- China

- /

- Capital Markets

- /

- SHSE:601696

What BOC International (China) CO., LTD.'s (SHSE:601696) 33% Share Price Gain Is Not Telling You

BOC International (China) CO., LTD. (SHSE:601696) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

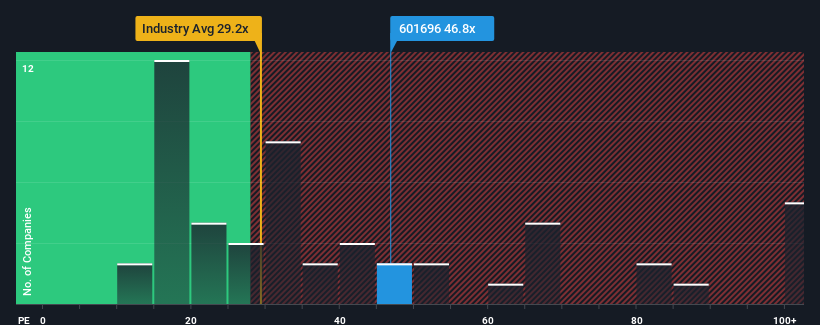

After such a large jump in price, BOC International (China)'s price-to-earnings (or "P/E") ratio of 46.8x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 28x and even P/E's below 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for BOC International (China) as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for BOC International (China)

Does Growth Match The High P/E?

BOC International (China)'s P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 26% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 21% as estimated by the lone analyst watching the company. With the market predicted to deliver 36% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that BOC International (China) is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

The strong share price surge has got BOC International (China)'s P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that BOC International (China) currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for BOC International (China) that you should be aware of.

If you're unsure about the strength of BOC International (China)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if BOC International (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601696

BOC International (China)

Provides investment banking and securities services in the People’s Republic of China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives