- China

- /

- Consumer Services

- /

- SZSE:300592

Insider-Led Growth: 3 Top Companies To Watch

Reviewed by Simply Wall St

In the current global market landscape, characterized by fluctuating indices and shifting policy expectations under the new U.S. administration, investors are seeking stability and growth potential amidst uncertainty. One key factor that can indicate a promising investment is high insider ownership in growth companies, as it often aligns management's interests with those of shareholders and can signal confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| On Holding (NYSE:ONON) | 31% | 29.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

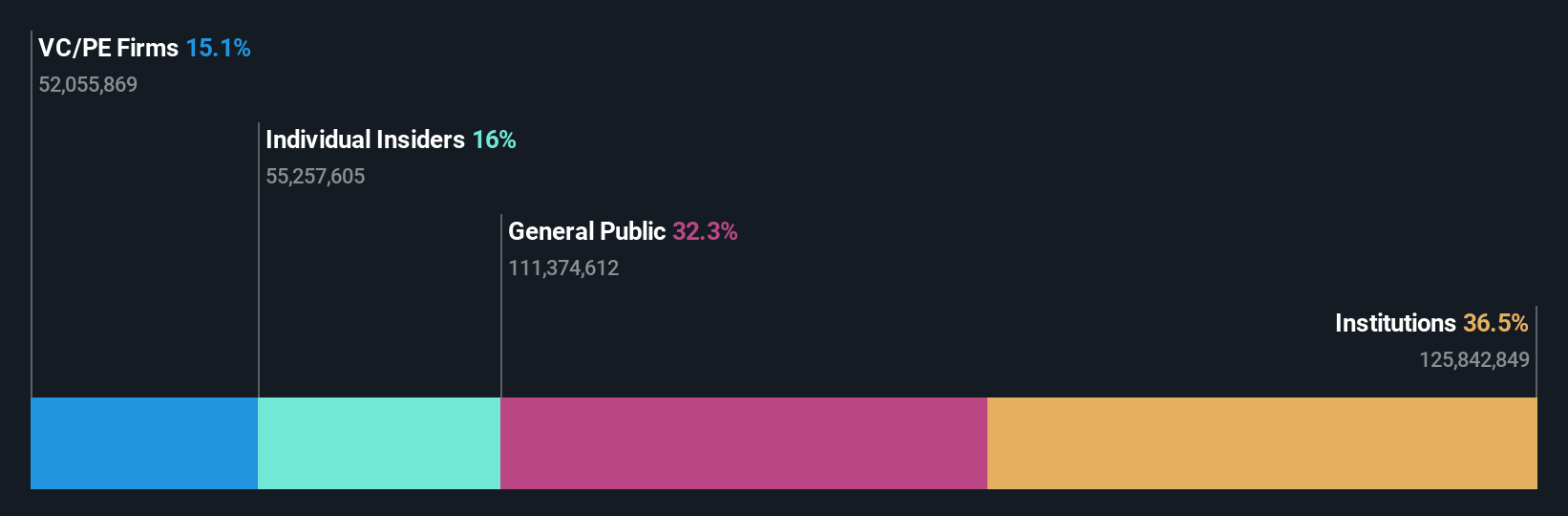

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of SEK15.62 billion.

Operations: The company's revenue primarily comes from its Communications Software segment, generating SEK1.78 billion.

Insider Ownership: 29.7%

Truecaller is poised for growth with earnings expected to rise significantly, outpacing the Swedish market. Analysts anticipate a 39.3% stock price increase, and the company trades at 52.6% below estimated fair value. Recent executive changes include Rishit Jhunjhunwala's appointment as CEO, ensuring strategic continuity. Partnerships with King Price Insurance and Halan bolster Truecaller's brand credibility and customer trust through enhanced communication solutions, further supporting its growth trajectory in a competitive market environment.

- Dive into the specifics of Truecaller here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Truecaller is priced lower than what may be justified by its financials.

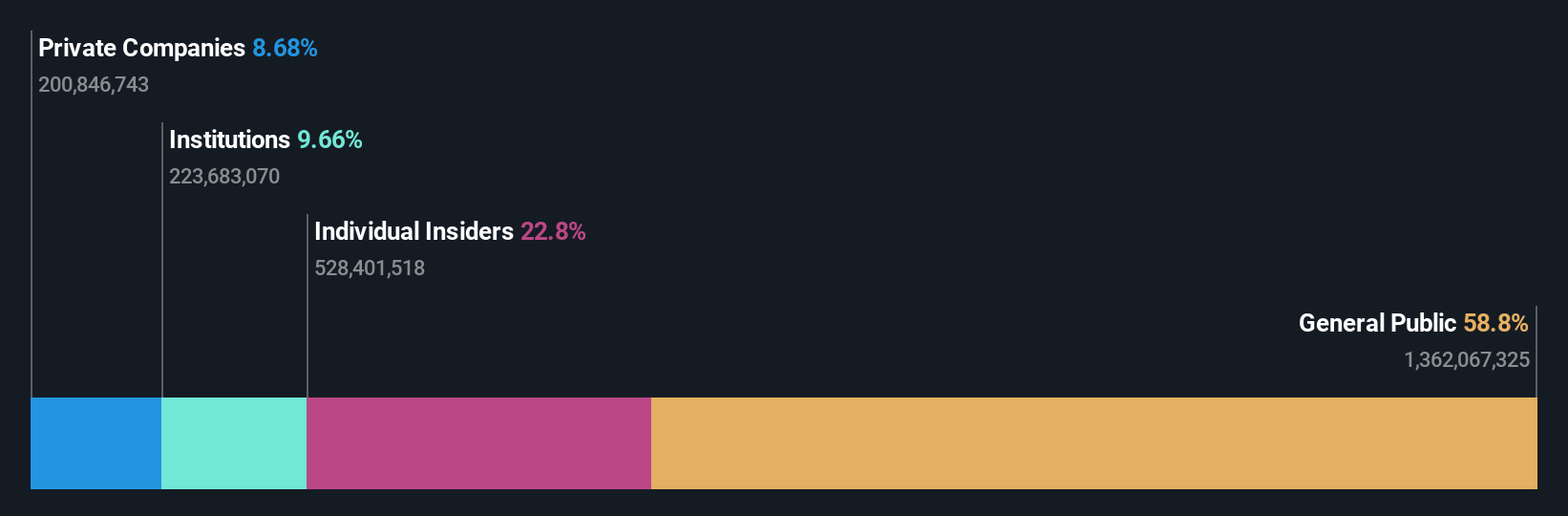

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and internationally, with a market cap of approximately HK$7.63 billion.

Operations: The company's revenue primarily comes from its software-as-a-service offering, totaling HK$2.18 billion.

Insider Ownership: 23.1%

Vobile Group's growth trajectory is underscored by a forecasted earnings increase of over 60% annually, surpassing the Hong Kong market average. Recent strategic moves include a private placement of HK$78 million in convertible bonds and a share buyback program aimed at enhancing shareholder value. Despite volatile share prices and reduced profit margins, these initiatives reflect strong insider confidence and potential for improved net asset value per share.

- Unlock comprehensive insights into our analysis of Vobile Group stock in this growth report.

- Our comprehensive valuation report raises the possibility that Vobile Group is priced higher than what may be justified by its financials.

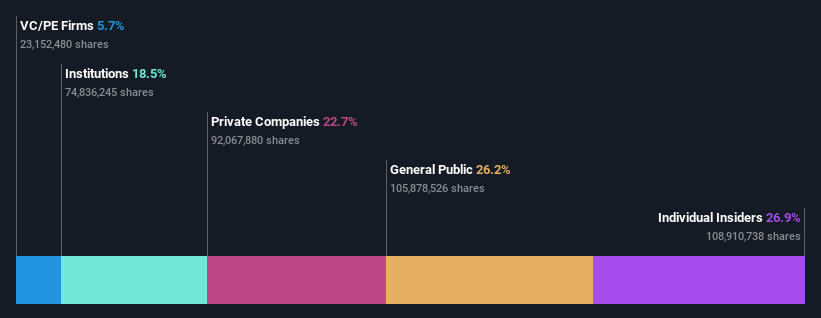

Huakai Yibai TechnologyLtd (SZSE:300592)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Huakai Yibai Technology Co., Ltd. offers environmental art design services for indoor spaces in the People’s Republic of China and has a market capitalization of CN¥5.77 billion.

Operations: Huakai Yibai Technology Co., Ltd. generates revenue through providing environmental art design services for indoor spaces within China.

Insider Ownership: 29.2%

Huakai Yibai Technology's revenue growth is projected at 22.9% annually, outpacing the Chinese market average. Despite a low forecasted return on equity and recent shareholder dilution, earnings are expected to grow significantly at 33.8% per year. Recent M&A activity shows insider confidence with substantial stakes acquired by Hu Fanjin and Zhuang Junchao for over CNY 240 million each, indicating strong internal belief in the company's growth potential despite declining profit margins.

- Take a closer look at Huakai Yibai TechnologyLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Huakai Yibai TechnologyLtd is trading beyond its estimated value.

Next Steps

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1543 more companies for you to explore.Click here to unveil our expertly curated list of 1546 Fast Growing Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Huakai Yibai TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300592

Huakai Yibai TechnologyLtd

Provides environmental art design services for indoor spaces in the People’s Republic of China.

High growth potential with excellent balance sheet.