David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, TECON BIOLOGY Co.LTD (SZSE:002100) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for TECON BIOLOGYLTD

What Is TECON BIOLOGYLTD's Debt?

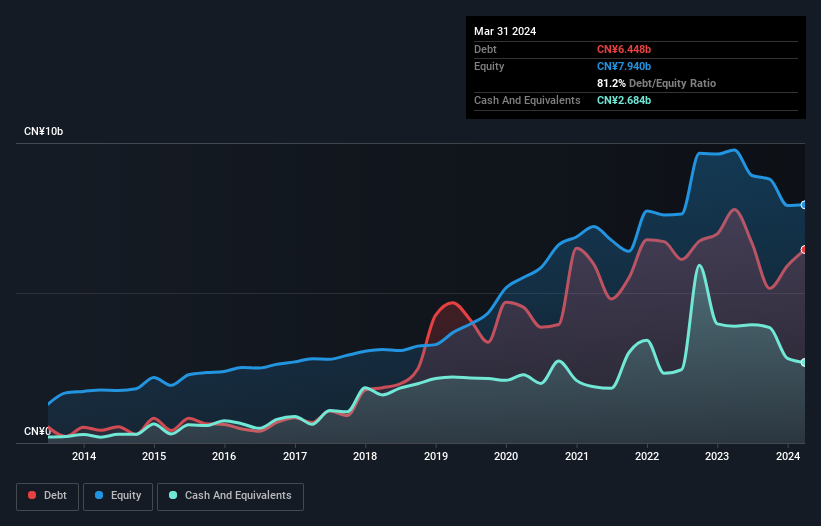

As you can see below, TECON BIOLOGYLTD had CN¥6.45b of debt at March 2024, down from CN¥7.78b a year prior. On the flip side, it has CN¥2.68b in cash leading to net debt of about CN¥3.76b.

How Healthy Is TECON BIOLOGYLTD's Balance Sheet?

According to the last reported balance sheet, TECON BIOLOGYLTD had liabilities of CN¥7.10b due within 12 months, and liabilities of CN¥2.13b due beyond 12 months. On the other hand, it had cash of CN¥2.68b and CN¥968.3m worth of receivables due within a year. So it has liabilities totalling CN¥5.57b more than its cash and near-term receivables, combined.

This deficit isn't so bad because TECON BIOLOGYLTD is worth CN¥10.4b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine TECON BIOLOGYLTD's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, TECON BIOLOGYLTD reported revenue of CN¥19b, which is a gain of 8.1%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Importantly, TECON BIOLOGYLTD had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable CN¥1.2b at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of CN¥1.3b into a profit. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - TECON BIOLOGYLTD has 1 warning sign we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if TECON BIOLOGYLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002100

TECON BIOLOGYLTD

Engages in the provision of animal health care, feed, pig breeding, agricultural product processing and trade, and financial services in China and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives