- China

- /

- Infrastructure

- /

- SZSE:002023

Undiscovered Gems In Global And 2 Other Emerging Small Caps To Watch

Reviewed by Simply Wall St

Amidst a backdrop of record highs in U.S. equities and speculation around potential interest rate cuts, small-cap stocks have been leading the charge, with the Russell 2000 Index notably outperforming its larger counterparts. In this dynamic environment, discerning investors often seek out lesser-known opportunities that exhibit strong fundamentals and resilience to economic shifts—qualities that can position these undiscovered gems for potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 31.08% | 1.17% | 31.28% | ★★★★★★ |

| Saha-Union | 0.74% | 0.97% | 18.05% | ★★★★★★ |

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Thai Steel Cable | NA | 4.17% | 18.81% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. engages in the production, processing, and sale of rice wine both domestically in China and internationally, with a market cap of CN¥10.20 billion.

Operations: Kuaijishan generates revenue primarily through the sale of rice wine in both domestic and international markets. The company focuses on optimizing its cost structure to enhance profitability, with a particular emphasis on managing production and processing expenses. Its financial performance is highlighted by a noteworthy trend in gross profit margin, which has shown significant variation over recent periods.

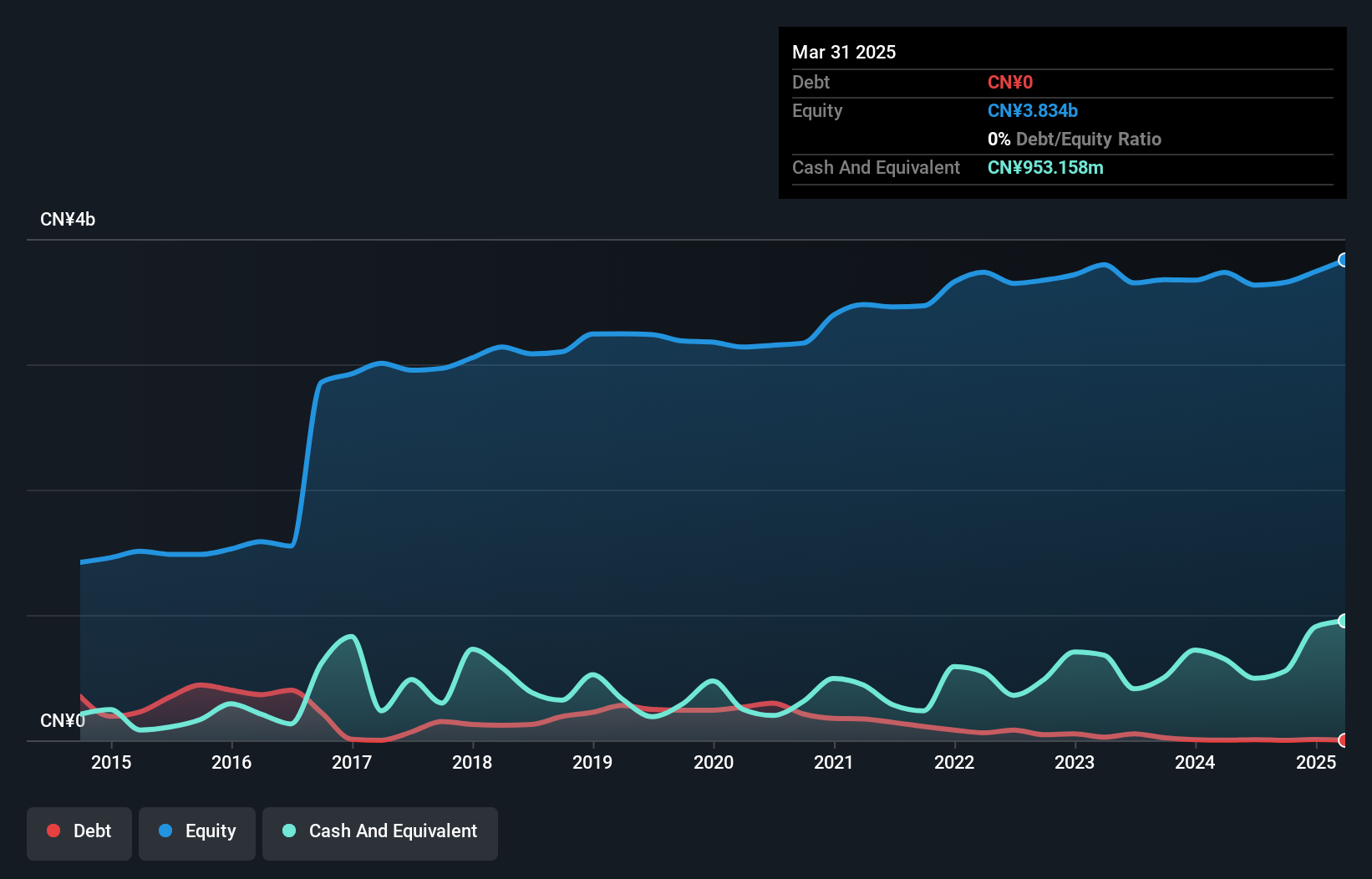

Kuaijishan Shaoxing Rice Wine, a smaller player in the beverage industry, has shown promising financial health with no debt on its books, contrasting sharply with a debt-to-equity ratio of 8.5% five years ago. The company's earnings growth of 10.2% over the past year outpaced the broader beverage industry's 3.5%, reflecting its robust performance in an otherwise competitive market. Despite high volatility in share price recently, Kuaijishan's free cash flow remains positive at A$245 million as of September 2024, suggesting strong operational efficiency and potential for continued growth amidst industry challenges.

- Get an in-depth perspective on Kuaijishan Shaoxing Rice Wine's performance by reading our health report here.

Understand Kuaijishan Shaoxing Rice Wine's track record by examining our Past report.

Anbang Save-Guard GroupLtd (SHSE:603373)

Simply Wall St Value Rating: ★★★★★★

Overview: Anbang Save-Guard Group Co., Ltd. offers financial armed escort and financial outsourcing services with a market capitalization of CN¥6.10 billion.

Operations: Anbang Save-Guard Group Co., Ltd. generates revenue primarily from financial armed escort and financial outsourcing services. The company's net profit margin is currently at 8.5%.

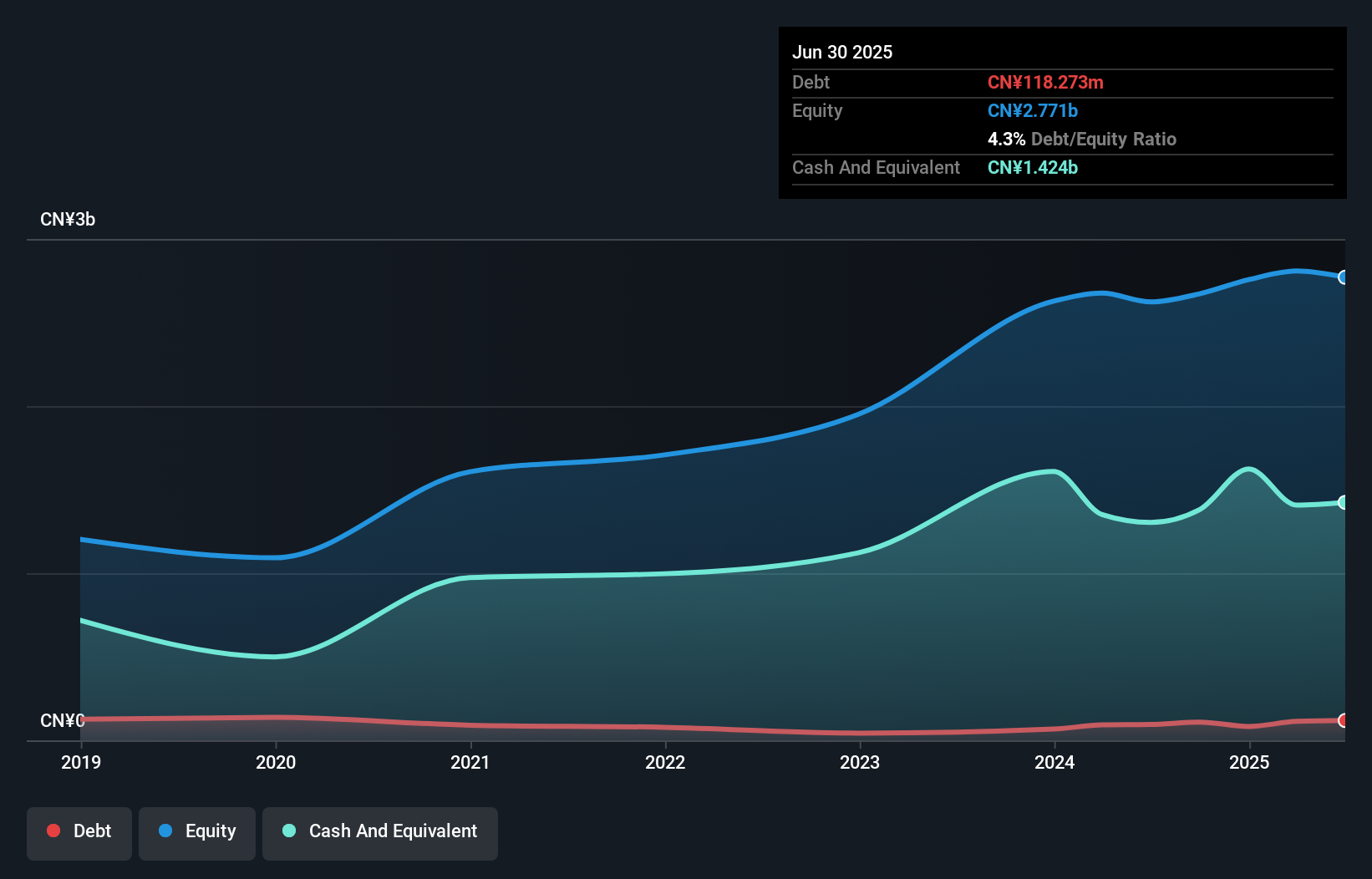

Anbang Save-Guard Group Ltd. offers a compelling opportunity with its stock trading 30.4% below estimated fair value, signaling potential for appreciation. Despite recent volatility, the company boasts high-quality earnings and has reduced its debt to equity ratio from 10.3% to 4% over five years, highlighting improved financial health. Earnings have grown by 5.6%, outpacing the industry's modest 0.9%. With more cash than total debt and interest coverage not being an issue, Anbang's financial footing seems solid as it remains profitable with positive free cash flow, suggesting resilience against market fluctuations and future growth prospects in the commercial services sector.

Sichuan Haite High-techLtd (SZSE:002023)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sichuan Haite High-tech Co., Ltd specializes in providing aircraft airborne equipment maintenance services in China and has a market capitalization of CN¥8.91 billion.

Operations: Haite High-tech generates its revenue primarily through aircraft airborne equipment maintenance services. The company's net profit margin has shown fluctuations, with the most recent figure at 7.5%.

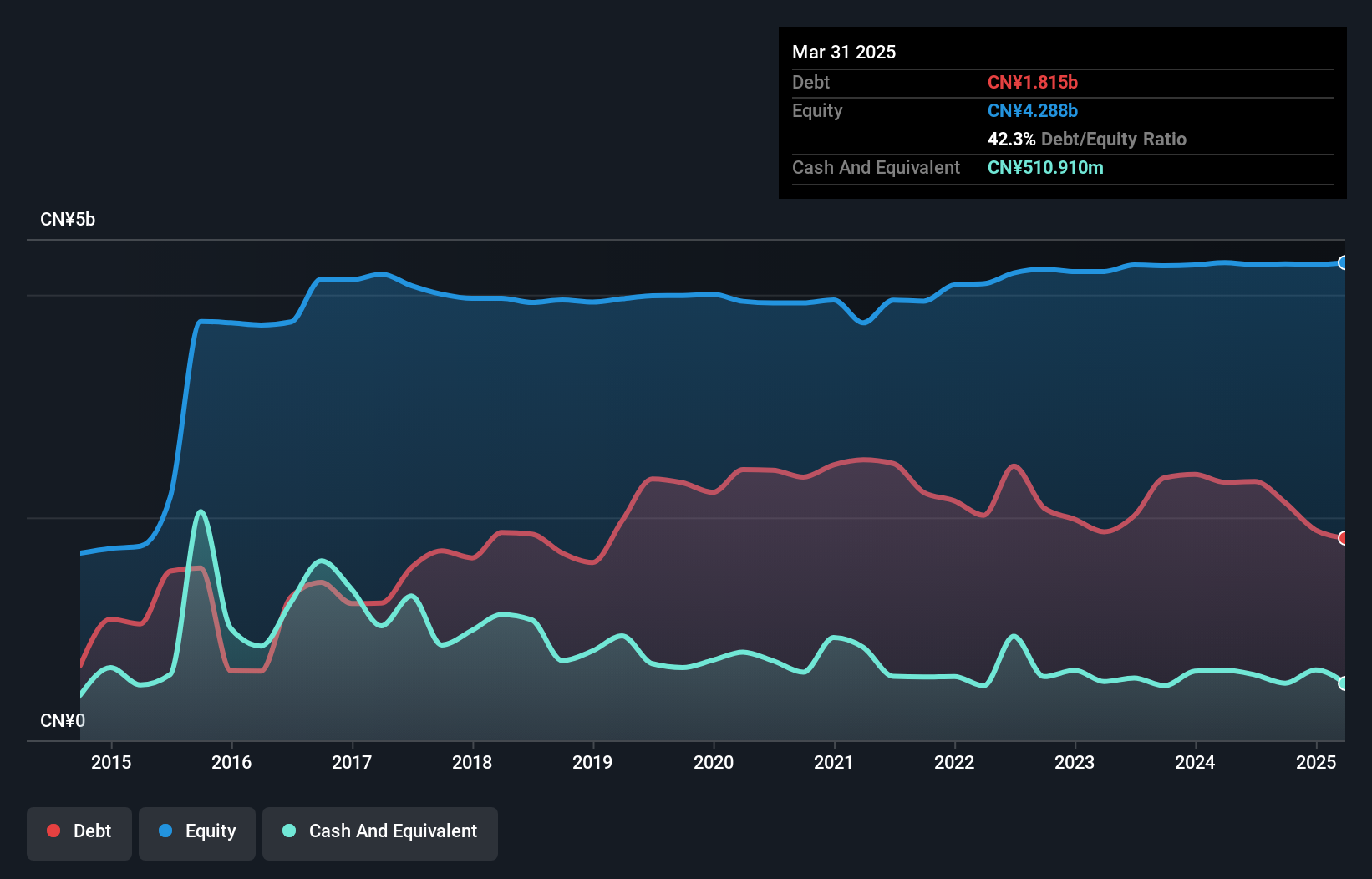

Sichuan Haite High-techLtd, a smaller player in the industry, has shown promising financial metrics. Over the past year, earnings growth of 6.9% outpaced the infrastructure sector's -1.5%, highlighting its competitive edge. The company boasts a satisfactory net debt to equity ratio of 30.4%, having improved from 61.7% over five years, indicating effective debt management strategies are likely in place. Despite high-quality earnings reported for 2023, interest payments on debt are not well covered by EBIT at just 1.9x coverage, suggesting potential concerns in this area may need addressing soon to ensure sustained profitability and growth prospects remain robust for investors considering this stock as an option within their portfolios moving forward into future quarters ahead too!

- Click to explore a detailed breakdown of our findings in Sichuan Haite High-techLtd's health report.

Where To Now?

- Access the full spectrum of 2981 Global Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002023

Sichuan Haite High-techLtd

Provides aircraft airborne equipment maintenance services in China.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026