As global markets navigate a mixed start to the year, with the S&P 500 capping off a strong two-year performance despite recent economic data concerns, investors are keenly observing how small-cap stocks might capitalize on these dynamics. Amidst this backdrop, identifying stocks with solid fundamentals and growth potential becomes crucial for those looking to uncover undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Baotou Huazi Industry (SHSE:600191)

Simply Wall St Value Rating: ★★★★★★

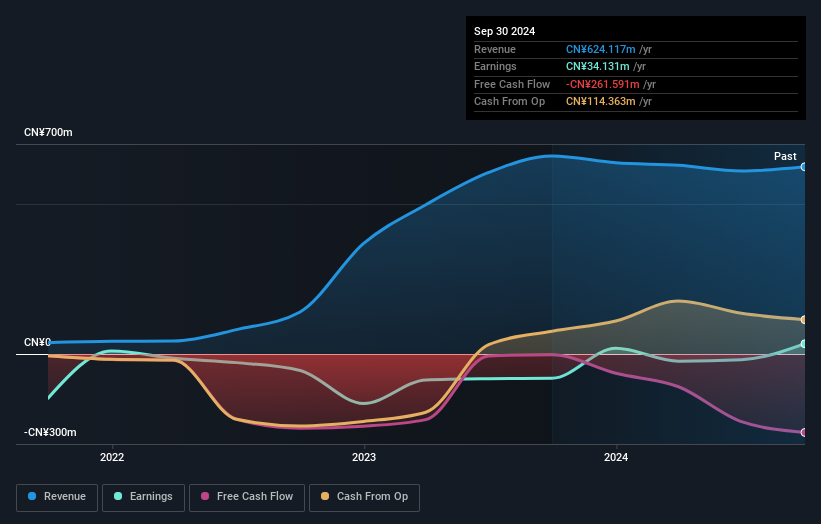

Overview: Baotou Huazi Industry Co., Ltd focuses on refining, producing, and selling sugar in China with a market cap of CN¥3.32 billion.

Operations: The company generates revenue through its sugar refining and production operations. It has a market capitalization of CN¥3.32 billion, reflecting its financial standing in the industry.

Baotou Huazi Industry, a relatively small player in its sector, has shown promising signs of financial health. The company recently reported net income of CNY 43.41 million for the first nine months of 2024, up from CNY 28.15 million the previous year, with basic earnings per share rising to CNY 0.09 from CNY 0.058. It boasts high-quality earnings and a satisfactory net debt to equity ratio at just 0.3%, indicating strong financial management over time as it reduced its debt ratio from 5.2% to 1.8% in five years while becoming profitable last year despite industry challenges.

Neto Malinda Trading (TASE:NTML)

Simply Wall St Value Rating: ★★★★★★

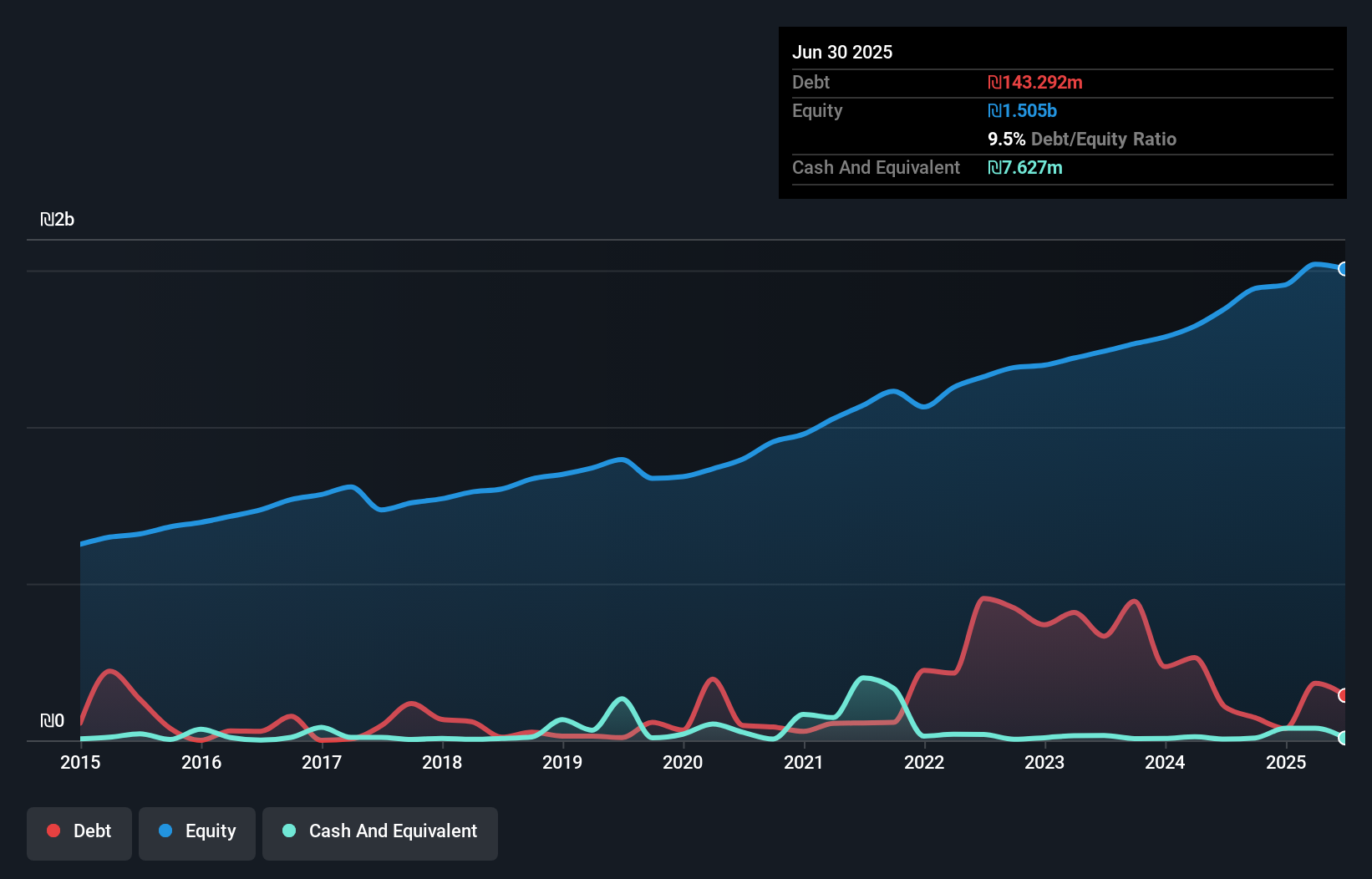

Overview: Neto Malinda Trading Ltd. is a company that manufactures, imports, markets, and distributes kosher food products with a market capitalization of approximately ₪1.63 billion.

Operations: Neto Malinda Trading generates revenue primarily from three segments: imports (₪1.99 billion), the local market (₪1.93 billion), and Neto Group factories (₪753.64 million). The import segment is the largest contributor to its revenue stream.

Neto Malinda Trading, a dynamic player in the food sector, has shown impressive earnings growth of 124.6% over the past year, outpacing industry averages. The company's debt to equity ratio improved from 6.9% to 5% over five years, indicating effective debt management. Its net income for Q3 reached ILS 62.89 million, up from ILS 27.24 million a year prior, with basic EPS at ILS 3.18 compared to ILS 1.38 last year. Trading significantly below its estimated fair value enhances its appeal as a potential investment opportunity in an evolving market landscape.

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI)

Simply Wall St Value Rating: ★★★★★☆

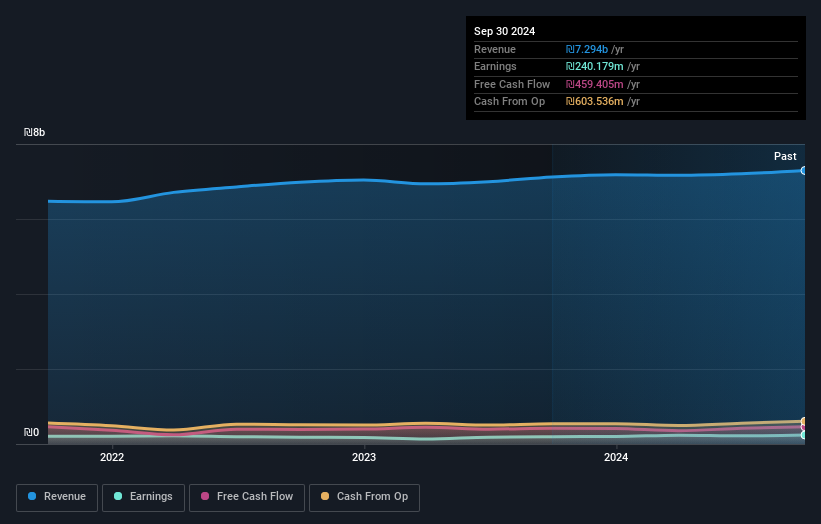

Overview: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd operates a chain of discount retail stores in Israel and has a market cap of ₪3.43 billion.

Operations: Rami Levi generates revenue primarily from its retail chains, amounting to ₪6.40 billion. The company's financial performance is impacted by segment adjustments and consolidation factors, which collectively contribute to the overall revenue structure.

Rami Levi Chain Stores, a notable player in the retail sector, demonstrates robust financial health with earnings growing at 10.4% annually over the past five years. Despite trailing the industry’s recent growth of 56.7%, its earnings quality remains high, and interest payments are well-covered by EBIT at 10.9x coverage. The company has effectively reduced its debt-to-equity ratio from 6.2% to 2% in five years and trades significantly below estimated fair value by about 70%. Recent results show improved performance with third-quarter net income rising to ILS 60.95 million from ILS 38.22 million last year, indicating solid operational progress.

Key Takeaways

- Access the full spectrum of 4665 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neto Malinda Trading might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NTML

Neto Malinda Trading

Manufactures, imports, markets, and distributes kosher food products.

Flawless balance sheet and good value.

Market Insights

Community Narratives