- China

- /

- Semiconductors

- /

- SHSE:688419

Undiscovered Gems None Featuring Pan Asian Microvent Tech (Jiangsu) And 2 Other Small Caps

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and concerns over consumer spending, major U.S. stock indices experienced declines, with the S&P 500 and Russell 2000 both finishing lower amid tariff fears and cost pressures. This environment of uncertainty highlights the importance of identifying small-cap stocks that possess strong fundamentals and resilience to navigate such volatile market conditions. A good stock in this context is one that demonstrates potential for growth despite broader economic challenges, often characterized by innovative offerings or niche market positions that can withstand external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.92% | 8.23% | 18.26% | ★★★★★★ |

| Intelligent Wave | NA | 7.78% | 15.50% | ★★★★★★ |

| Kyoritsu Electric | 7.58% | 3.45% | 12.53% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yashima Denki | 2.71% | -1.00% | 18.12% | ★★★★★★ |

| Toyo Kanetsu K.K | 33.97% | 3.33% | 18.20% | ★★★★★☆ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Loadstar Capital K.K | 244.76% | 17.29% | 21.16% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Pan Asian Microvent Tech (Jiangsu) (SHSE:688386)

Simply Wall St Value Rating: ★★★★★★

Overview: Pan Asian Microvent Tech (Jiangsu) Corporation specializes in producing micro permeable polymer and membrane components for the automotive, packing, and protective air ventilation industries globally, with a market cap of CN¥2.56 billion.

Operations: The company generates revenue primarily from its industrial conglomerate segment, amounting to CN¥474.31 million. It has a market cap of CN¥2.56 billion.

Pan Asian Microvent Tech (Jiangsu) showcases a compelling story with its earnings surging 99% over the past year, outpacing the broader Chemicals industry, which saw a negative trend. The company's price-to-earnings ratio of 27x is attractive compared to the CN market average of 38x, suggesting potential value. With a satisfactory net debt to equity ratio at 11.7%, financial stability seems well-managed. Despite not being free cash flow positive, interest payments are well-covered by EBIT at an impressive 48x coverage. A recent extraordinary shareholders meeting hints at strategic moves that could influence future growth trajectories in this niche sector.

- Click here and access our complete health analysis report to understand the dynamics of Pan Asian Microvent Tech (Jiangsu).

Learn about Pan Asian Microvent Tech (Jiangsu)'s historical performance.

Nextool Technology (SHSE:688419)

Simply Wall St Value Rating: ★★★★★★

Overview: Nextool Technology Co., Ltd. specializes in the research, development, manufacture, and sale of intelligent manufacturing equipment for plastic extrusion molding and semiconductor packaging, with a market cap of CN¥3.03 billion.

Operations: The company generates revenue primarily from the sale of intelligent manufacturing equipment for plastic extrusion molding and semiconductor packaging. Its cost structure includes expenses related to research, development, and manufacturing processes. The net profit margin is a key indicator of financial performance.

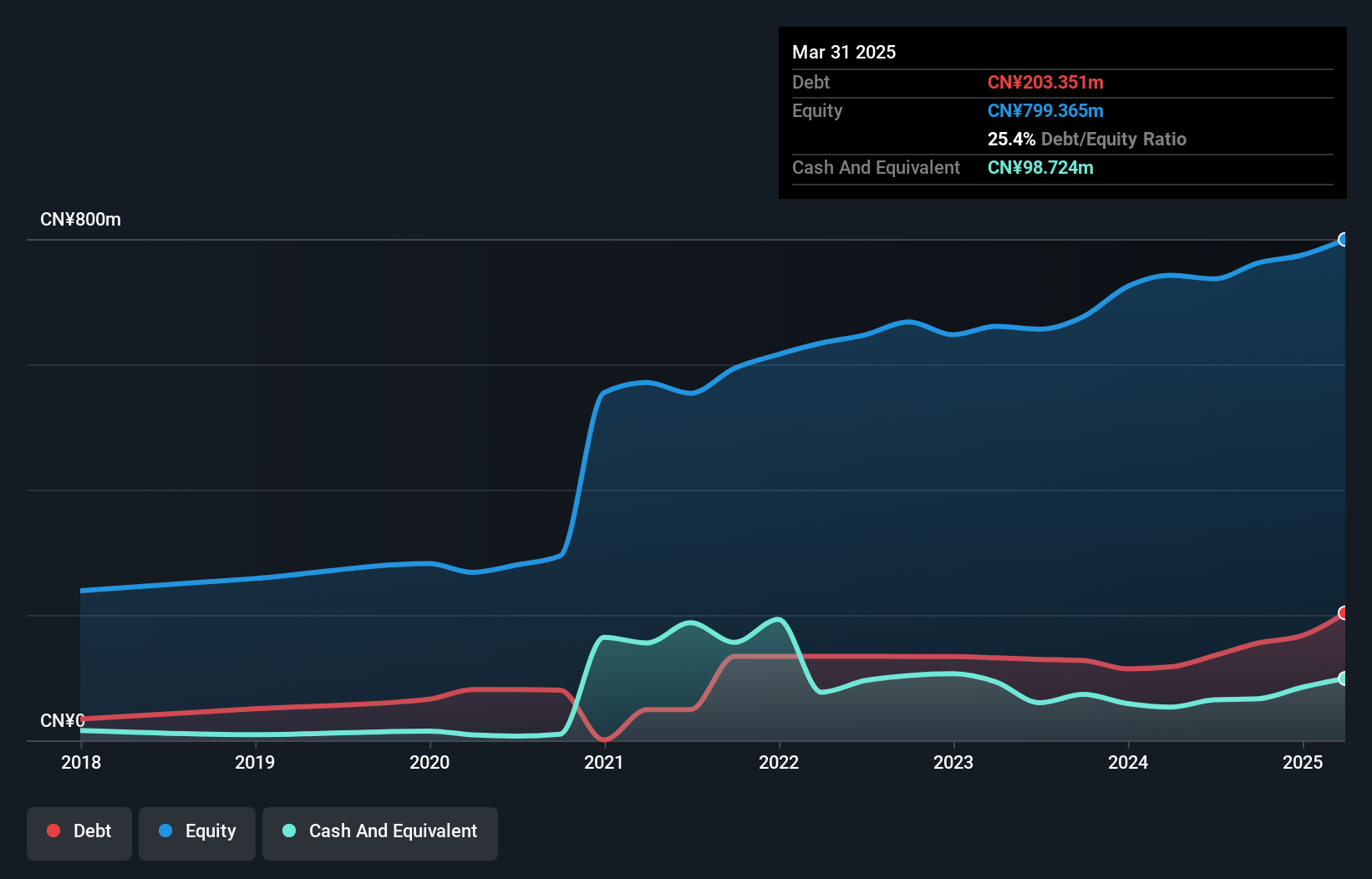

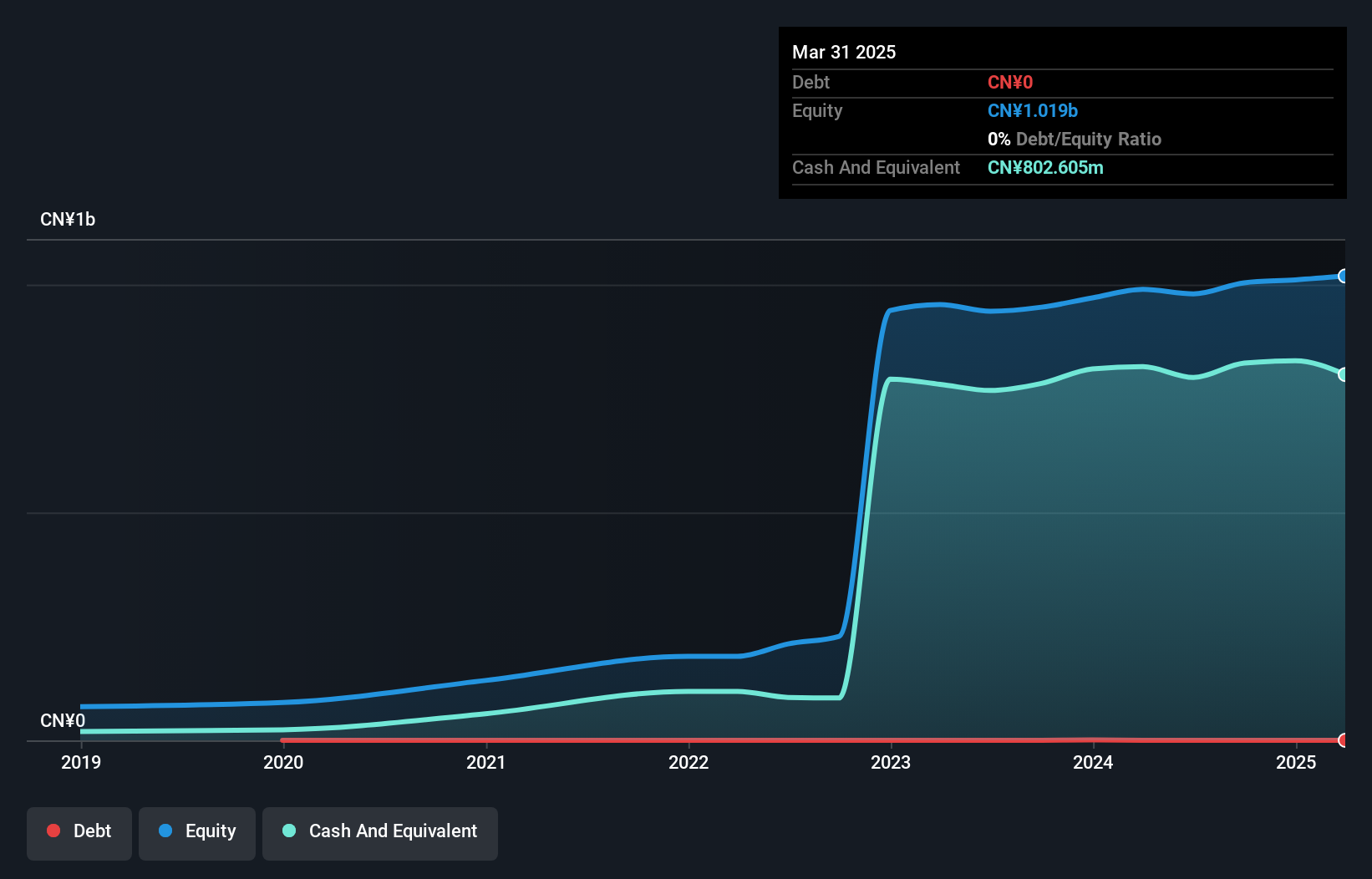

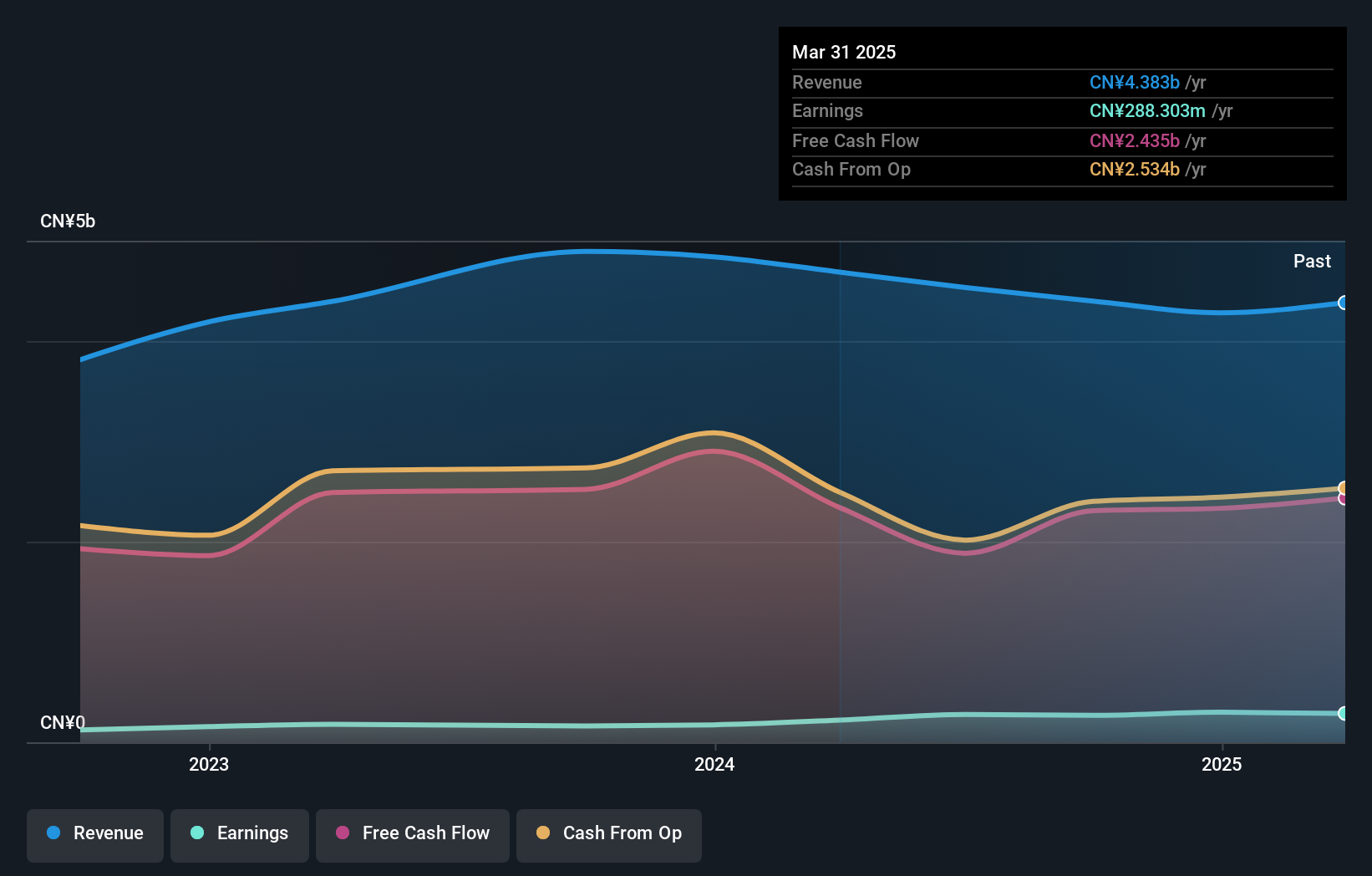

Nextool Technology, a nimble player in the semiconductor space, boasts impressive earnings growth of 72.1% over the past year, outpacing the industry's 13.9%. The company operates debt-free and has consistently maintained this status for five years, underscoring its financial prudence. Trading at 9.2% below its estimated fair value suggests potential undervaluation in the market's eyes. With high-quality past earnings and positive free cash flow, Nextool appears robust despite recent challenges like negative levered free cash flow of CNY -8.79 million as of June 2023 due to capital expenditures reaching CNY -20.65 million during that period.

- Take a closer look at Nextool Technology's potential here in our health report.

Explore historical data to track Nextool Technology's performance over time in our Past section.

GDH Supertime Group (SZSE:001338)

Simply Wall St Value Rating: ★★★★★☆

Overview: GDH Supertime Group Company Limited focuses on the development, production, and sale of malt to beer manufacturers in China with a market capitalization of CN¥5.68 billion.

Operations: The primary revenue stream for GDH Supertime Group comes from its beer-making segment, generating CN¥4.15 billion. The company has a market capitalization of CN¥5.68 billion.

GDH Supertime Group, a smaller player in the market, is making waves with its impressive financial metrics. The company has seen its earnings grow by 65% over the past year, significantly outpacing the Beverage industry's 16% growth rate. Trading at 85.7% below its estimated fair value, it appears undervalued and potentially appealing to investors seeking hidden opportunities. Despite an increase in debt to equity from 1% to 11.2% over five years, GDH maintains more cash than total debt, suggesting a solid financial footing. High-quality earnings further enhance its profile as a promising investment candidate in this sector.

- Get an in-depth perspective on GDH Supertime Group's performance by reading our health report here.

Assess GDH Supertime Group's past performance with our detailed historical performance reports.

Seize The Opportunity

- Access the full spectrum of 4749 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nextool Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688419

Nextool Technology

Engages in the research, development, manufacture, and sale of intelligent manufacturing equipment used in the fields of plastic extrusion molding and semiconductor packaging in China and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives