- China

- /

- Electrical

- /

- SHSE:688411

Kuaijishan Shaoxing Rice Wine And 2 Other Undiscovered Asian Gems

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions, small-cap stocks in Asia are gaining attention amidst a backdrop of cautious optimism and shifting economic dynamics. In this environment, identifying promising stocks often involves looking for companies with unique market positions or innovative products that can thrive despite broader uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Ve Wong | 12.54% | 0.72% | 3.87% | ★★★★★★ |

| Tianjin Port Holdings | 17.03% | -3.88% | 9.77% | ★★★★★★ |

| ITE Tech | NA | 7.53% | 13.84% | ★★★★★★ |

| Yantai Ishikawa Sealing Technology | NA | 10.42% | -9.07% | ★★★★★★ |

| First Copper Technology | 19.89% | 3.59% | 15.41% | ★★★★★★ |

| JinXianDai Information IndustryLtd | 16.54% | -0.60% | -32.74% | ★★★★★☆ |

| Jinlihua Electric | 48.71% | 7.36% | 31.30% | ★★★★★☆ |

| Sinomag Technology | 68.98% | 16.59% | 3.83% | ★★★★☆☆ |

| ITCENGLOBAL | 62.78% | 15.22% | -11.48% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. is engaged in the production, processing, and sale of rice wine both domestically and internationally, with a market capitalization of CN¥7 billion.

Operations: Kuaijishan's primary revenue stream is from the sale of rice wine, both in domestic and international markets. The company has a market capitalization of approximately CN¥7 billion.

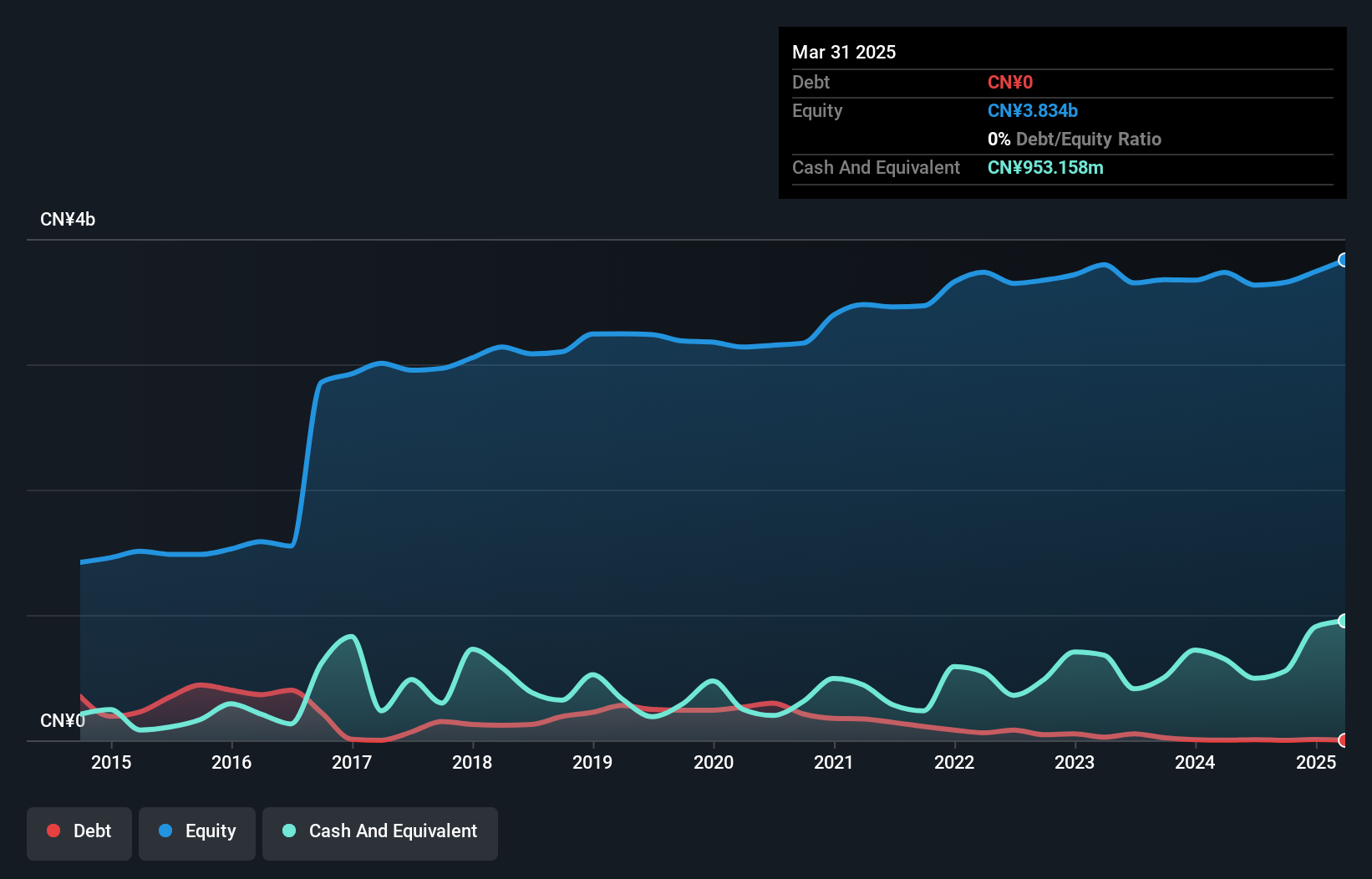

Kuaijishan Shaoxing Rice Wine, a modestly sized player in the beverage sector, has shown promising financial health. Over the past five years, its debt to equity ratio impressively dropped from 8.5% to nearly zero at 0.01%, indicating strong financial management. The company posted earnings growth of 10% last year, surpassing the broader beverage industry's growth of 7%. Trading at a notable discount of over 28% below its estimated fair value suggests potential upside for investors seeking value opportunities in niche markets like rice wine. With more cash than total debt and positive free cash flow, Kuaijishan appears well-positioned for future growth.

Beijing HyperStrong Technology (SHSE:688411)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing HyperStrong Technology Co., Ltd. specializes in the design, development, integration, and operation of energy storage power stations across China, Europe, North America, and Australia with a market capitalization of CN¥13.21 billion.

Operations: The company generates revenue primarily from the design, development, integration, and operation of energy storage power stations across multiple regions. It has a market capitalization of CN¥13.21 billion.

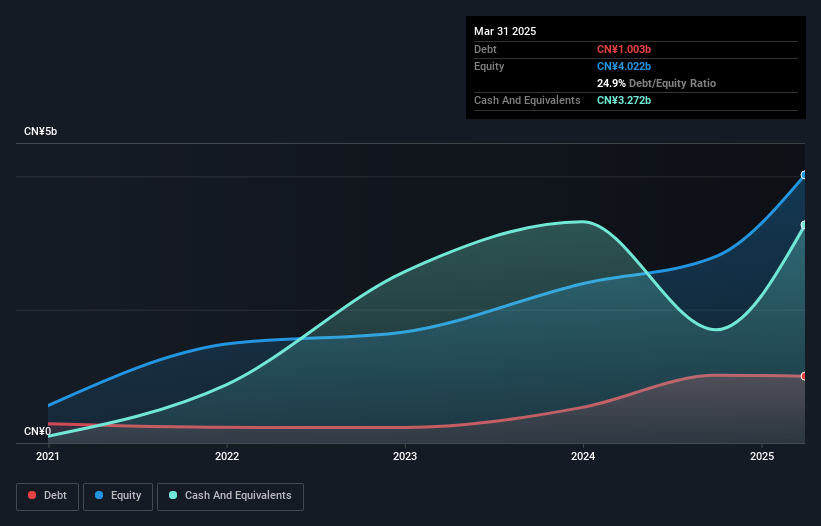

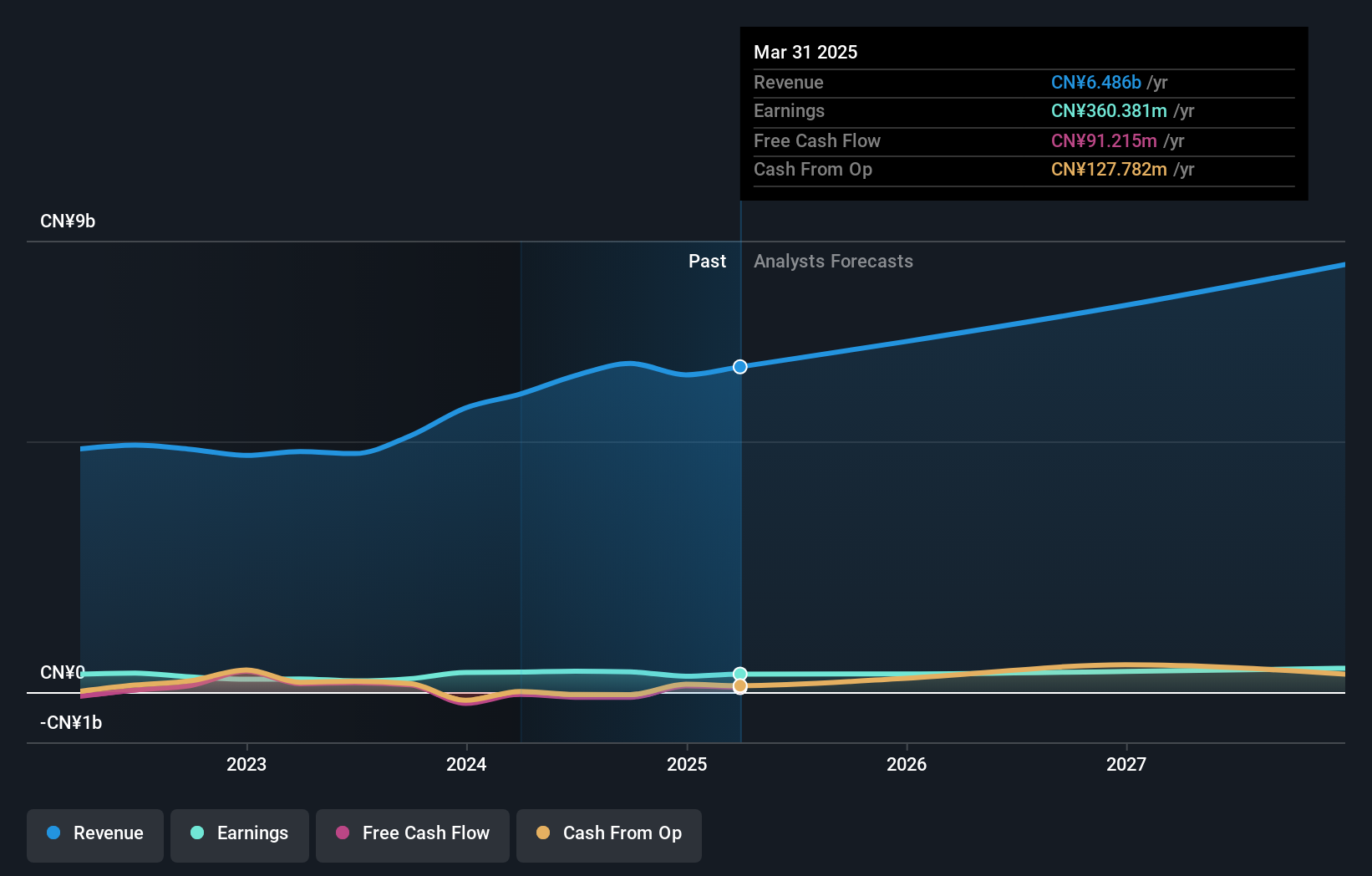

Beijing HyperStrong Technology, a smaller player in the tech industry, shows promise with its earnings growth of 11.9% over the past year, outpacing the Electrical industry's -0.8%. The company has managed to keep its debt levels in check, having more cash than total debt. Despite its high-quality earnings and a price-to-earnings ratio of 20.4x—lower than the CN market's 37x—the share price has been highly volatile recently. Although not free cash flow positive currently, future earnings are projected to grow by an impressive 29.63% per year, suggesting potential for significant value creation ahead.

Beijing Lier High-temperature MaterialsLtd (SZSE:002392)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Lier High-temperature Materials Co., Ltd. operates in the high-temperature materials industry and has a market cap of CN¥7.16 billion.

Operations: The company generates revenue primarily from the high-temperature materials industry. With a market cap of CN¥7.16 billion, it focuses on producing and supplying specialized materials for various industrial applications.

Beijing Lier High-temperature Materials, a smaller player in its sector, has shown significant financial strength. Its interest payments are comfortably covered by EBIT at 487.8 times, reflecting robust earnings quality. The company reported impressive growth with earnings increasing 48.5% over the past year, outpacing the industry’s -3.7%. Despite not being free cash flow positive recently, it holds more cash than total debt and has seen its debt-to-equity ratio rise from 1.3 to 6.3 over five years. Recent buybacks include repurchasing 2,156,800 shares for ¥10 million this quarter as part of a larger plan initiated last year.

Key Takeaways

- Get an in-depth perspective on all 2668 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing HyperStrong Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688411

Beijing HyperStrong Technology

Engages in the design, development, integration, and operation of energy storage power stations in China, Europe, North America, and Australia.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives