- China

- /

- Life Sciences

- /

- SZSE:300347

October 2024's Leading Growth Companies With Insider Ownership

Reviewed by Simply Wall St

In October 2024, global markets are navigating a complex landscape marked by rising U.S. Treasury yields and cautious economic growth across major regions, with the S&P 500 Index experiencing a slight downturn after weeks of gains. Amid these conditions, growth stocks have shown resilience, particularly those with high insider ownership—a factor that can signal confidence in a company's long-term potential even as broader market uncertainties persist.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★★★

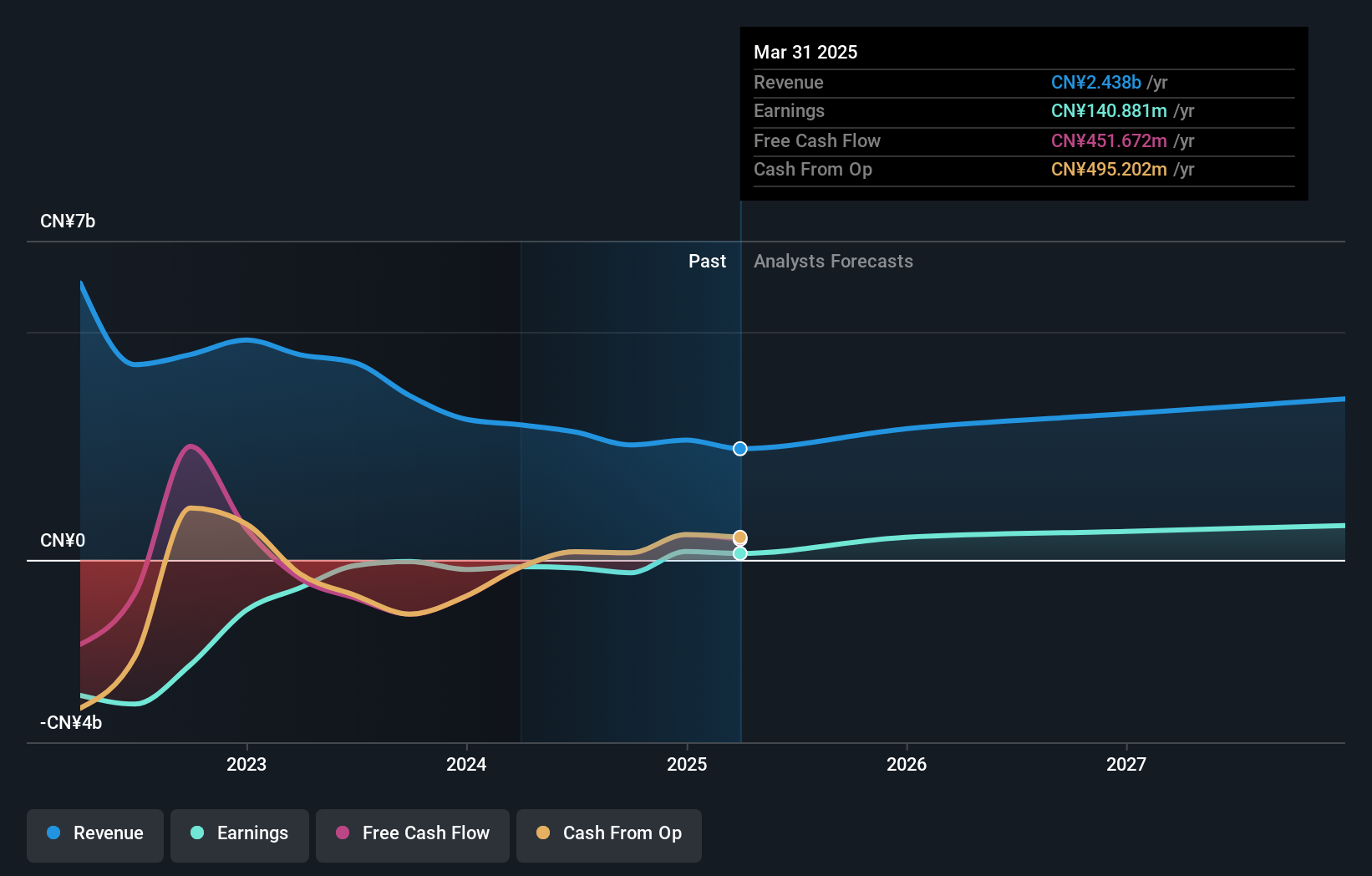

Overview: Offcn Education Technology Co., Ltd. operates as a multi-category vocational education institution in China with a market cap of CN¥19.24 billion.

Operations: The company generates revenue of CN¥2.76 billion from its education and training segment in China.

Insider Ownership: 25.1%

Revenue Growth Forecast: 20.8% p.a.

Offcn Education Technology is positioned for significant growth, with earnings forecasted to grow 70.97% annually and revenue expected to rise by 20.8% per year, outpacing the Chinese market. Despite trading at a substantial discount to its estimated fair value, the company faces challenges with interest payments not well covered by earnings and a highly volatile share price. Recent half-year results show improved net income of CNY 115.9 million from CNY 81.98 million previously, despite lower sales and revenue figures compared to last year.

- Delve into the full analysis future growth report here for a deeper understanding of Offcn Education Technology.

- The valuation report we've compiled suggests that Offcn Education Technology's current price could be quite moderate.

Hangzhou Tigermed Consulting (SZSE:300347)

Simply Wall St Growth Rating: ★★★★☆☆

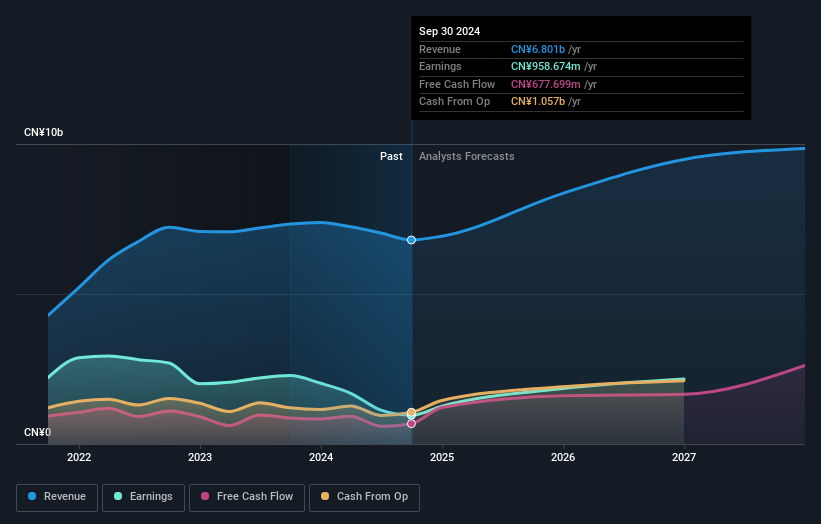

Overview: Hangzhou Tigermed Consulting Co., Ltd offers contract research organization services both within China and internationally, with a market capitalization of approximately CN¥57.16 billion.

Operations: The company generates revenue from contract research organization services in the People’s Republic of China and internationally.

Insider Ownership: 27.8%

Revenue Growth Forecast: 13.8% p.a.

Hangzhou Tigermed Consulting demonstrates potential for growth with earnings projected to increase by 26.31% annually, surpassing the Chinese market's average. However, revenue growth is anticipated at a slower pace of 13.8% per year. Despite trading below its estimated fair value and maintaining a reliable dividend yield of 0.8%, the company faces challenges with declining profit margins and recent financial results showing decreased net income from CNY 1,388.34 million to CNY 492.85 million year-on-year.

- Click to explore a detailed breakdown of our findings in Hangzhou Tigermed Consulting's earnings growth report.

- In light of our recent valuation report, it seems possible that Hangzhou Tigermed Consulting is trading beyond its estimated value.

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

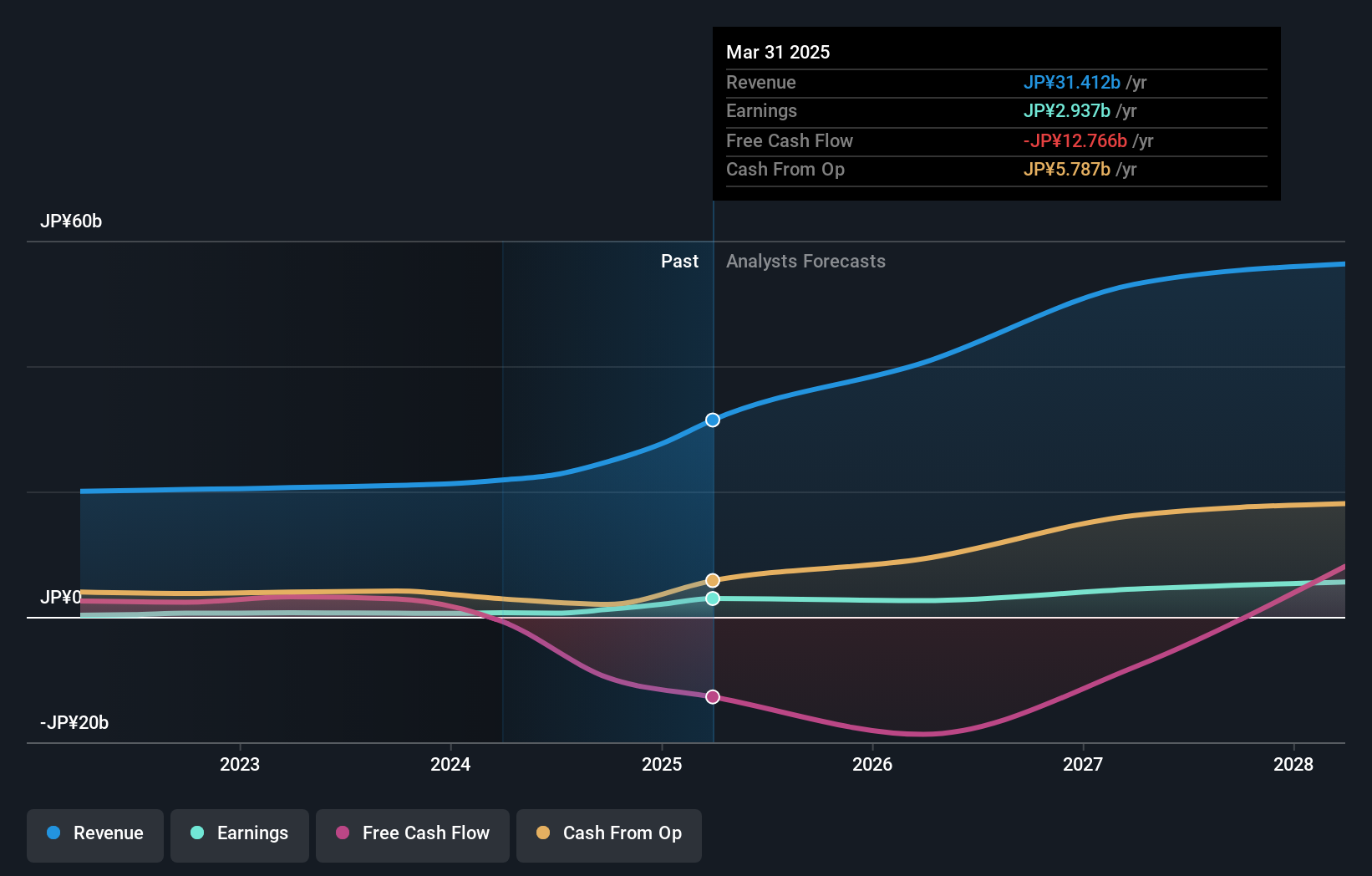

Overview: SAKURA Internet Inc. offers cloud computing services in Japan and has a market cap of ¥162.92 billion.

Operations: The company's revenue primarily comes from its Internet Infrastructure Business, which generated ¥22.66 billion.

Insider Ownership: 18.2%

Revenue Growth Forecast: 33.9% p.a.

SAKURA Internet shows robust growth potential, with earnings expected to grow significantly at 55.6% annually, outpacing the JP market. Revenue is also forecast to rise by 33.9% per year, well above market averages. Despite recent shareholder dilution and high share price volatility, insider ownership remains strong with no substantial insider trading activity reported recently. The company projects full-year net sales of ¥28 billion and an operating profit of ¥2 billion for fiscal 2025.

- Navigate through the intricacies of SAKURA Internet with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that SAKURA Internet is priced higher than what may be justified by its financials.

Taking Advantage

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1510 more companies for you to explore.Click here to unveil our expertly curated list of 1513 Fast Growing Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Tigermed Consulting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300347

Hangzhou Tigermed Consulting

Provides contract research organization services in the People’s Republic of China and internationally.

Excellent balance sheet established dividend payer.