November 2024's Top Growth Companies With Insider Confidence

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely watching how policy changes might influence economic growth and inflation. Amidst this backdrop of optimism tempered by uncertainty, companies with strong insider ownership often signal confidence in their long-term growth prospects, making them attractive considerations for those looking to navigate these evolving market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

BeiJing Seeyon Internet Software (SHSE:688369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiJing Seeyon Internet Software Corp. offers collaborative management software, solutions, platforms, and cloud services to organizational customers in China, with a market cap of CN¥2.77 billion.

Operations: Revenue Segments (in millions of CN¥): Collaborative management software and solutions contribute CN¥1,200 million, platforms generate CN¥800 million, and cloud services account for CN¥1.5 billion.

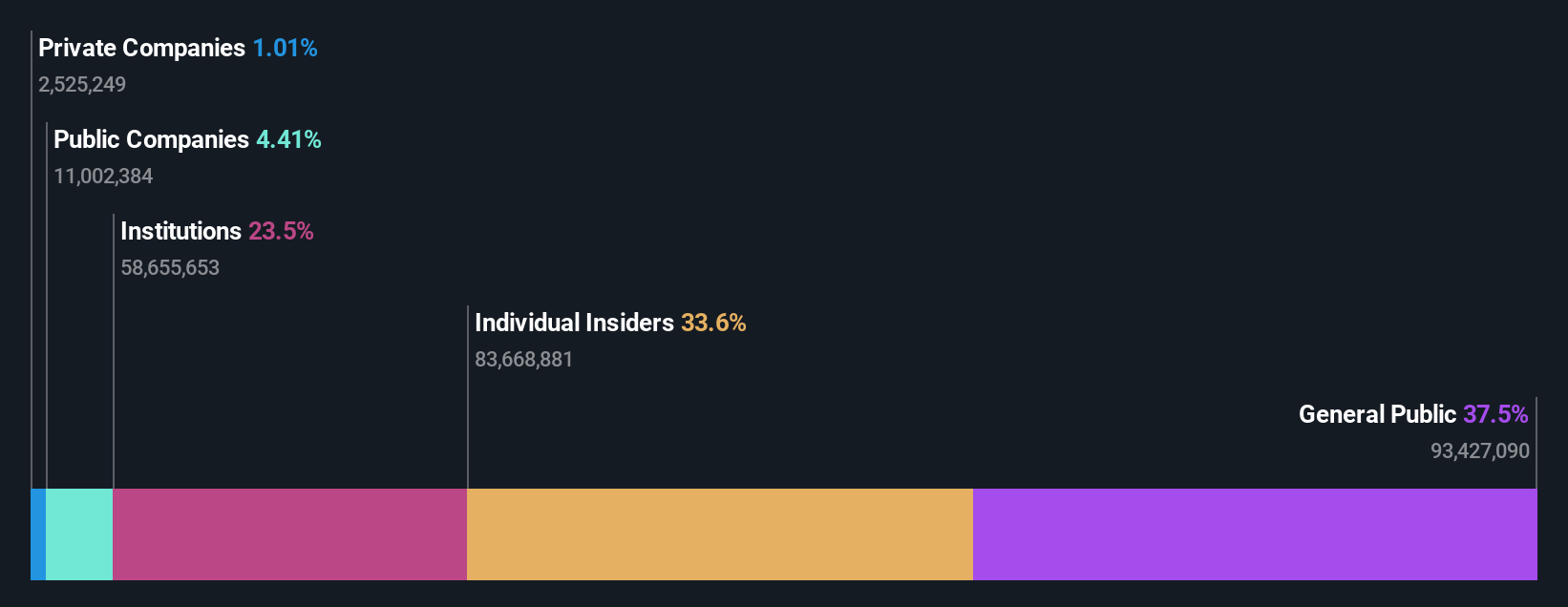

Insider Ownership: 23.9%

Earnings Growth Forecast: 124.6% p.a.

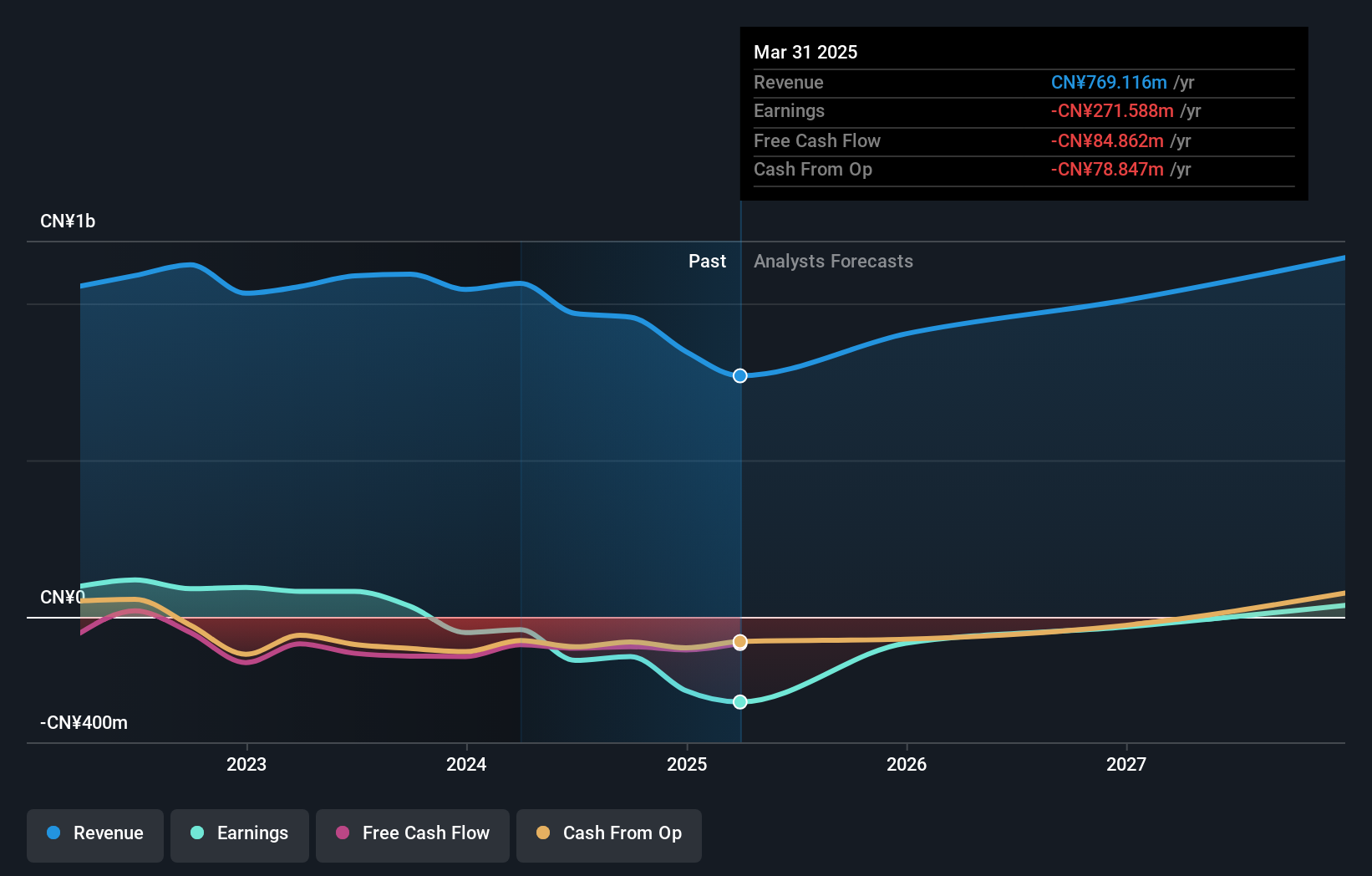

BeiJing Seeyon Internet Software shows potential for growth, with expected annual profit growth above market averages and revenue forecasted to grow at 16.9% annually. However, recent earnings reports highlight challenges, with sales declining to CNY 616.88 million and a net loss of CNY 109.4 million for the first nine months of 2024. Despite this, the company is trading at good value compared to peers, although its share price has been highly volatile recently.

- Delve into the full analysis future growth report here for a deeper understanding of BeiJing Seeyon Internet Software.

- The valuation report we've compiled suggests that BeiJing Seeyon Internet Software's current price could be quite moderate.

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry, with a market cap of CN¥5.31 billion.

Operations: Jilin OLED Material Tech Co., Ltd. derives its revenue from the research, development, production, and sale of organic electroluminescent materials and equipment within China's new display industry.

Insider Ownership: 10.8%

Earnings Growth Forecast: 50.2% p.a.

Jilin OLED Material Tech demonstrates growth potential with its earnings forecasted to rise 50.2% annually, outpacing the Chinese market average. Revenue is also expected to grow rapidly at 45.3% per year, indicating robust business expansion prospects. Recent earnings show a modest increase in net income to CNY 101.25 million for the first nine months of 2024, despite a volatile share price and low return on equity forecasts. The stock trades at good value relative to industry peers but faces challenges with dividend sustainability due to insufficient coverage by earnings or cash flows.

- Take a closer look at Jilin OLED Material Tech's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Jilin OLED Material Tech is trading behind its estimated value.

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and distribution of liquid crystal materials, OLED materials, and drug intermediates, with a market capitalization of CN¥6.03 billion.

Operations: The company's revenue is primarily derived from its specialty chemicals segment, which amounts to CN¥1.37 billion.

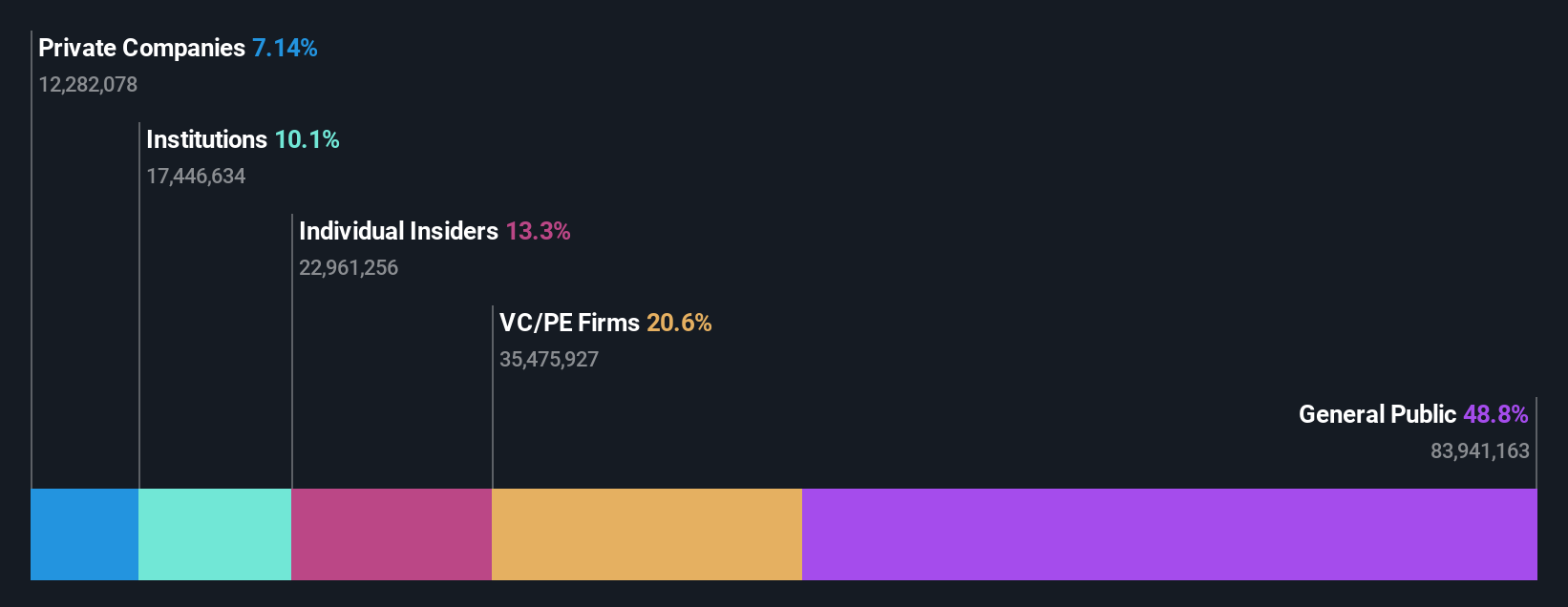

Insider Ownership: 13%

Earnings Growth Forecast: 23.8% p.a.

Xi'an Manareco New Materials shows strong growth potential, with earnings rising by 63.5% over the past year and forecasted to grow at 23.82% annually. Recent nine-month results reported a net income of CNY 185.3 million, up from CNY 98.06 million the previous year, reflecting significant revenue increases to CNY 1.09 billion. Despite its unstable dividend track record and low future return on equity forecasts, it trades below estimated fair value and has completed a share buyback program worth CNY 61.42 million.

- Click here to discover the nuances of Xi'an Manareco New MaterialsLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Xi'an Manareco New MaterialsLtd's share price might be too pessimistic.

Turning Ideas Into Actions

- Reveal the 1524 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688550

Xi'an Manareco New MaterialsLtd

Manufactures and markets liquid crystal materials, OLED materials, and drug intermediates.

Flawless balance sheet with solid track record.