- China

- /

- Capital Markets

- /

- SZSE:002670

Guosheng Financial Holding's (SZSE:002670) growing losses don't faze investors as the stock spikes 39% this past week

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, the Guosheng Financial Holding Inc. (SZSE:002670) share price is up 36% in the last three years, clearly besting the market decline of around 18% (not including dividends).

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Guosheng Financial Holding

Guosheng Financial Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Guosheng Financial Holding actually saw its revenue drop by 9.2% per year over three years. The revenue growth might be lacking but the share price has gained 11% each year in that time. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

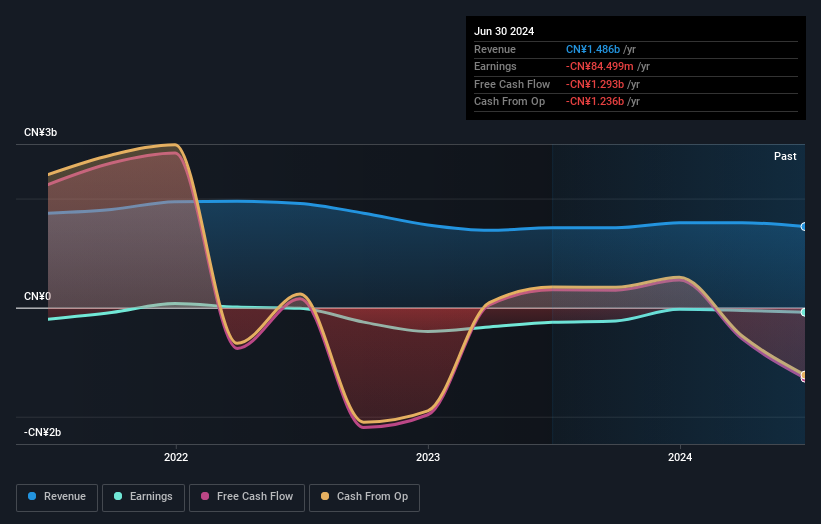

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We're pleased to report that Guosheng Financial Holding shareholders have received a total shareholder return of 32% over one year. That gain is better than the annual TSR over five years, which is 1.9%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Guosheng Financial Holding you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002670

Guosheng Financial Holding

Provides diversified financial services in China.

Adequate balance sheet with questionable track record.