- China

- /

- Capital Markets

- /

- SHSE:601696

BOC International (China) CO., LTD.'s (SHSE:601696) Earnings Haven't Escaped The Attention Of Investors

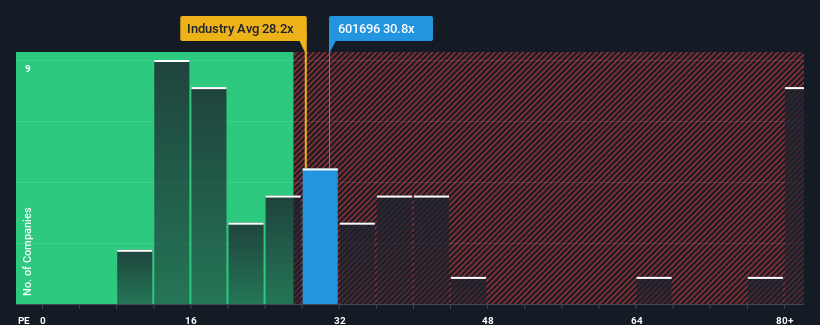

With a median price-to-earnings (or "P/E") ratio of close to 29x in China, you could be forgiven for feeling indifferent about BOC International (China) CO., LTD.'s (SHSE:601696) P/E ratio of 30.8x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

BOC International (China) certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for BOC International (China)

Is There Some Growth For BOC International (China)?

There's an inherent assumption that a company should be matching the market for P/E ratios like BOC International (China)'s to be considered reasonable.

Retrospectively, the last year delivered a decent 3.1% gain to the company's bottom line. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 36% during the coming year according to the lone analyst following the company. That's shaping up to be similar to the 38% growth forecast for the broader market.

With this information, we can see why BOC International (China) is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of BOC International (China)'s analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for BOC International (China) with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if BOC International (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601696

BOC International (China)

Provides investment banking and securities services in the People’s Republic of China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives