Is Now The Time To Put Jiangsu King's Luck Brewery Ltd (SHSE:603369) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Jiangsu King's Luck Brewery Ltd (SHSE:603369). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Jiangsu King's Luck Brewery Ltd

How Fast Is Jiangsu King's Luck Brewery Ltd Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Jiangsu King's Luck Brewery Ltd has managed to grow EPS by 24% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

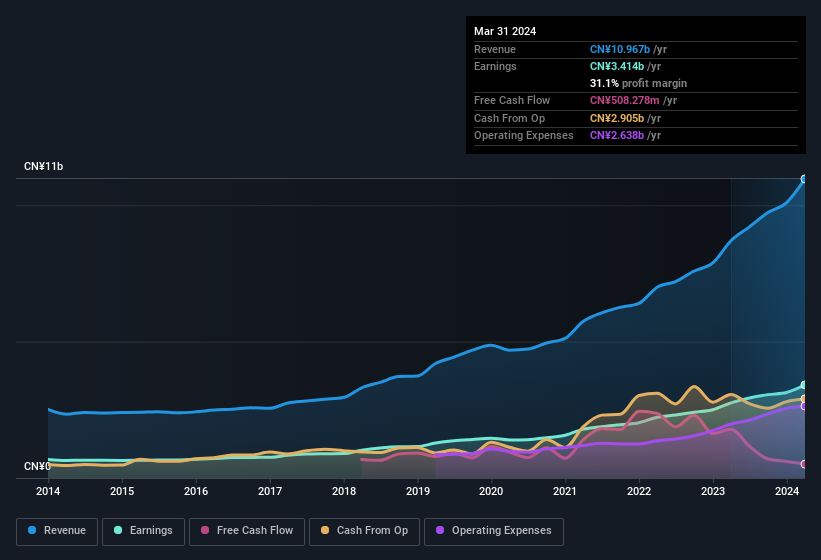

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Jiangsu King's Luck Brewery Ltd remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 26% to CN¥11b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Jiangsu King's Luck Brewery Ltd's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Jiangsu King's Luck Brewery Ltd Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a CN¥57b company like Jiangsu King's Luck Brewery Ltd. But we are reassured by the fact they have invested in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥5.1b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does Jiangsu King's Luck Brewery Ltd Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Jiangsu King's Luck Brewery Ltd's strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Jiangsu King's Luck Brewery Ltd's continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. It is worth noting though that we have found 2 warning signs for Jiangsu King's Luck Brewery Ltd (1 is a bit concerning!) that you need to take into consideration.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603369

Jiangsu King's Luck Brewery Ltd

Jiangsu King's Luck Brewery Joint-Stock Co.,Ltd.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives