- China

- /

- Hospitality

- /

- SZSE:002159

Further Upside For Wuhan Sante Cableway Group Co., Ltd. (SZSE:002159) Shares Could Introduce Price Risks After 27% Bounce

Wuhan Sante Cableway Group Co., Ltd. (SZSE:002159) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

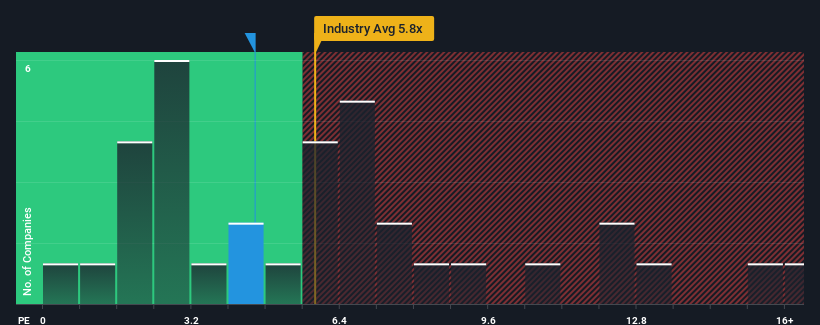

In spite of the firm bounce in price, it would still be understandable if you think Wuhan Sante Cableway Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 4.6x, considering almost half the companies in China's Hospitality industry have P/S ratios above 5.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Wuhan Sante Cableway Group

How Wuhan Sante Cableway Group Has Been Performing

With revenue growth that's superior to most other companies of late, Wuhan Sante Cableway Group has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Wuhan Sante Cableway Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Wuhan Sante Cableway Group would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 105%. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 33% over the next year. With the industry predicted to deliver 35% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Wuhan Sante Cableway Group is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Wuhan Sante Cableway Group's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Wuhan Sante Cableway Group currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Wuhan Sante Cableway Group with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Sante Cableway Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002159

Flawless balance sheet and good value.

Market Insights

Community Narratives