- China

- /

- Commercial Services

- /

- SHSE:603200

None Undiscovered Gems 3 Small Cap Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced challenges amid geopolitical tensions and concerns about consumer spending, with indices like the Russell 2000 experiencing notable declines. Despite these hurdles, small-cap companies often present unique opportunities for investors willing to explore beyond the more widely recognized names, as they can offer growth potential that aligns well with a strategic investment approach during uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AOKI Holdings | 27.05% | 3.74% | 52.54% | ★★★★★★ |

| Kyoritsu Electric | 7.58% | 3.45% | 12.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Hokkan Holdings | 56.86% | -6.83% | 14.66% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Y.D. More Investments | 69.32% | 30.27% | 27.89% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 141.86% | 2.81% | 3.53% | ★★★★☆☆ |

| Libra Insurance | 38.26% | 44.30% | 56.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shanghai Emperor of Cleaning Hi-Tech (SHSE:603200)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Emperor of Cleaning Hi-Tech Co., Ltd offers water treatment and air duct cleaning services across China, with a market capitalization of CN¥5.12 billion.

Operations: The company generates revenue primarily from its water treatment and air duct cleaning services. It has a market capitalization of CN¥5.12 billion.

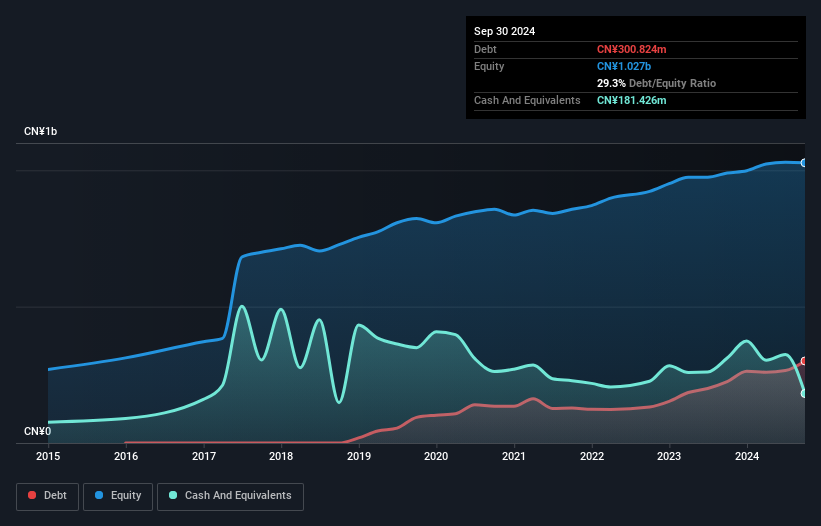

Shanghai Emperor of Cleaning Hi-Tech, a smaller player in its industry, has demonstrated impressive earnings growth of 84.8% over the past year, far outpacing the Commercial Services industry's 1.7%. The company's net debt to equity ratio stands at a satisfactory 11.6%, indicating prudent financial management despite an increase from 11.4% to 29.3% over five years. Although not free cash flow positive recently, it remains profitable with high-quality earnings and forecasts suggest an annual earnings growth of approximately 54%. This combination of robust growth and solid financial health positions it well for future opportunities in its sector.

Jinzi HamLtd (SZSE:002515)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinzi Ham Co., Ltd. focuses on the research, development, production, and sale of fermented meat products both in China and internationally, with a market capitalization of CN¥5.15 billion.

Operations: Jinzi Ham Co., Ltd. generates revenue primarily through the sale of fermented meat products. The company's financial performance is characterized by a focus on its core product lines, which significantly contribute to its overall revenue streams.

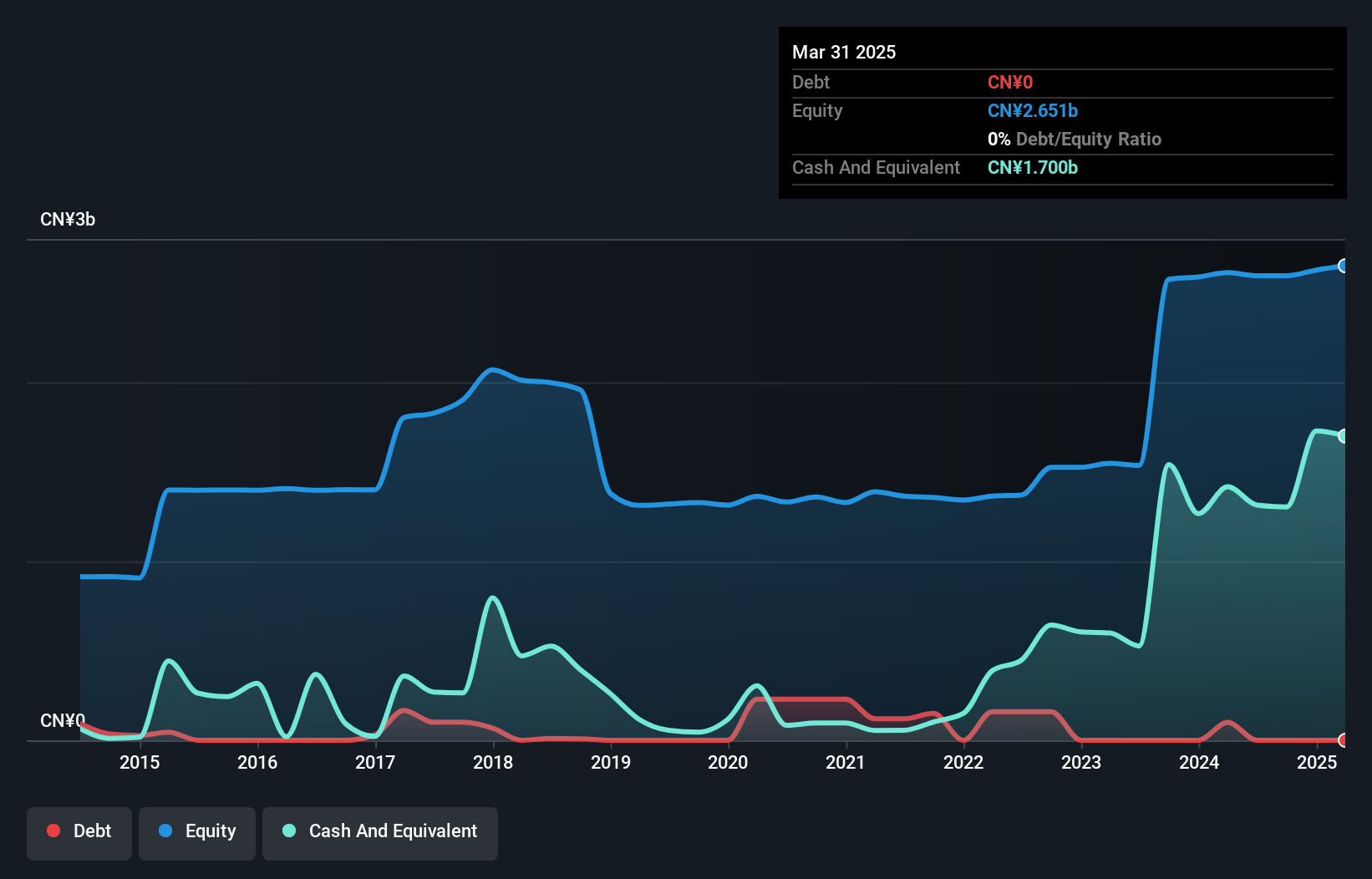

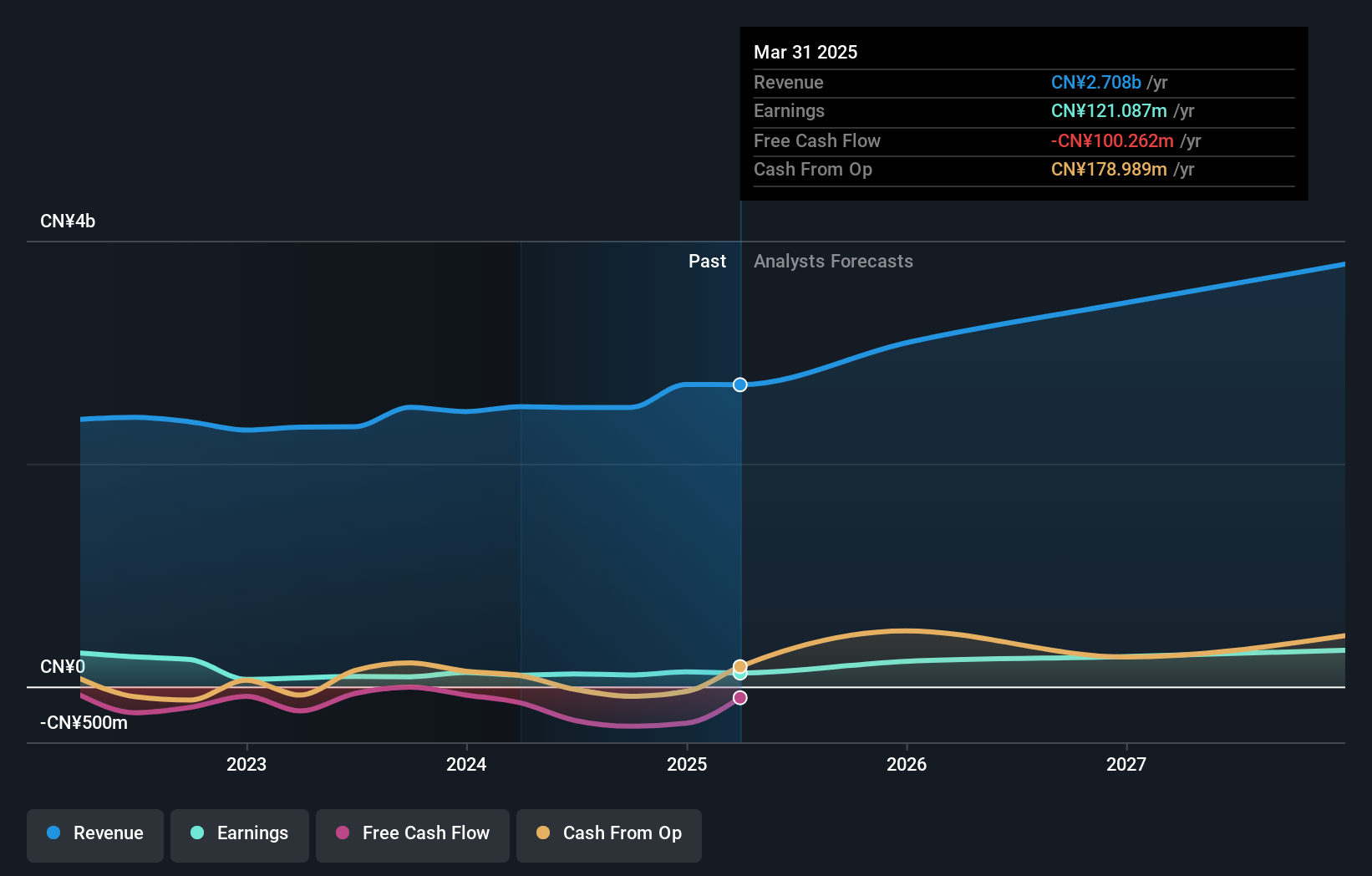

Jinzi Ham Ltd, a nimble player in the food sector, boasts impressive earnings growth of 79.8% over the past year, outpacing the industry average. With no debt on its books for five years, financial stability seems to be a strong suit for this company. The firm’s high-quality earnings reflect robust operational performance and profitability is not an issue given its free cash flow positivity. However, there has been a 6.6% annual decline in earnings over five years, which could suggest challenges in sustaining revenue momentum amidst market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Jinzi HamLtd.

Understand Jinzi HamLtd's track record by examining our Past report.

Longhua Technology GroupLtd (SZSE:300263)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Longhua Technology Group Co., Ltd. specializes in the manufacturing and sale of heat transfer and energy-saving equipment in China, with a market capitalization of CN¥6.42 billion.

Operations: The company generates revenue primarily from the sale of heat transfer and energy-saving equipment. Its cost structure includes production expenses, which impact its profitability. The net profit margin was reported at 9.5% in the latest financial period, reflecting its efficiency in managing costs relative to revenue generation.

With high-quality earnings and a net debt to equity ratio of 32.1%, Longhua Technology Group seems to be managing its financial obligations well. Over the past year, the company's earnings grew by 18.9%, outpacing the machinery industry's -0.06% shift, showcasing robust performance in a challenging sector. Despite an increase in its debt to equity ratio from 12.7% to 48.6% over five years, interest payments are well covered with EBIT at 5.5x coverage, indicating sound financial health amidst rising leverage levels and no free cash flow positivity yet achieved recently as of September 2024 at -356 million yuan (RMB).

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4753 more companies for you to explore.Click here to unveil our expertly curated list of 4756 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603200

Shanghai Emperor of Cleaning Hi-Tech

Provides water treatment and air duct cleaning services in China.

High growth potential with solid track record.

Market Insights

Community Narratives