Earnings growth of 2.5% over 3 years hasn't been enough to translate into positive returns for Chongqing Brewery (SHSE:600132) shareholders

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Chongqing Brewery Co., Ltd. (SHSE:600132) have had an unfortunate run in the last three years. Sadly for them, the share price is down 59% in that time. More recently, the share price has dropped a further 14% in a month.

If the past week is anything to go by, investor sentiment for Chongqing Brewery isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Chongqing Brewery

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Chongqing Brewery actually saw its earnings per share (EPS) improve by 7.7% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. We like that Chongqing Brewery has actually grown its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

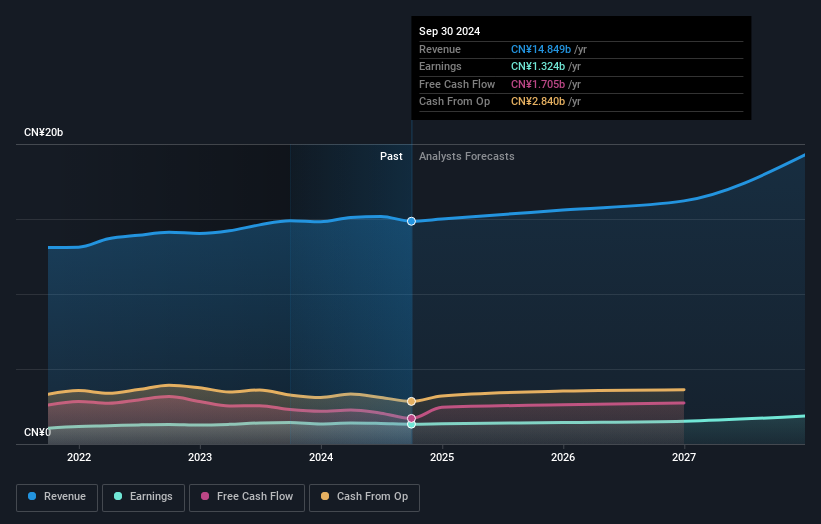

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Chongqing Brewery is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Chongqing Brewery in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Chongqing Brewery's TSR for the last 3 years was -55%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 14% in the last year, Chongqing Brewery shareholders lost 3.1% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Chongqing Brewery you should know about.

But note: Chongqing Brewery may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600132

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives