- China

- /

- Capital Markets

- /

- SHSE:600390

A Piece Of The Puzzle Missing From Minmetals Capital Company Limited's (SHSE:600390) 62% Share Price Climb

The Minmetals Capital Company Limited (SHSE:600390) share price has done very well over the last month, posting an excellent gain of 62%. Looking back a bit further, it's encouraging to see the stock is up 25% in the last year.

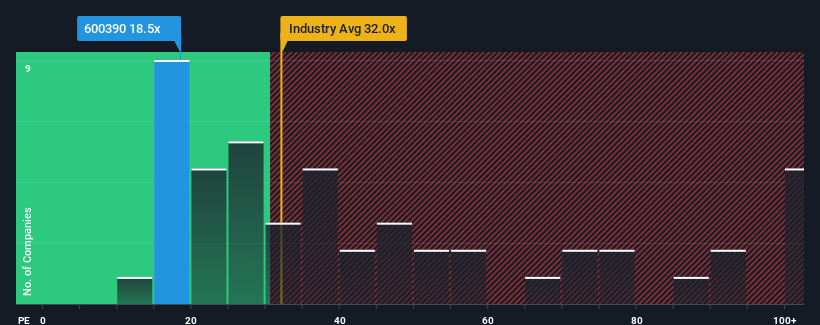

Although its price has surged higher, Minmetals Capital's price-to-earnings (or "P/E") ratio of 18.5x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 58x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Minmetals Capital has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Minmetals Capital

How Is Minmetals Capital's Growth Trending?

In order to justify its P/E ratio, Minmetals Capital would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 44%. As a result, earnings from three years ago have also fallen 60% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 25% per annum during the coming three years according to the sole analyst following the company. With the market only predicted to deliver 19% per year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Minmetals Capital's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Minmetals Capital's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Minmetals Capital's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Minmetals Capital has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600390

Minmetals Capital

Engages in the trust, financial leasing, securities, futures, funds, banking, insurance, and other businesses in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives