- China

- /

- Consumer Services

- /

- SZSE:003032

3 Stocks Estimated To Be Up To 40.4% Below Intrinsic Value

Reviewed by Simply Wall St

In the wake of recent political shifts and economic policy adjustments, global markets have shown a mix of optimism and caution, with U.S. stocks rallying to record highs amid expectations for growth-friendly policies. As investors navigate this evolving landscape, identifying undervalued stocks can present opportunities to capitalize on market inefficiencies, particularly when these equities are trading significantly below their intrinsic value amidst broader economic changes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Arteche Lantegi Elkartea (BME:ART) | €6.05 | €12.01 | 49.6% |

| Appier Group (TSE:4180) | ¥1700.00 | ¥3393.11 | 49.9% |

| XPEL (NasdaqCM:XPEL) | US$45.67 | US$91.12 | 49.9% |

| Cettire (ASX:CTT) | A$1.585 | A$2.94 | 46.1% |

| AirBoss of America (TSX:BOS) | CA$4.05 | CA$8.27 | 51% |

| Mona YongpyongLtd (KOSE:A070960) | ₩3380.00 | ₩6757.77 | 50% |

| KeePer Technical Laboratory (TSE:6036) | ¥3900.00 | ¥7791.60 | 49.9% |

| Redcentric (AIM:RCN) | £1.1625 | £2.32 | 50% |

| Nayuki Holdings (SEHK:2150) | HK$1.59 | HK$3.16 | 49.7% |

| QuinStreet (NasdaqGS:QNST) | US$23.42 | US$46.52 | 49.7% |

Let's review some notable picks from our screened stocks.

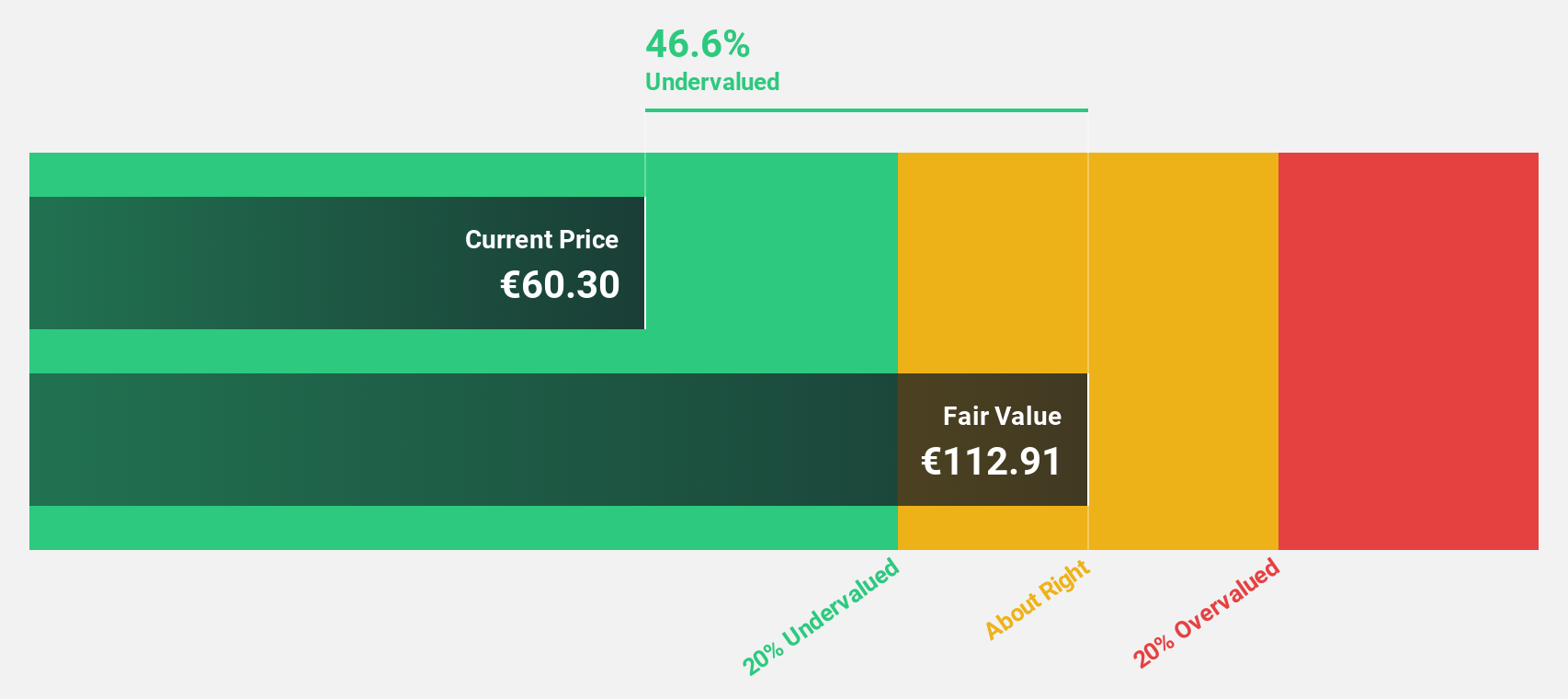

Qt Group Oyj (HLSE:QTCOM)

Overview: Qt Group Oyj provides cross-platform software development solutions across multiple countries, with a market cap of €1.77 billion.

Operations: The company's revenue is primarily generated from its Software Development Tools segment, totaling €195.71 million.

Estimated Discount To Fair Value: 40.4%

Qt Group Oyj is currently trading at €69.6, significantly below its estimated fair value of €116.79, suggesting it is undervalued based on discounted cash flow analysis. Despite recent insider selling and high share price volatility, the company's earnings are expected to grow significantly at 21.15% annually over the next three years, outpacing the Finnish market growth rate of 14.4%. However, recent corporate guidance has slightly lowered revenue growth expectations for 2024.

- Our growth report here indicates Qt Group Oyj may be poised for an improving outlook.

- Dive into the specifics of Qt Group Oyj here with our thorough financial health report.

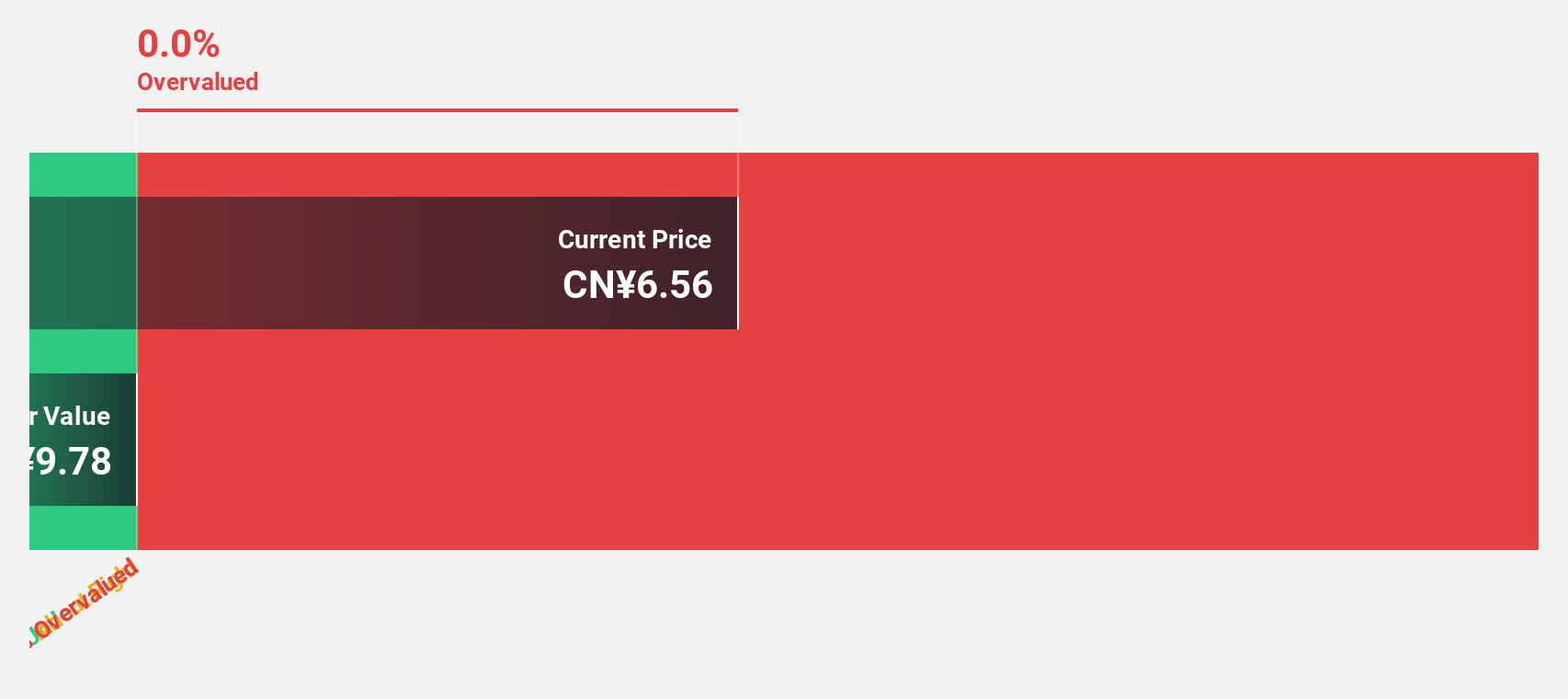

Jiangsu Chuanzhiboke Education Technology (SZSE:003032)

Overview: Jiangsu Chuanzhiboke Education Technology Co., LTD operates in the education technology sector and has a market cap of CN¥4.50 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Jiangsu Chuanzhiboke Education Technology Co., LTD.

Estimated Discount To Fair Value: 39.9%

Jiangsu Chuanzhiboke Education Technology is trading at CNY 11.17, considerably below its estimated fair value of CNY 18.59, indicating undervaluation based on discounted cash flow analysis. The company has faced recent financial challenges, with declining sales and a net loss reported for the first nine months of 2024. However, it is projected to achieve profitability within three years with revenue growth forecasted at 27.6% annually, surpassing the broader Chinese market's growth rate.

- The growth report we've compiled suggests that Jiangsu Chuanzhiboke Education Technology's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Jiangsu Chuanzhiboke Education Technology.

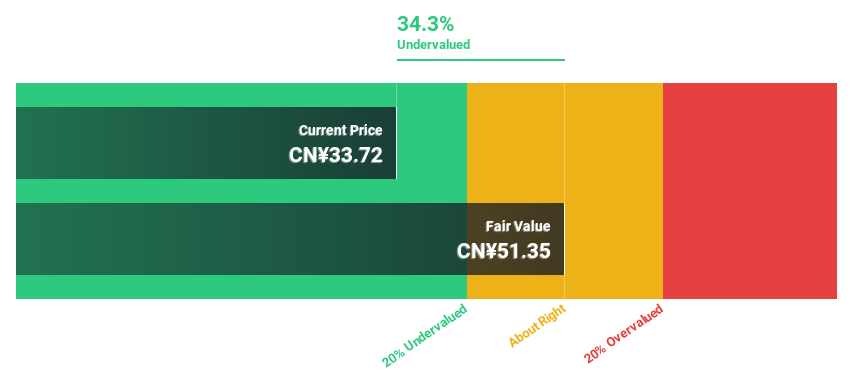

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893)

Overview: Zhejiang Songyuan Automotive Safety Systems Co., Ltd. operates in the automotive safety sector and has a market cap of CN¥7.53 billion.

Operations: The company's revenue from the Auto Parts & Accessories segment is CN¥1.78 billion.

Estimated Discount To Fair Value: 35.2%

Zhejiang Songyuan Automotive Safety Systems is trading at CN¥33.27, significantly below its estimated fair value of CN¥51.38, highlighting its undervaluation based on cash flow analysis. The company's earnings grew 73.6% over the past year and are projected to rise 28.1% annually, outpacing China's market growth rate of 26.2%. Despite high debt levels and a dividend not well covered by free cash flows, revenue growth remains robust at 24.8% per year.

- Our comprehensive growth report raises the possibility that Zhejiang Songyuan Automotive Safety SystemsLtd is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Songyuan Automotive Safety SystemsLtd.

Seize The Opportunity

- Reveal the 901 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003032

Jiangsu Chuanzhiboke Education Technology

Jiangsu Chuanzhiboke Education Technology Co., LTD.

High growth potential with mediocre balance sheet.