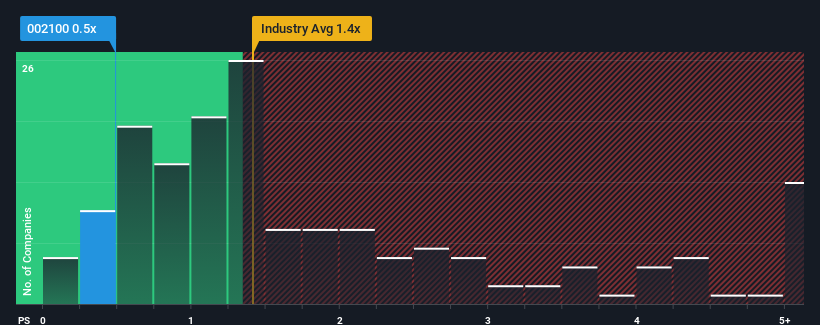

When you see that almost half of the companies in the Food industry in China have price-to-sales ratios (or "P/S") above 1.4x, TECON BIOLOGY Co.LTD (SZSE:002100) looks to be giving off some buy signals with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for TECON BIOLOGYLTD

How Has TECON BIOLOGYLTD Performed Recently?

With revenue growth that's superior to most other companies of late, TECON BIOLOGYLTD has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think TECON BIOLOGYLTD's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like TECON BIOLOGYLTD's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.1% gain to the company's revenues. The latest three year period has also seen an excellent 42% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 17%, which is not materially different.

With this in consideration, we find it intriguing that TECON BIOLOGYLTD's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does TECON BIOLOGYLTD's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for TECON BIOLOGYLTD remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Before you take the next step, you should know about the 1 warning sign for TECON BIOLOGYLTD that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TECON BIOLOGYLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002100

TECON BIOLOGYLTD

Engages in the provision of animal health care, feed, pig breeding, agricultural product processing and trade, and financial services in China and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives