- China

- /

- Consumer Services

- /

- SZSE:002375

Spotlight On January 2025's Noteworthy Penny Stocks

Reviewed by Simply Wall St

Global markets have begun the year with notable volatility, as inflation concerns and political uncertainties weigh heavily on investor sentiment. Despite these challenges, investors continue to seek opportunities that balance risk and potential reward. Penny stocks, often representing smaller or newer companies, remain an intriguing area for exploration due to their capacity for growth and value when supported by robust financials. In this context, we will explore three penny stocks that stand out for their financial strength and potential resilience in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$39.97B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £5.00 | £478.61M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.045 | £744.58M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.715 | MYR423.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.415 | £178.93M | ★★★★★☆ |

| Starflex (SET:SFLEX) | THB2.54 | THB1.97B | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$140.36M | ★★★★☆☆ |

Click here to see the full list of 5,711 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Zhejiang Dongwang Times Technology (SHSE:600052)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Dongwang Times Technology Co., Ltd. operates in China, offering energy-saving services and film and television culture solutions, with a market cap of CN¥3.52 billion.

Operations: The company generates CN¥412.81 million in revenue from its operations within China.

Market Cap: CN¥3.52B

Zhejiang Dongwang Times Technology's recent financial performance shows a transition to profitability, with net income reaching CN¥93.19 million for the nine months ending September 2024. Despite a large one-off gain impacting results, the company's operating cash flow effectively covers its debt, and short-term assets significantly exceed liabilities. The price-to-earnings ratio of 23.5x suggests it may be undervalued compared to the broader Chinese market. However, earnings have declined by an average of 62.1% annually over five years, and dividend coverage by free cash flows remains weak, indicating potential risks for investors in this sector.

- Dive into the specifics of Zhejiang Dongwang Times Technology here with our thorough balance sheet health report.

- Explore historical data to track Zhejiang Dongwang Times Technology's performance over time in our past results report.

Shenzhen Jinjia GroupLtd (SZSE:002191)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Jinjia Group Co., Ltd. focuses on the research, development, and production of packaging materials in China and has a market capitalization of CN¥5.59 billion.

Operations: The company generates revenue of CN¥3.18 billion from its operations within China.

Market Cap: CN¥5.59B

Shenzhen Jinjia Group Co., Ltd.'s financial results for the nine months ending September 2024 reveal a decline in revenue to CN¥2.19 billion from CN¥2.95 billion the previous year, with net income also falling to CN¥237.37 million. Despite this, the company has become profitable recently and maintains more cash than total debt, although its operating cash flow is negative and does not cover debt well. The board's average tenure of 9.3 years indicates experienced leadership, but a large one-off loss impacts earnings quality, and dividend sustainability remains questionable due to weak coverage by earnings or free cash flows.

- Take a closer look at Shenzhen Jinjia GroupLtd's potential here in our financial health report.

- Explore Shenzhen Jinjia GroupLtd's analyst forecasts in our growth report.

Zhejiang Yasha DecorationLtd (SZSE:002375)

Simply Wall St Financial Health Rating: ★★★★★★

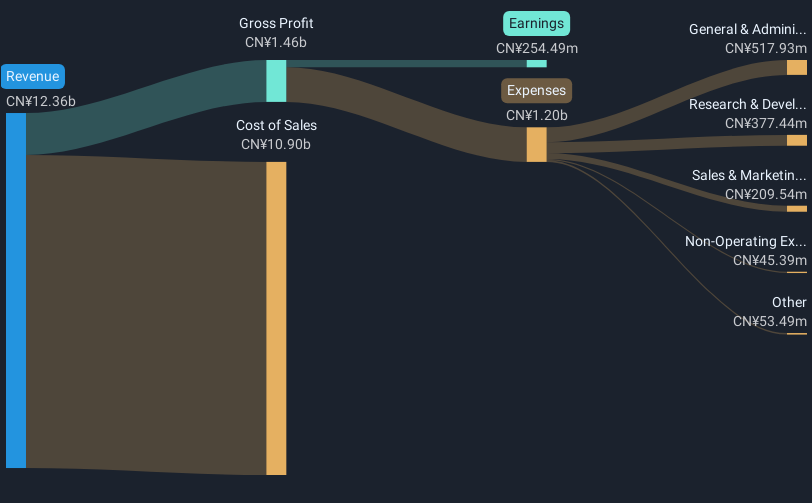

Overview: Zhejiang Yasha Decoration Co., Ltd operates in building decoration, curtain wall decoration, and intelligent system integration sectors with a market cap of CN¥4.86 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for Zhejiang Yasha Decoration Co., Ltd.

Market Cap: CN¥4.86B

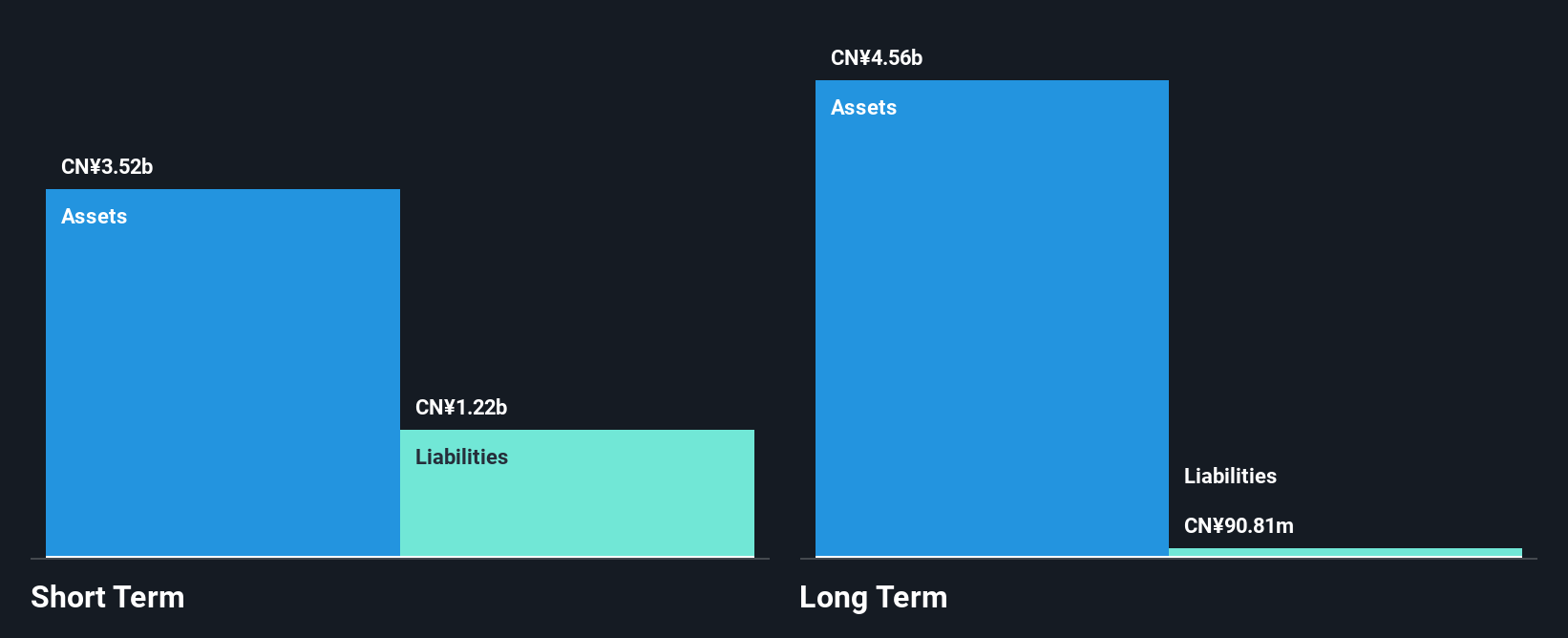

Zhejiang Yasha Decoration Co., Ltd. reported stable earnings for the nine months ending September 2024, with net income at CN¥253.03 million, slightly up from the previous year. The company's price-to-earnings ratio of 19.1x is attractive compared to the broader Chinese market average of 34.1x, indicating potential value for investors seeking lower valuations in this sector. Additionally, Zhejiang Yasha's financial health appears robust as it holds more cash than debt and has improved its debt-to-equity ratio over five years from 23.8% to 17.7%. However, its return on equity remains low at 3.1%, suggesting limited profitability efficiency relative to peers.

- Navigate through the intricacies of Zhejiang Yasha DecorationLtd with our comprehensive balance sheet health report here.

- Gain insights into Zhejiang Yasha DecorationLtd's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Click here to access our complete index of 5,711 Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zhejiang Yasha DecorationLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Yasha DecorationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002375

Zhejiang Yasha DecorationLtd

Engages in the building decoration, curtain wall decoration, intelligent system integration, and other businesses.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives