Even With A 29% Surge, Cautious Investors Are Not Rewarding Tangrenshen Group Co., Ltd's (SZSE:002567) Performance Completely

Tangrenshen Group Co., Ltd (SZSE:002567) shares have had a really impressive month, gaining 29% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

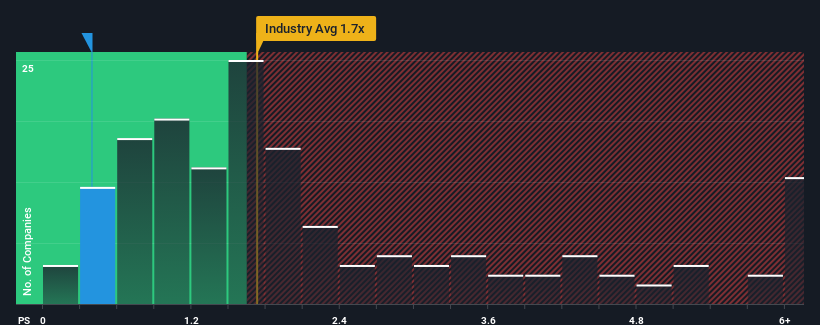

In spite of the firm bounce in price, Tangrenshen Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Food industry in China have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Tangrenshen Group

How Tangrenshen Group Has Been Performing

Tangrenshen Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tangrenshen Group.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Tangrenshen Group would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 27% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 31% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 10%, which is noticeably less attractive.

In light of this, it's peculiar that Tangrenshen Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Tangrenshen Group's P/S Mean For Investors?

Despite Tangrenshen Group's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Tangrenshen Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Tangrenshen Group you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tangrenshen Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002567

Tangrenshen Group

Engages in the research and development, production and sales of feed, live pigs, meat, and animal health products in China.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives