- China

- /

- Capital Markets

- /

- SZSE:000166

Market Still Lacking Some Conviction On Shenwan Hongyuan Group Co., Ltd. (SZSE:000166)

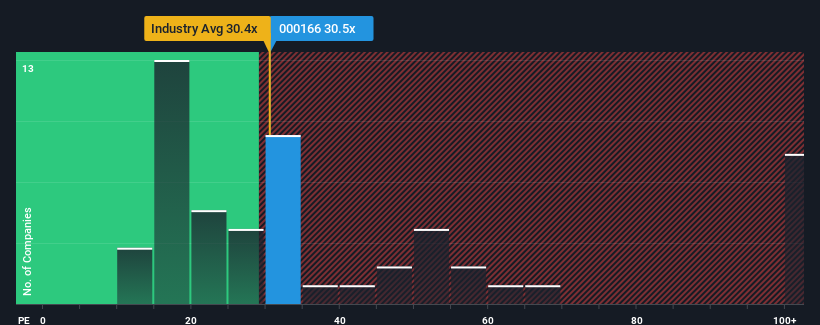

Shenwan Hongyuan Group Co., Ltd.'s (SZSE:000166) price-to-earnings (or "P/E") ratio of 30.5x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 35x and even P/E's above 67x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Shenwan Hongyuan Group as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Shenwan Hongyuan Group

What Are Growth Metrics Telling Us About The Low P/E?

Shenwan Hongyuan Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 45% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 53% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 59% as estimated by the three analysts watching the company. With the market only predicted to deliver 38%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Shenwan Hongyuan Group is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shenwan Hongyuan Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shenwan Hongyuan Group you should be aware of.

If these risks are making you reconsider your opinion on Shenwan Hongyuan Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000166

Shenwan Hongyuan Group

Provides various financial products and services to corporate, professional institutional, individuals, and non-professional institutional customers.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives