Jiahe Foods Industry Co., Ltd.'s (SHSE:605300) Price Is Right But Growth Is Lacking

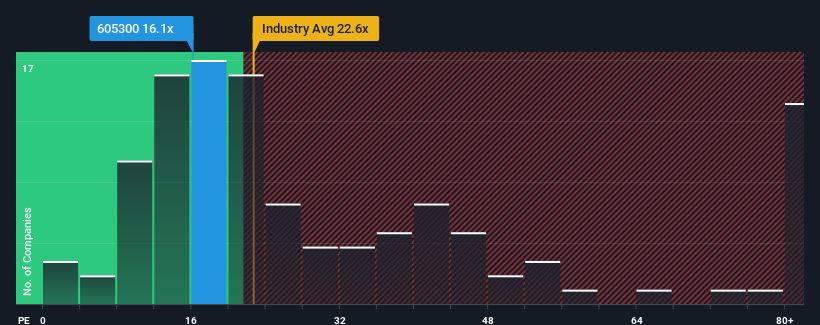

With a price-to-earnings (or "P/E") ratio of 16.1x Jiahe Foods Industry Co., Ltd. (SHSE:605300) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 51x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Jiahe Foods Industry certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Jiahe Foods Industry

Is There Any Growth For Jiahe Foods Industry?

There's an inherent assumption that a company should underperform the market for P/E ratios like Jiahe Foods Industry's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 121% last year. As a result, it also grew EPS by 7.4% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 6.6% per year over the next three years. That's shaping up to be materially lower than the 23% per annum growth forecast for the broader market.

With this information, we can see why Jiahe Foods Industry is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Jiahe Foods Industry's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jiahe Foods Industry maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Jiahe Foods Industry that you need to take into consideration.

If you're unsure about the strength of Jiahe Foods Industry's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Jiahe Foods Industry, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605300

Jiahe Foods Industry

Manufactures and sells food ingredients in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives