- China

- /

- Real Estate

- /

- SZSE:000048

Shenzhen Kingkey Smart Agriculture TimesLtd And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by geopolitical tensions and economic uncertainties, smaller-cap indexes have shown resilience, outperforming their larger counterparts. With U.S. indices nearing record highs and positive sentiment bolstered by strong labor market data, investors are increasingly focusing on stocks with robust fundamentals that can weather such volatile conditions. In this context, identifying companies with strong financial health and growth potential becomes crucial for those looking to capitalize on emerging opportunities within the small-cap space.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen Kingkey Smart Agriculture TimesLtd (SZSE:000048)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Kingkey Smart Agriculture Times Co., Ltd operates in the real estate and breeding sectors in China, with a market cap of CN¥8.55 billion.

Operations: The company generates revenue primarily from its real estate and breeding operations in China. With a market capitalization of CN¥8.55 billion, it focuses on these two sectors to drive its financial performance.

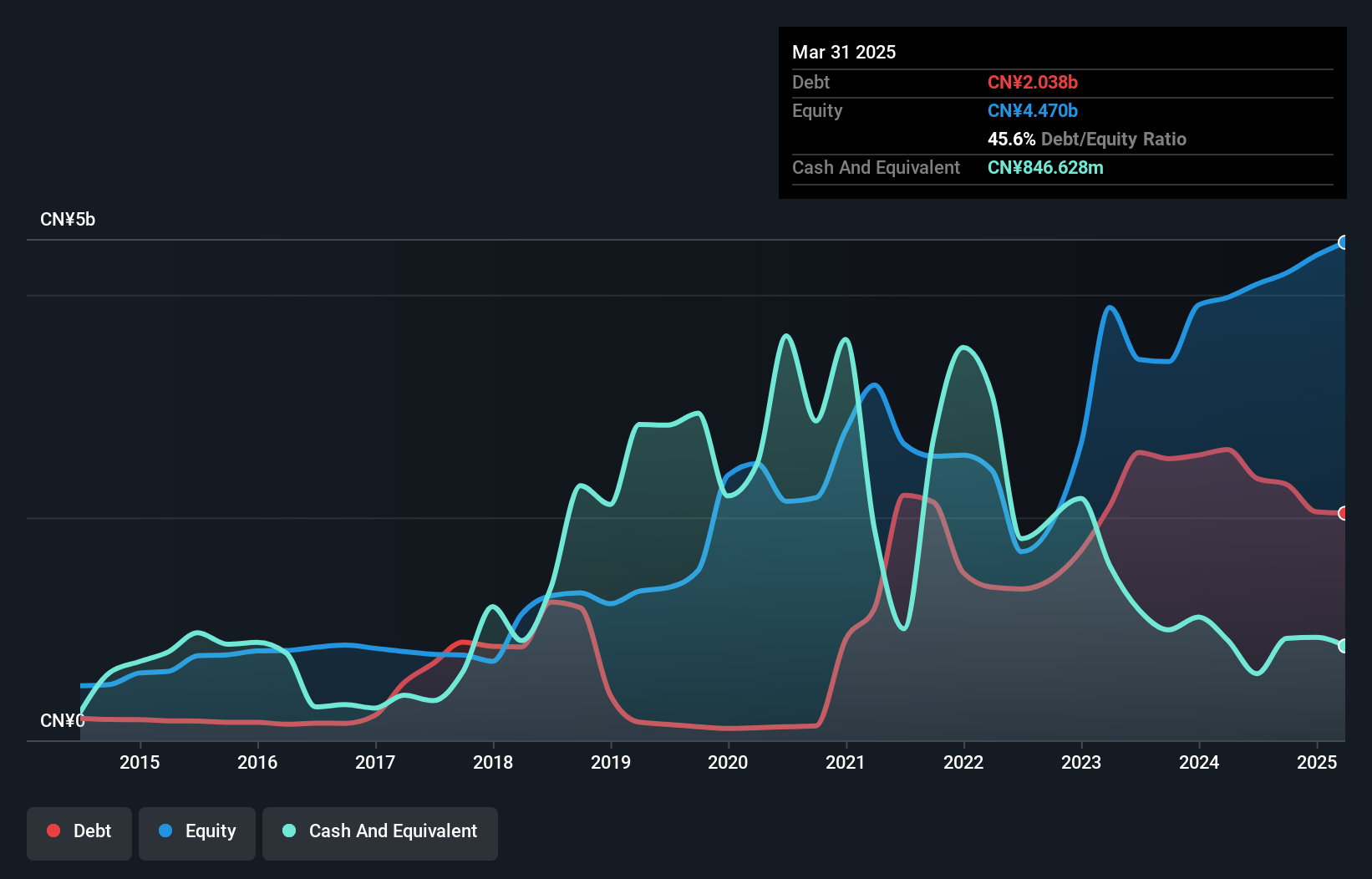

Shenzhen Kingkey Smart Agriculture Times, a relatively small player in its field, has shown mixed performance recently. The company's net debt to equity ratio stands at a satisfactory 33%, while interest payments are well covered with EBIT at 15.8 times the repayments, indicating solid financial health. However, over the past year, earnings growth was negative at -47.5%, contrasting with the industry average of -38.4%. Recent earnings for nine months ending September 2024 show sales of CNY 4.60 billion and net income of CNY 601.8 million, both significantly lower than last year’s figures. Despite these challenges, it repurchased shares worth CNY 153 million this year and announced dividends on A shares for shareholders in September.

- Navigate through the intricacies of Shenzhen Kingkey Smart Agriculture TimesLtd with our comprehensive health report here.

Understand Shenzhen Kingkey Smart Agriculture TimesLtd's track record by examining our Past report.

Shenzhen Mingdiao DecorationLtd (SZSE:002830)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Mingdiao Decoration Co., Ltd. offers home decoration and furnishing services in China with a market capitalization of CN¥1.83 billion.

Operations: The company generates revenue primarily from home decoration and furnishing services in China. With a market capitalization of CN¥1.83 billion, it focuses on delivering tailored interior solutions.

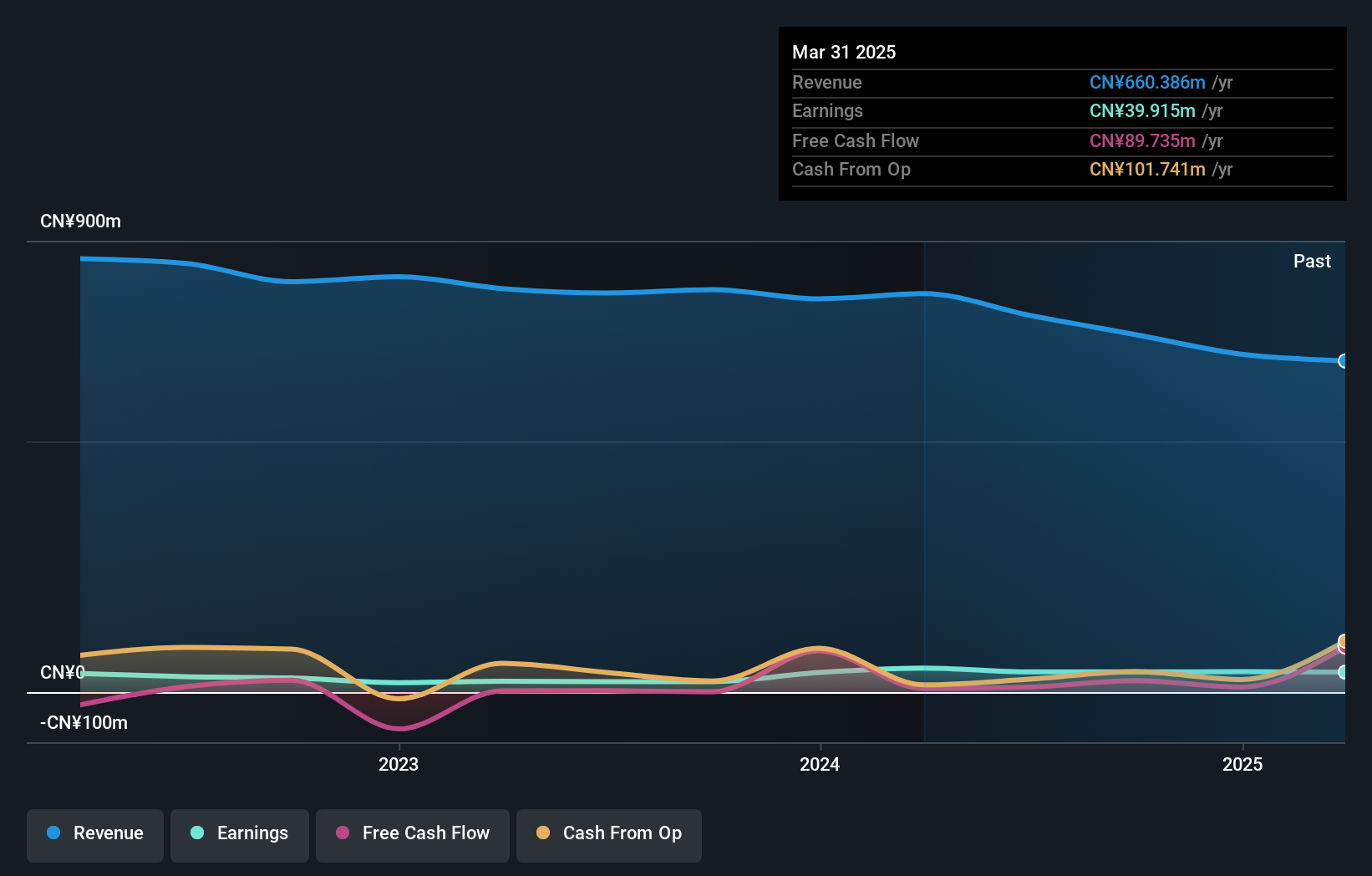

Shenzhen Mingdiao Decoration Ltd., a small player in its field, is making waves with an impressive 92.9% earnings growth over the past year, outpacing the Consumer Services industry average of 23.3%. This company operates debt-free, eliminating concerns about interest payments. Despite a dip in sales from CN¥518.17 million to CN¥446.91 million for the nine months ending September 2024, net income rose to CN¥16.1 million from CN¥14.95 million last year, showcasing resilience and operational efficiency amidst challenges. A notable one-off gain of CN¥10.3M has impacted recent financial results positively, hinting at strategic maneuvers enhancing profitability potential further down the line.

DOUTOR NICHIRES Holdings (TSE:3087)

Simply Wall St Value Rating: ★★★★★☆

Overview: DOUTOR NICHIRES Holdings Co., Ltd. operates and manages cafes and restaurants in Japan, with a market cap of ¥99.96 billion.

Operations: DOUTOR NICHIRES Holdings generates revenue primarily through its network of cafes and restaurants across Japan. The company focuses on optimizing operational efficiency to manage costs effectively. Notably, it has reported a consistent trend in its net profit margin over recent periods, reflecting its ability to balance revenue growth with expense management.

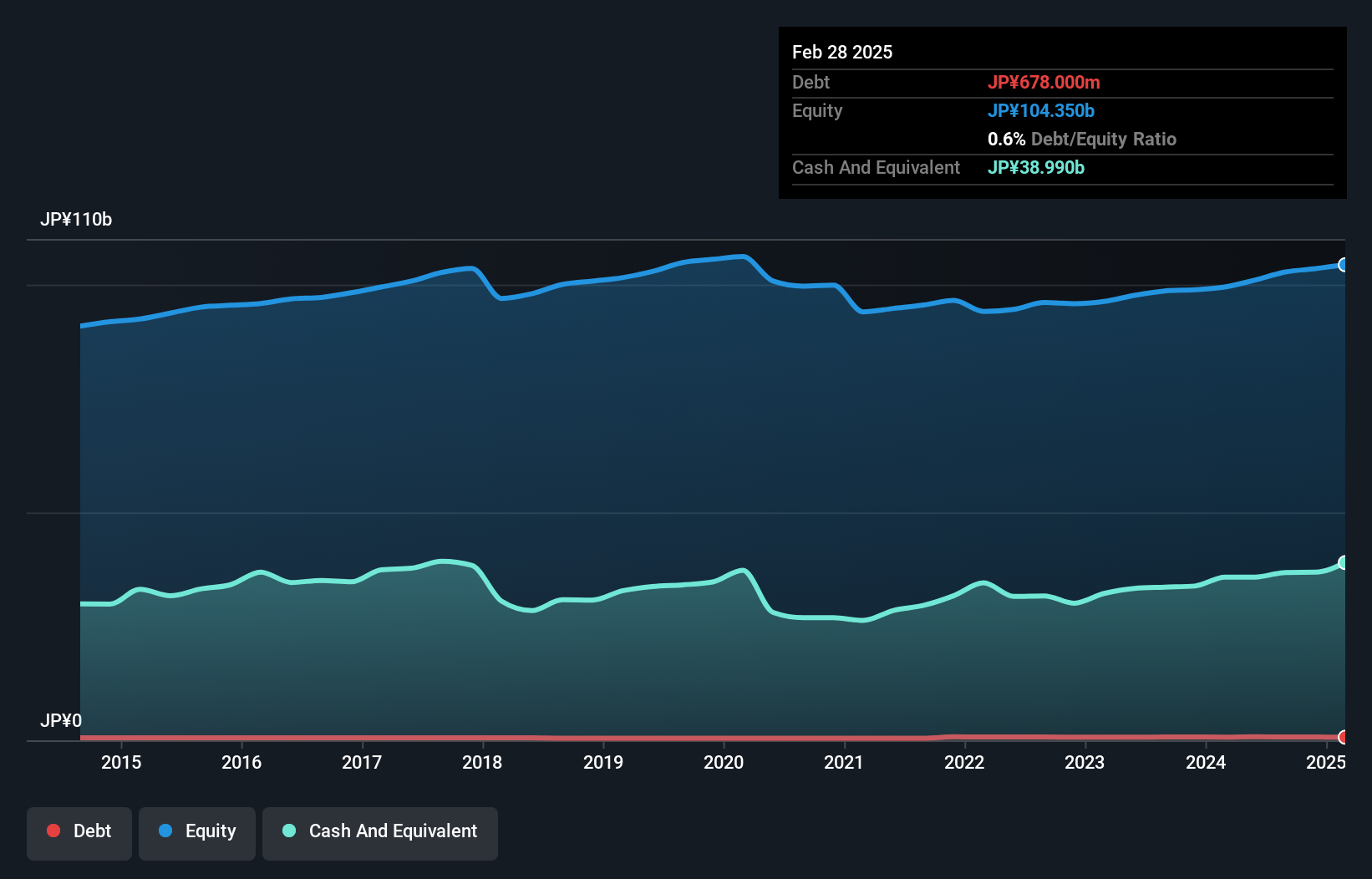

DOUTOR NICHIRES Holdings, a smaller player in the hospitality sector, has shown robust performance with earnings growth of 33.9% over the past year, outpacing the industry average of 27.2%. Its debt-to-equity ratio climbed from 0.4% to 0.7% over five years but remains manageable as cash exceeds total debt. The company enjoys high-quality earnings and trades at a favorable price-to-earnings ratio of 16.5x compared to the industry average of 22.1x, suggesting potential undervaluation relative to peers. Future growth is projected at an annual rate of 8.68%, indicating promising prospects for continued expansion and value creation in its market niche.

Turning Ideas Into Actions

- Gain an insight into the universe of 4621 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000048

Shenzhen Kingkey Smart Agriculture TimesLtd

Engages in the real estate and breeding businesses in China.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives