Jonjee Hi-Tech Industrial and Commercial Holding Co.,Ltd's (SHSE:600872) Share Price Not Quite Adding Up

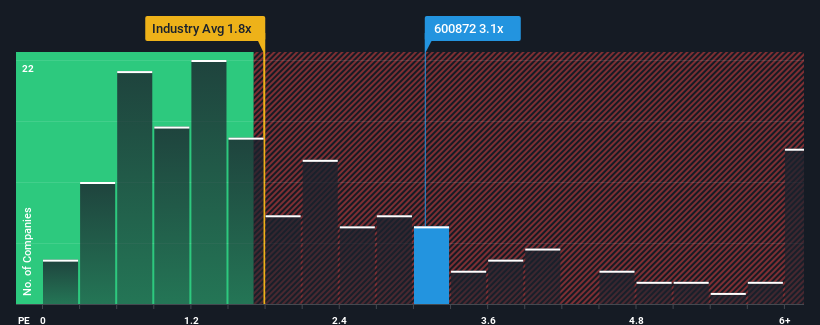

When you see that almost half of the companies in the Food industry in China have price-to-sales ratios (or "P/S") below 1.8x, Jonjee Hi-Tech Industrial and Commercial Holding Co.,Ltd (SHSE:600872) looks to be giving off some sell signals with its 3.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Jonjee Hi-Tech Industrial and Commercial HoldingLtd

How Jonjee Hi-Tech Industrial and Commercial HoldingLtd Has Been Performing

Jonjee Hi-Tech Industrial and Commercial HoldingLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jonjee Hi-Tech Industrial and Commercial HoldingLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Jonjee Hi-Tech Industrial and Commercial HoldingLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.9%. Regardless, revenue has managed to lift by a handy 8.6% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 14% as estimated by the analysts watching the company. With the industry predicted to deliver 14% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Jonjee Hi-Tech Industrial and Commercial HoldingLtd's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given Jonjee Hi-Tech Industrial and Commercial HoldingLtd's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Jonjee Hi-Tech Industrial and Commercial HoldingLtd (of which 2 shouldn't be ignored!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600872

Jonjee Hi-Tech Industrial and Commercial HoldingLtd

Produces and sells seasoning products in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives