- China

- /

- Oil and Gas

- /

- SHSE:900948

Take Care Before Diving Into The Deep End On Inner Mongolia Yitai Coal Co.,Ltd. (SHSE:900948)

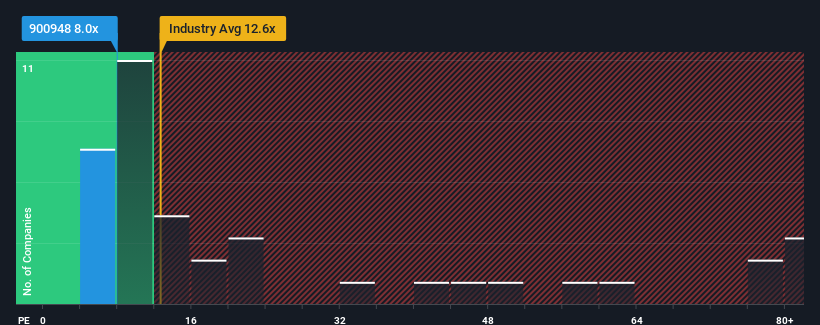

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may consider Inner Mongolia Yitai Coal Co.,Ltd. (SHSE:900948) as a highly attractive investment with its 8x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For instance, Inner Mongolia Yitai CoalLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Inner Mongolia Yitai CoalLtd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Inner Mongolia Yitai CoalLtd's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. Still, the latest three year period has seen an excellent 459% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Inner Mongolia Yitai CoalLtd's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Inner Mongolia Yitai CoalLtd currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Inner Mongolia Yitai CoalLtd you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:900948

Inner Mongolia Yitai CoalLtd

Engages in the mining, production, transportation, and sale of coal in the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives