- China

- /

- Consumer Services

- /

- SZSE:003032

Jiangsu Chuanzhiboke Education Technology Co., LTD.'s (SZSE:003032) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

The Jiangsu Chuanzhiboke Education Technology Co., LTD. (SZSE:003032) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

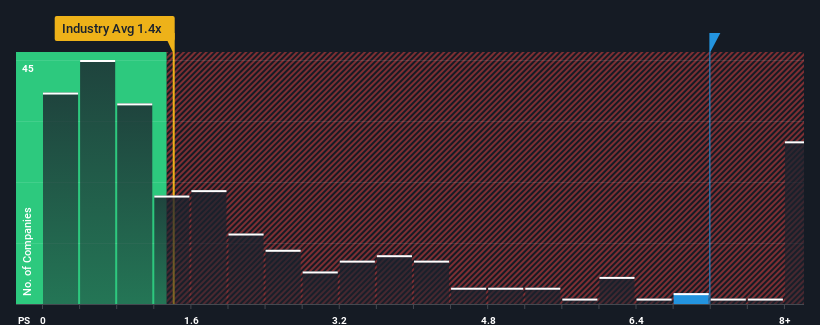

Although its price has dipped substantially, given around half the companies in China's Consumer Services industry have price-to-sales ratios (or "P/S") below 3.6x, you may still consider Jiangsu Chuanzhiboke Education Technology as a stock to avoid entirely with its 7.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Jiangsu Chuanzhiboke Education Technology

What Does Jiangsu Chuanzhiboke Education Technology's Recent Performance Look Like?

Jiangsu Chuanzhiboke Education Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jiangsu Chuanzhiboke Education Technology.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Chuanzhiboke Education Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. The last three years don't look nice either as the company has shrunk revenue by 16% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 16% each year over the next three years. With the industry predicted to deliver 14% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Jiangsu Chuanzhiboke Education Technology's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Even after such a strong price drop, Jiangsu Chuanzhiboke Education Technology's P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Jiangsu Chuanzhiboke Education Technology currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Jiangsu Chuanzhiboke Education Technology has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Jiangsu Chuanzhiboke Education Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003032

Jiangsu Chuanzhiboke Education Technology

Jiangsu Chuanzhiboke Education Technology Co., LTD.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives