3 Growth Companies With High Insider Ownership Growing Revenue Up To 30%

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have put pressure on stocks, with growth companies showing resilience amid these challenges. As investors navigate this environment, high insider ownership in growth companies can be a positive indicator of confidence and alignment with shareholder interests, particularly when these firms are demonstrating significant revenue growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 101.9% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Intellect Design Arena (NSEI:INTELLECT)

Simply Wall St Growth Rating: ★★★★☆☆

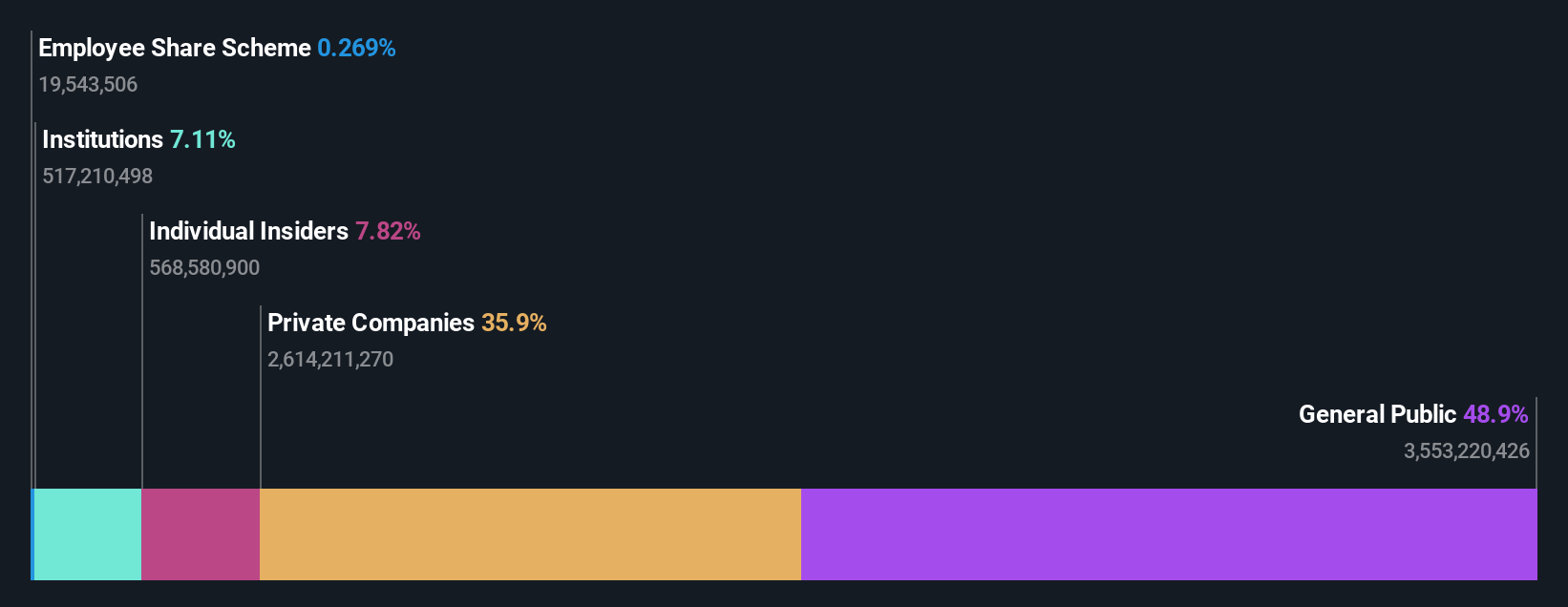

Overview: Intellect Design Arena Limited offers software development and related services for the banking, insurance, and financial services sectors both in India and internationally, with a market cap of ₹104.58 billion.

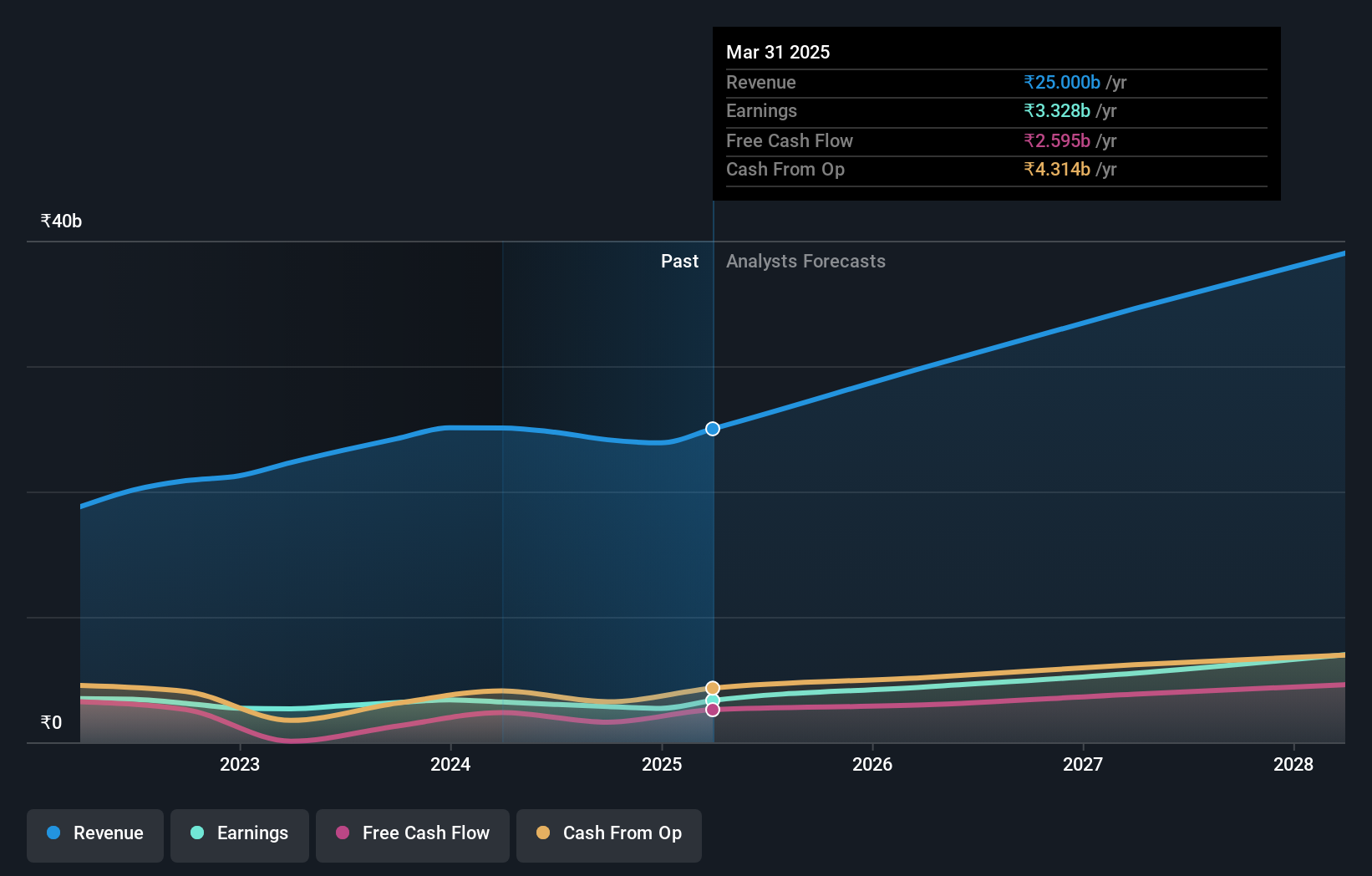

Operations: The company generates revenue of ₹24.12 billion from software product licenses and related services.

Insider Ownership: 14.3%

Revenue Growth Forecast: 12% p.a.

Intellect Design Arena, with its focus on financial technology solutions, is experiencing notable growth prospects. Its earnings are forecast to grow significantly at 24.6% annually, outpacing the Indian market's average. Despite a recent decline in quarterly revenue and net income, strategic partnerships and innovative product launches like eMACH.ai continue to drive expansion across regions such as the Middle East. Insider activity shows more buying than selling recently, indicating confidence in future performance despite a current unstable dividend track record.

- Navigate through the intricacies of Intellect Design Arena with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Intellect Design Arena shares in the market.

Ningxia Baofeng Energy Group (SHSE:600989)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal mining and chemical products such as methanol and olefins, with a market cap of approximately CN¥116.67 billion.

Operations: The company generates revenue from the production, processing, and sale of coal mining products including washing and coking, as well as chemical products such as coal tar, crude benzene, C4 deep-processed items, methanol, and olefins.

Insider Ownership: 35%

Revenue Growth Forecast: 27.5% p.a.

Ningxia Baofeng Energy Group demonstrates strong growth potential, with earnings expected to increase significantly at 36.8% annually, surpassing the CN market average. Recent nine-month results show revenue reaching CNY 24.27 billion and net income of CNY 4.54 billion, reflecting robust performance despite a high debt level and unsustainable dividend coverage by free cash flow. The stock trades at a good value below analyst price targets, suggesting room for appreciation amidst favorable industry comparisons.

- Unlock comprehensive insights into our analysis of Ningxia Baofeng Energy Group stock in this growth report.

- Upon reviewing our latest valuation report, Ningxia Baofeng Energy Group's share price might be too pessimistic.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

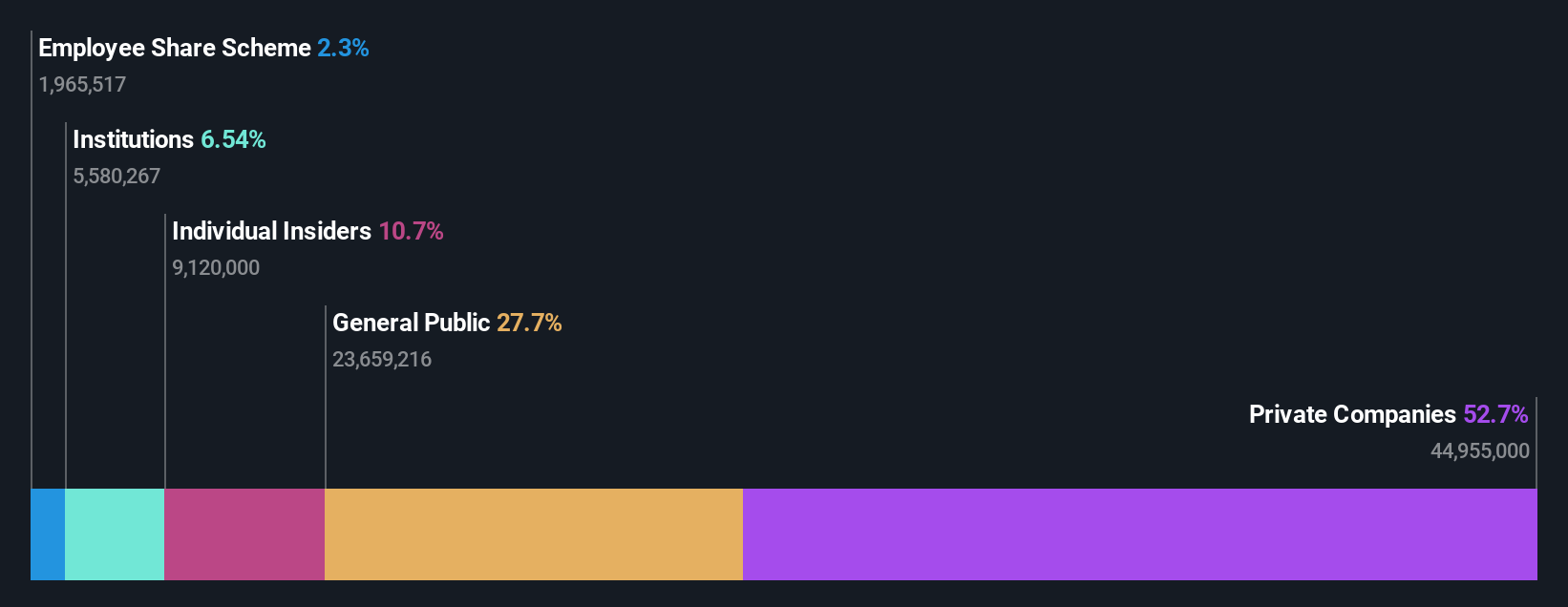

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. operates in the agricultural technology sector and has a market cap of CN¥6.28 billion.

Operations: Zhejiang Top Cloud-agri Technology Co., Ltd. generates its revenue from various segments within the agricultural technology sector.

Insider Ownership: 10.7%

Revenue Growth Forecast: 30.6% p.a.

Zhejiang Top Cloud-agri Technology showcases promising growth, with earnings projected to rise 31.1% annually, outpacing the CN market. Recent nine-month results reveal sales of CNY 335.51 million and net income of CNY 76.6 million, indicating solid performance despite high share price volatility. The company's recent IPO raised CNY 309.14 million, enhancing its capital base and positioning it for future expansion while being added to key stock indices reflects growing market recognition.

- Take a closer look at Zhejiang Top Cloud-agri TechnologyLtd's potential here in our earnings growth report.

- The analysis detailed in our Zhejiang Top Cloud-agri TechnologyLtd valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 1526 Fast Growing Companies With High Insider Ownership now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Baofeng Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600989

Ningxia Baofeng Energy Group

Produces, processes, and sells coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed, methanol, and olefin products.

Very undervalued with exceptional growth potential.