Take Care Before Diving Into The Deep End On Beijing Dabeinong Technology Group Co.,Ltd. (SZSE:002385)

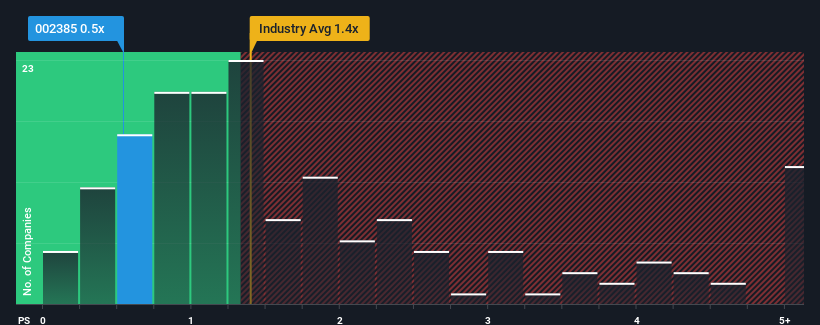

When you see that almost half of the companies in the Food industry in China have price-to-sales ratios (or "P/S") above 1.4x, Beijing Dabeinong Technology Group Co.,Ltd. (SZSE:002385) looks to be giving off some buy signals with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Beijing Dabeinong Technology GroupLtd

How Beijing Dabeinong Technology GroupLtd Has Been Performing

While the industry has experienced revenue growth lately, Beijing Dabeinong Technology GroupLtd's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Dabeinong Technology GroupLtd.Is There Any Revenue Growth Forecasted For Beijing Dabeinong Technology GroupLtd?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beijing Dabeinong Technology GroupLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.1%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 24% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 17% over the next year. That's shaping up to be similar to the 17% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Beijing Dabeinong Technology GroupLtd's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Beijing Dabeinong Technology GroupLtd's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Plus, you should also learn about these 2 warning signs we've spotted with Beijing Dabeinong Technology GroupLtd (including 1 which makes us a bit uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Beijing Dabeinong Technology GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Dabeinong Technology GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002385

Beijing Dabeinong Technology GroupLtd

Beijing Dabeinong Technology Group Co.,Ltd.

Good value average dividend payer.

Market Insights

Community Narratives