Further weakness as Tangrenshen Group (SZSE:002567) drops 7.9% this week, taking five-year losses to 42%

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Tangrenshen Group Co., Ltd (SZSE:002567) shareholders for doubting their decision to hold, with the stock down 45% over a half decade. And it's not just long term holders hurting, because the stock is down 34% in the last year. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days.

If the past week is anything to go by, investor sentiment for Tangrenshen Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Tangrenshen Group

Given that Tangrenshen Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, Tangrenshen Group grew its revenue at 11% per year. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 8% per year, for five years: a poor performance. Those who bought back then clearly believed in stronger growth - and maybe even profits. There is always a big risk of losing money yourself when you buy shares in a company that loses money.

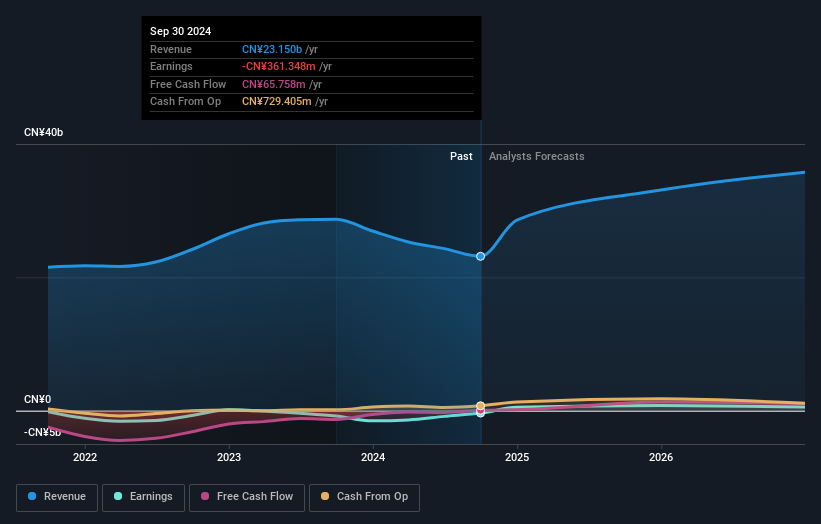

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Tangrenshen Group's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Tangrenshen Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Tangrenshen Group's TSR, which was a 42% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 6.1% in the last year, Tangrenshen Group shareholders lost 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tangrenshen Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002567

Tangrenshen Group

Engages in the research and development, production and sales of feed, live pigs, meat, and animal health products in China.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives