- China

- /

- Electrical

- /

- SZSE:300786

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As global markets face a turbulent start to the year, with U.S. equities declining amid inflation concerns and political uncertainties, investors are keenly watching for signs of stability and growth potential. In such a volatile environment, companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 35.8% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

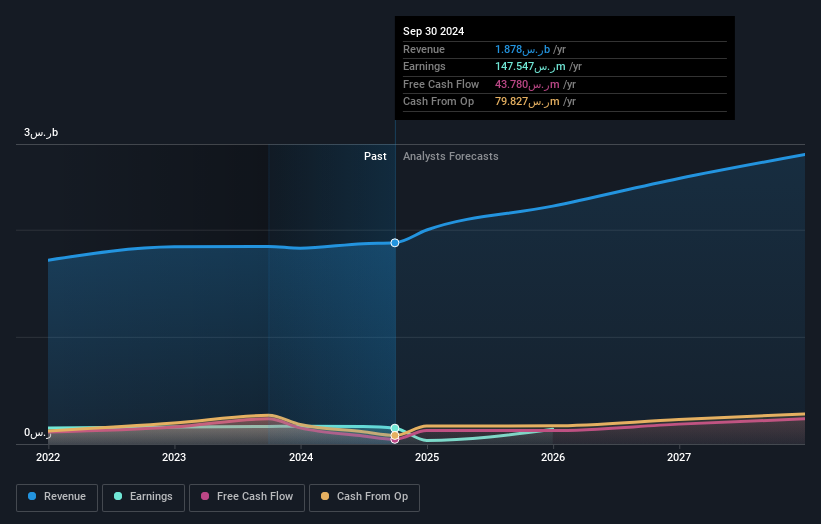

Saudi Manpower Solutions (SASE:1834)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Saudi Manpower Solutions Company offers recruitment, manpower, and logistics services to workers, government, and private sectors in Saudi Arabia with a market cap of SAR3.10 billion.

Operations: The company generates revenue from its Corporate Segment, amounting to SAR1.25 billion, and its Individual Segment, contributing SAR542.26 million.

Insider Ownership: 10.5%

Earnings Growth Forecast: 22% p.a.

Saudi Manpower Solutions is experiencing robust earnings growth, forecasted at 22% annually, outpacing the Saudi market's 6%. The company's Return on Equity is expected to reach a high of 30.9% in three years. While revenue growth is moderate at 10.3%, it surpasses the negative market trend. Its price-to-earnings ratio of 21x indicates good value compared to the SA market average of 23.4x. Recently added to major indices, enhancing its visibility and potential investor interest.

- Click to explore a detailed breakdown of our findings in Saudi Manpower Solutions' earnings growth report.

- The valuation report we've compiled suggests that Saudi Manpower Solutions' current price could be inflated.

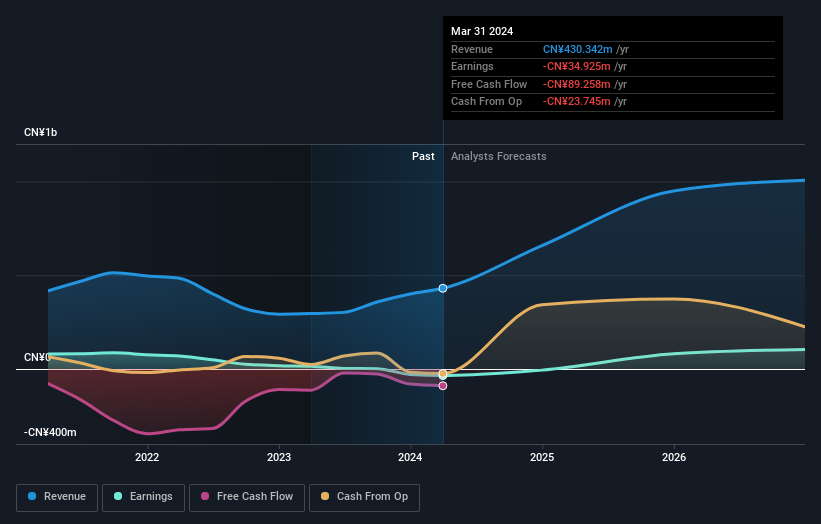

Qingdao Guolin Technology GroupLtd (SZSE:300786)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingdao Guolin Technology Group Co., Ltd. specializes in the design, manufacture, installation, commissioning, operation, and maintenance of ozone equipment and has a market cap of CN¥2.46 billion.

Operations: Qingdao Guolin Technology Group Co., Ltd. generates revenue through its activities in designing, manufacturing, installing, commissioning, operating, and maintaining ozone equipment.

Insider Ownership: 29.5%

Earnings Growth Forecast: 111.7% p.a.

Qingdao Guolin Technology Group shows promising growth potential, with revenue expected to increase by 29.1% annually, surpassing the Chinese market's average. Despite a current net loss of CNY 35.33 million for nine months in 2024, profitability is anticipated within three years. The company's earnings are forecasted to grow significantly at 111.66% per year. However, its Return on Equity is projected to remain low at 7%, and recent share price volatility may concern some investors.

- Take a closer look at Qingdao Guolin Technology GroupLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Qingdao Guolin Technology GroupLtd is trading beyond its estimated value.

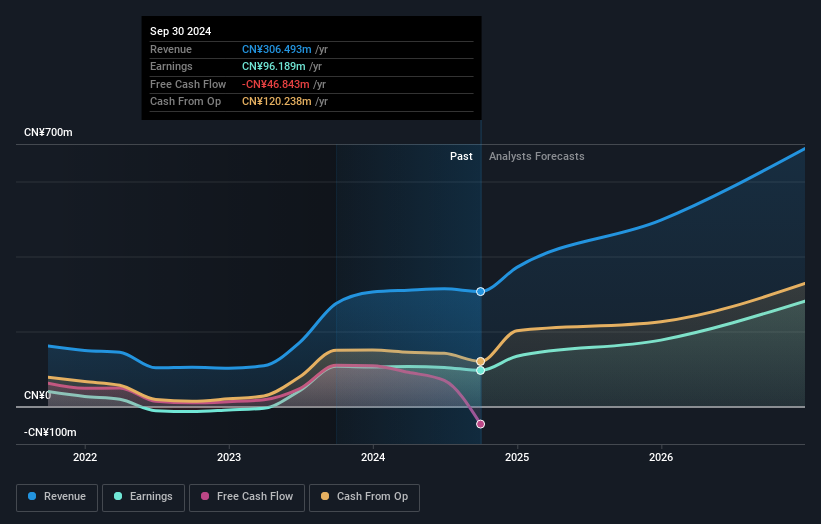

Western Regions Tourism DevelopmentLtd (SZSE:300859)

Simply Wall St Growth Rating: ★★★★★★

Overview: Western Regions Tourism Development Co., Ltd operates in the tourism and travel services sector in China, with a market cap of CN¥5.26 billion.

Operations: The company generates revenue from its tourism catering services, amounting to CN¥306.49 million.

Insider Ownership: 13.9%

Earnings Growth Forecast: 44.3% p.a.

Western Regions Tourism Development Ltd. demonstrates strong growth potential, with earnings projected to grow significantly at 44.3% annually, outpacing the Chinese market average. Revenue is also expected to rise by 34.9% per year. Despite a slight decline in net income from CNY 124.71 million to CNY 115.31 million for the first nine months of 2024, insider ownership remains high and stable, with no substantial insider trading activity reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Western Regions Tourism DevelopmentLtd.

- Our expertly prepared valuation report Western Regions Tourism DevelopmentLtd implies its share price may be too high.

Where To Now?

- Click through to start exploring the rest of the 1435 Fast Growing Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Qingdao Guolin Technology GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qingdao Guolin Technology GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300786

Qingdao Guolin Technology GroupLtd

Engages in the design and manufacture, installation, commissioning, operation, and maintenance of ozone equipment.

Mediocre balance sheet minimal.

Market Insights

Community Narratives