- China

- /

- Oil and Gas

- /

- SHSE:600714

Qinghai Jinrui Mineral Development Co., Ltd's (SHSE:600714) Earnings Haven't Escaped The Attention Of Investors

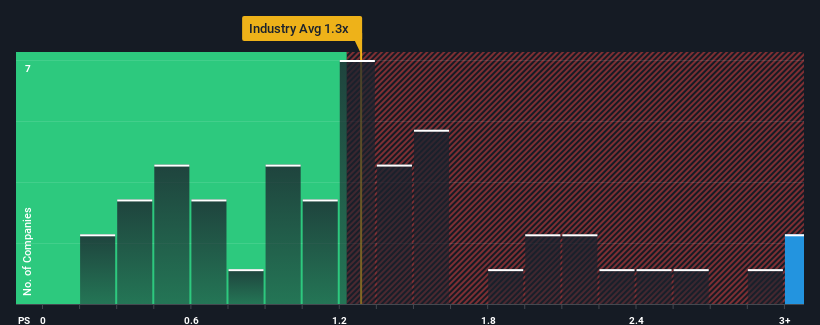

When you see that almost half of the companies in the Oil and Gas industry in China have price-to-sales ratios (or "P/S") below 1.3x, Qinghai Jinrui Mineral Development Co., Ltd (SHSE:600714) looks to be giving off strong sell signals with its 8.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Qinghai Jinrui Mineral Development

How Has Qinghai Jinrui Mineral Development Performed Recently?

For example, consider that Qinghai Jinrui Mineral Development's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Qinghai Jinrui Mineral Development, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Qinghai Jinrui Mineral Development's Revenue Growth Trending?

In order to justify its P/S ratio, Qinghai Jinrui Mineral Development would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 41%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 63% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 2.5%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Qinghai Jinrui Mineral Development is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Qinghai Jinrui Mineral Development can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Qinghai Jinrui Mineral Development (1 makes us a bit uncomfortable!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Qinghai Jinrui Mining Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600714

Qinghai Jinrui Mining Development

Produces and sells strontium salt products in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives