- China

- /

- Metals and Mining

- /

- SZSE:000612

Undiscovered Gems Including JiaoZuo WanFang Aluminum Manufacturing And Two More Small Caps

Reviewed by Simply Wall St

In the current global market landscape, rising U.S. Treasury yields have exerted pressure on stocks, with large-cap equities faring better than their small-cap counterparts as evidenced by recent declines in the S&P MidCap 400 and Russell 2000 indices. Amidst these broader market dynamics, investors may find potential opportunities in lesser-known small-cap stocks that exhibit strong fundamentals and resilience to economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

JiaoZuo WanFang Aluminum Manufacturing (SZSE:000612)

Simply Wall St Value Rating: ★★★★★★

Overview: JiaoZuo WanFang Aluminum Manufacturing Co., Ltd is involved in the smelting and processing of aluminum products in China with a market cap of CN¥8.88 billion.

Operations: JiaoZuo WanFang Aluminum Manufacturing generates revenue primarily from the smelting and processing of aluminum products. The company's financial performance is influenced by its cost structure, which impacts profitability.

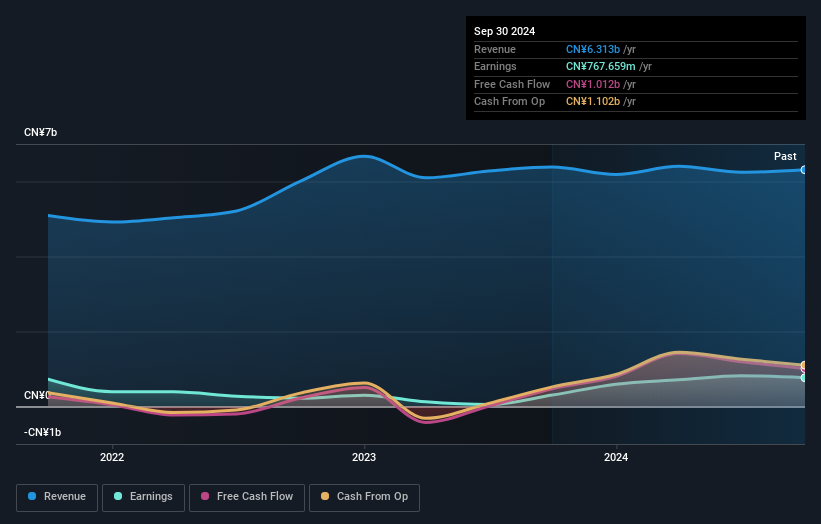

JiaoZuo WanFang Aluminum Manufacturing, a notable player in the aluminum sector, has shown impressive financial resilience. Recent earnings for the nine months ending September 2024 saw net income surge to CNY 527.98 million from CNY 353.37 million last year, with basic earnings per share rising to CNY 0.443 from CNY 0.296. The company's debt-to-equity ratio improved significantly over five years, dropping from 38% to just 12%. Despite trading at a substantial discount of about 83% below its estimated fair value, JiaoZuo WanFang's earnings growth outpaced the industry average by a wide margin of over 150%.

Chongyi Zhangyuan Tungsten (SZSE:002378)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chongyi Zhangyuan Tungsten Co., Ltd. is involved in the mining of tungsten and other metal mineral products both in China and internationally, with a market capitalization of CN¥8.01 billion.

Operations: Chongyi Zhangyuan Tungsten generates revenue primarily from the mining of tungsten and other metal mineral products. The company's net profit margin has shown fluctuations, reflecting changes in operational efficiency and market conditions.

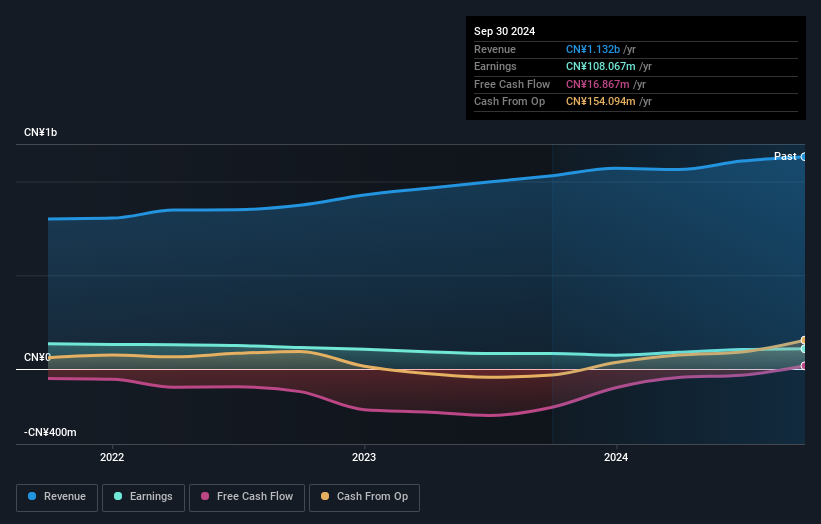

Chongyi Zhangyuan Tungsten, a player in the metals and mining sector, has shown solid earnings growth of 32.9% over the past year, outpacing its industry peers which saw a decrease of 2.3%. The company's net debt to equity ratio stands at 63%, indicating a high level of leverage, though interest payments are well covered with an EBIT coverage of 15.7 times. Recent results for the nine months ending September 2024 reveal sales reaching CN¥2.82 billion and net income climbing to CN¥146.58 million from CN¥110.21 million last year, reflecting robust operational performance despite financial constraints.

Sinomag Technology (SZSE:300835)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sinomag Technology Co., Ltd. focuses on the research, development, production, and sale of permanent ferrite magnets and soft magnetic cores and components globally, with a market capitalization of CN¥3.54 billion.

Operations: Sinomag Technology generates revenue primarily from the sale of permanent ferrite magnets and soft magnetic cores. The company's financial performance is characterized by a net profit margin trend, which provides insight into its profitability.

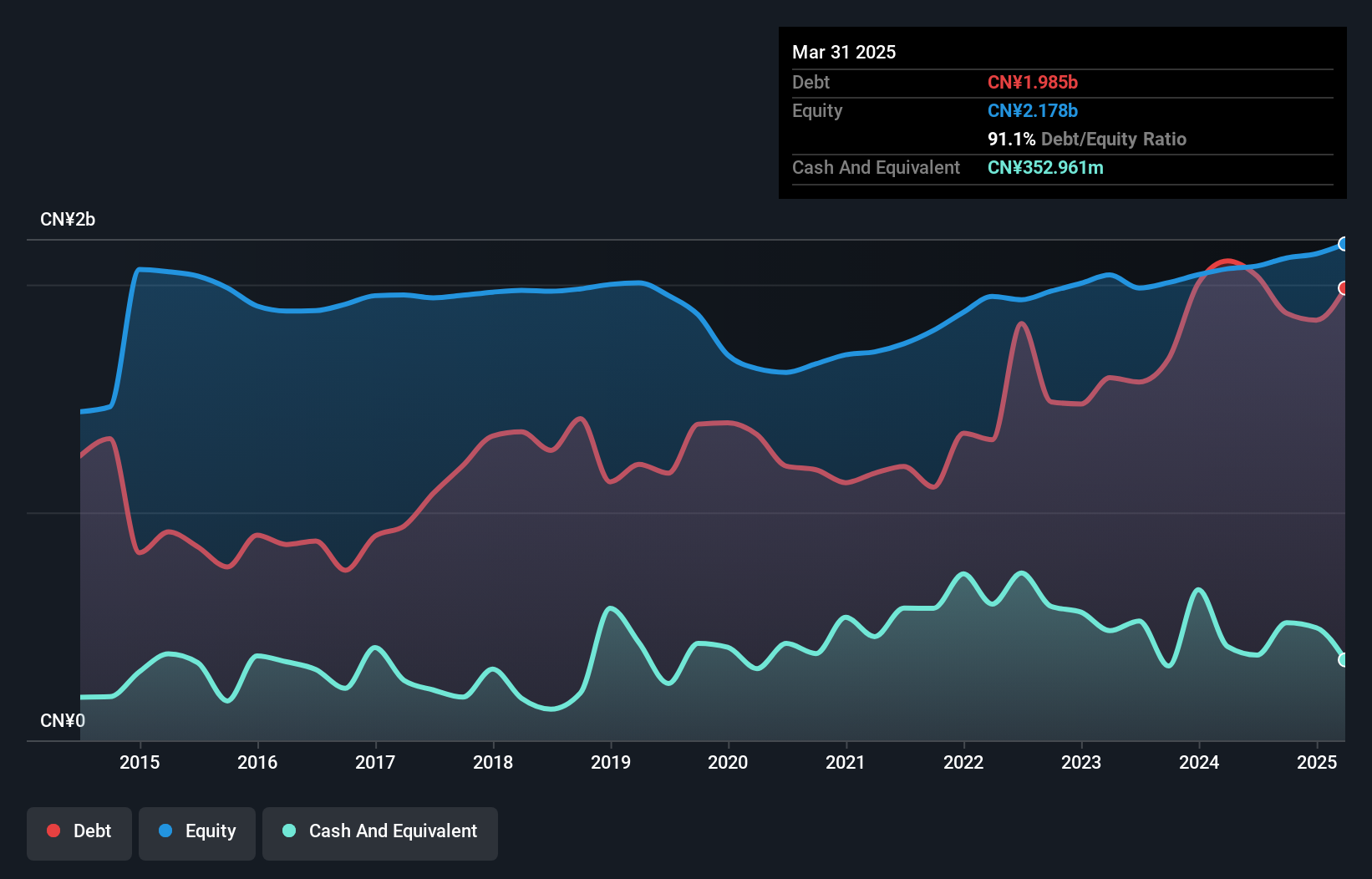

Sinomag Technology, a smaller player in the electrical sector, has shown impressive financial performance recently. Their net income for the first nine months of 2024 reached CNY 99.42 million, up from CNY 65.23 million a year ago, with earnings per share rising to CNY 0.84 from CNY 0.54. The company also completed a share buyback worth CNY 39.87 million in September, indicating confidence in its valuation and future prospects. Despite an increased debt to equity ratio of 46%, their interest coverage is strong at nearly twelve times EBIT, and they maintain satisfactory net debt levels at around thirty-one percent equity.

- Dive into the specifics of Sinomag Technology here with our thorough health report.

Evaluate Sinomag Technology's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4730 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000612

JiaoZuo WanFang Aluminum Manufacturing

Engages in smelting and processing aluminum products in China.

Flawless balance sheet with solid track record and pays a dividend.