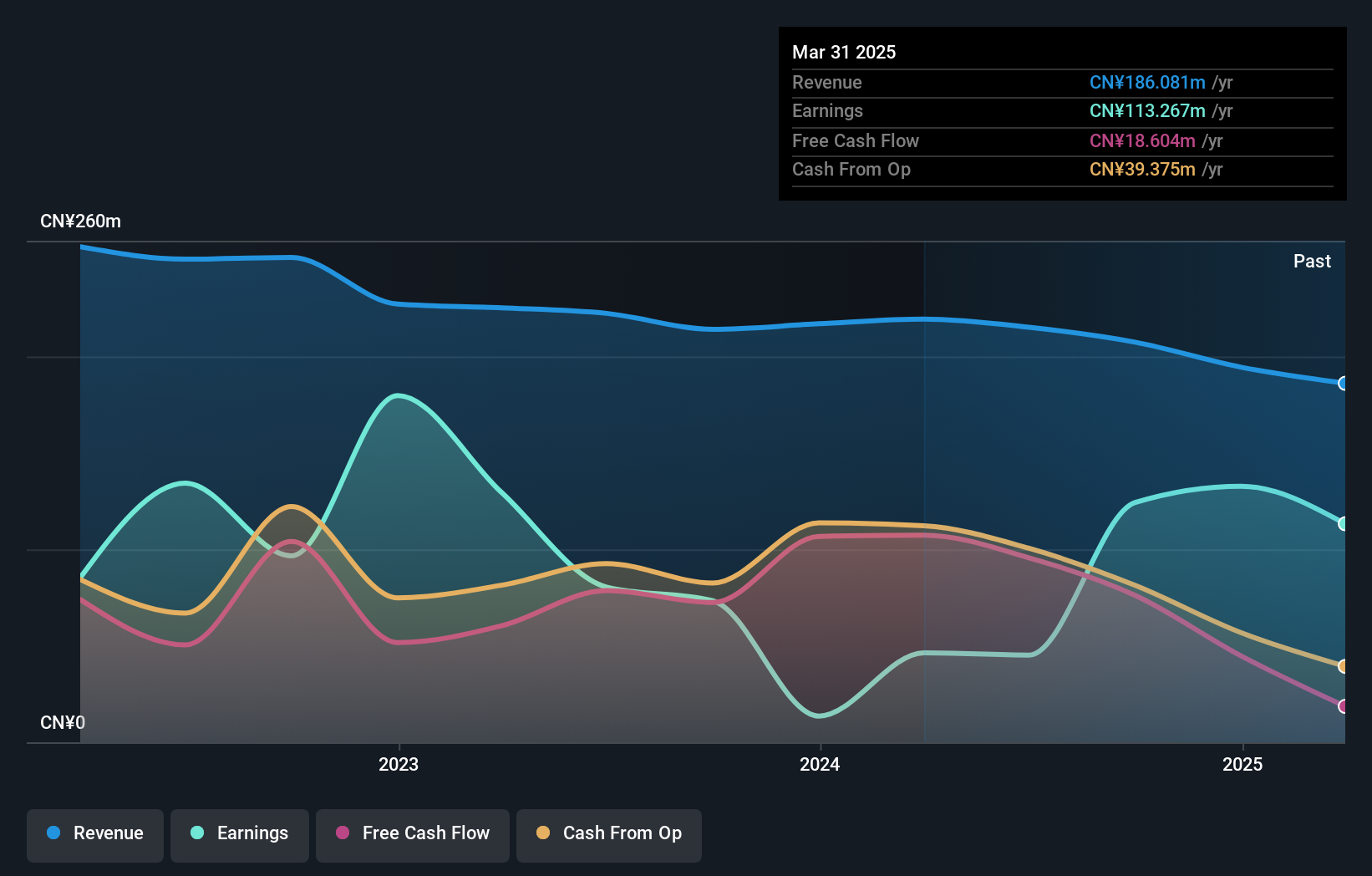

Baida Group Ltd. showcases a strong financial position, being debt-free and boasting a notable earnings growth of 69.3% over the past year, outpacing the Multiline Retail industry at -6.8%. This performance is partly due to a significant one-off gain of CN¥45.2 million in its recent results up to September 2024. Despite sales dropping to CN¥142.49 million from CN¥152.02 million, net income soared to CN¥131.53 million from last year's CN¥20.81 million for the same period, reflecting improved profitability with basic earnings per share climbing from CNY 0.06 to CNY 0.35.

- Delve into the full analysis health report here for a deeper understanding of Baida GroupLtd.

Gain insights into Baida GroupLtd's past trends and performance with our Past report.

Sichuan Huiyu Pharmaceutical (SHSE:688553)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Huiyu Pharmaceutical Co., Ltd. is engaged in the research, development, production, and sale of anti-tumor and injection drugs both in China and internationally, with a market capitalization of CN¥6.46 billion.

Operations: Huiyu Pharmaceutical generates revenue primarily from its medicine segment, totaling CN¥1.12 billion.

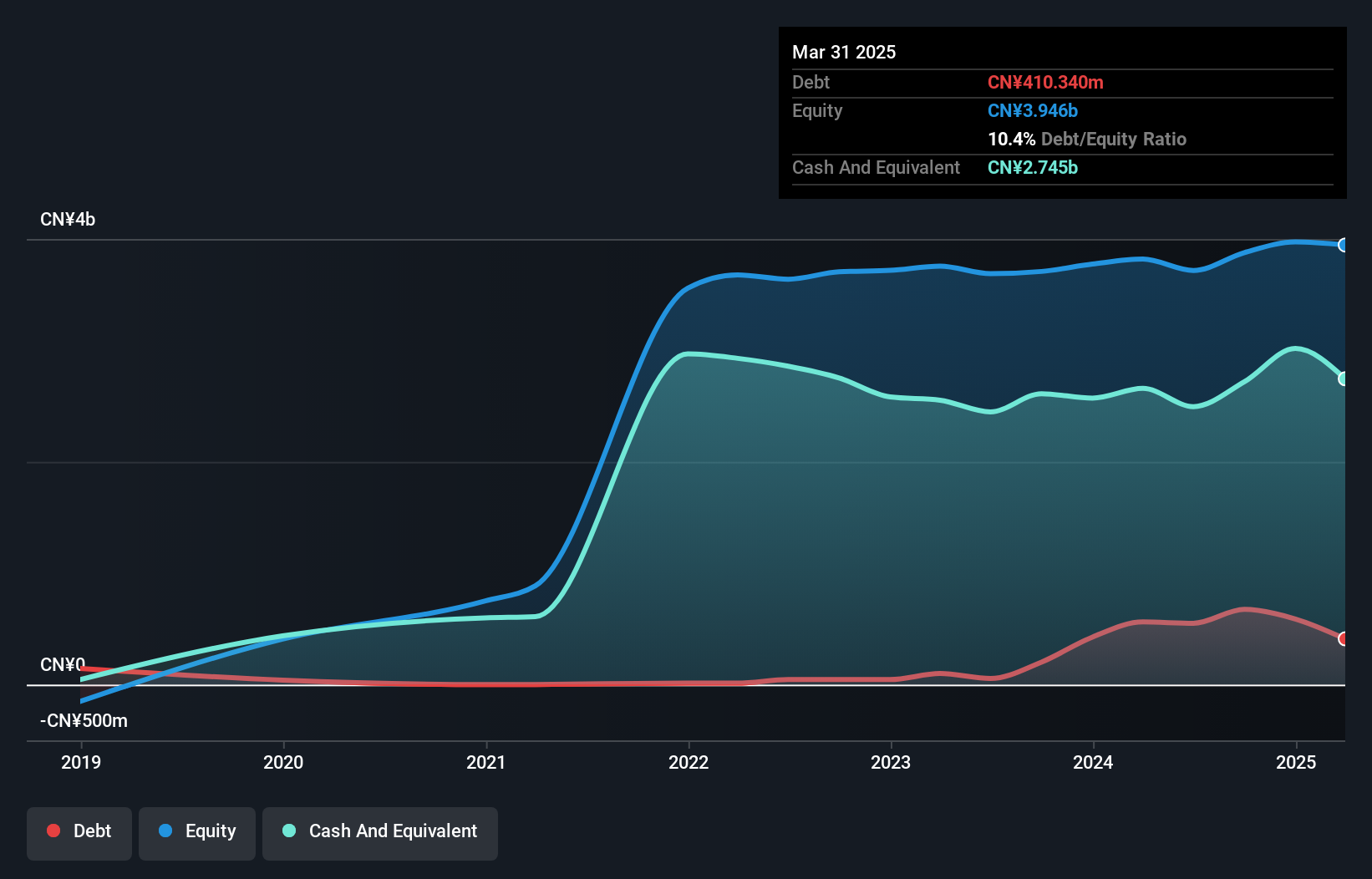

Huiyu Pharma, a nimble player in the pharmaceutical sector, reported impressive earnings growth of 171% over the past year, outpacing its industry by a wide margin. The company’s net income for the nine months ending September 2024 was CNY 227.35 million, up from CNY 88.94 million a year earlier. Despite this strong performance, Huiyu's earnings have seen an annual decline of nearly 20% over five years due to large one-off gains like CN¥179 million impacting recent results. Its debt-to-equity ratio improved significantly from 24.8 to 17.4 over five years, indicating prudent financial management.

- Get an in-depth perspective on Sichuan Huiyu Pharmaceutical's performance by reading our health report here.

Learn about Sichuan Huiyu Pharmaceutical's historical performance.

Beingmate (SZSE:002570)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beingmate Co., Ltd. is a company that focuses on the research, development, production, and sale of children's and nutritious food products in China with a market cap of CN¥5.67 billion.

Operations: Beingmate generates revenue primarily from milk powder, contributing CN¥2.42 billion, followed by rice noodles at CN¥58.99 million.

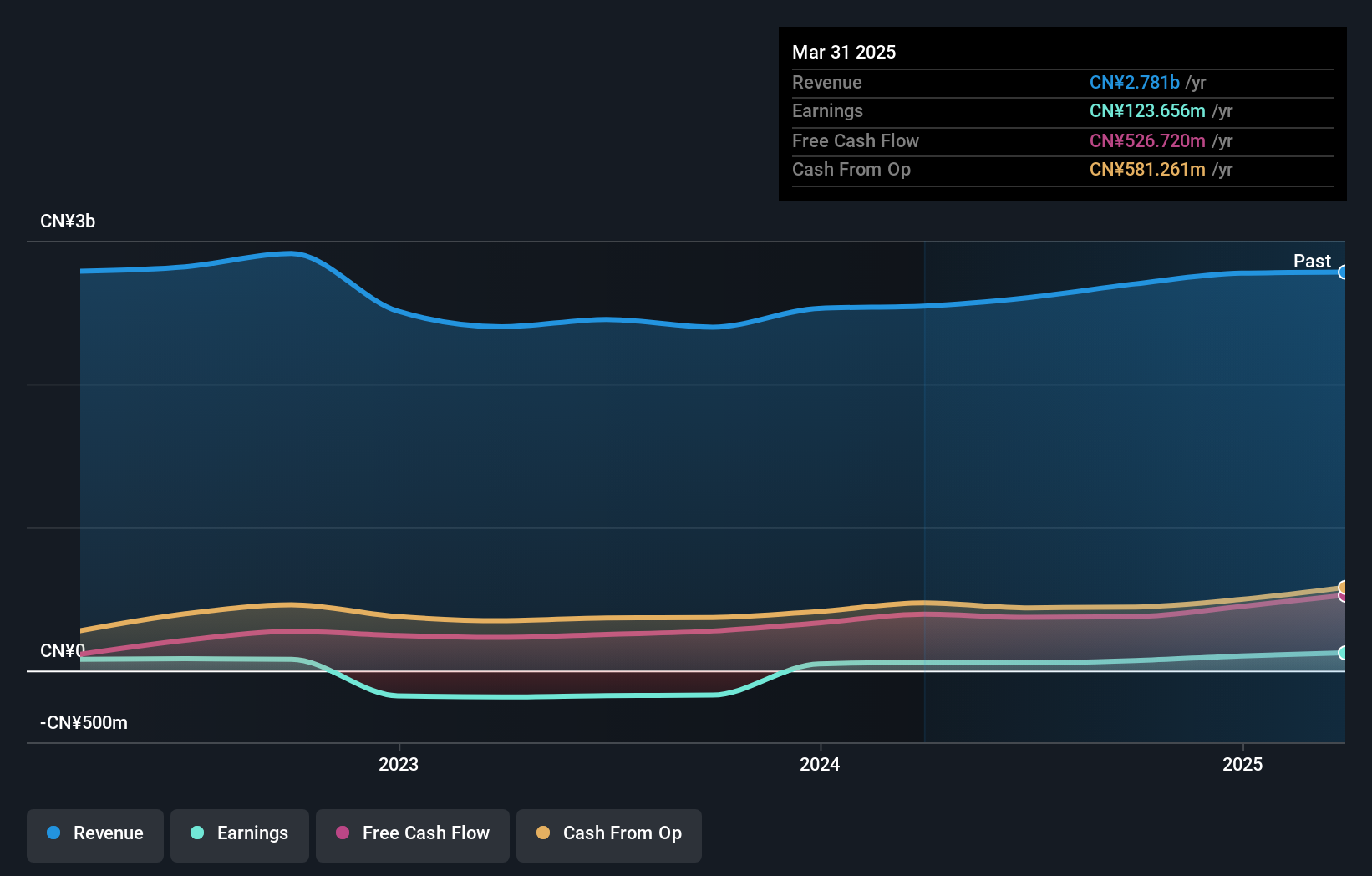

Beingmate, a promising player in the food industry, has recently turned profitable, with its earnings outpacing the sector's -2.4% growth rate. Its net debt to equity ratio stands at a satisfactory 0.9%, reflecting strong financial health. The company reported sales of CNY 2.09 billion for the first nine months of 2024, up from CNY 1.92 billion last year, with net income climbing to CNY 71.79 million from CNY 49.41 million previously. Additionally, Beingmate repurchased approximately 47 million shares for CNY 132.35 million this year under its buyback program announced in January, enhancing shareholder value amidst volatile share price movements recently observed over three months.

- Dive into the specifics of Beingmate here with our thorough health report.

Review our historical performance report to gain insights into Beingmate's's past performance.

Next Steps

- Click through to start exploring the rest of the 4736 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688553

Sichuan Huiyu Pharmaceutical

Research and develops, produces, and sells anti-tumor and injection drugs in China and internationally.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives