- China

- /

- Consumer Services

- /

- SZSE:000526

Optimistic Investors Push Xueda (Xiamen) Education Technology Group Co., Ltd. (SZSE:000526) Shares Up 26% But Growth Is Lacking

Despite an already strong run, Xueda (Xiamen) Education Technology Group Co., Ltd. (SZSE:000526) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 203% following the latest surge, making investors sit up and take notice.

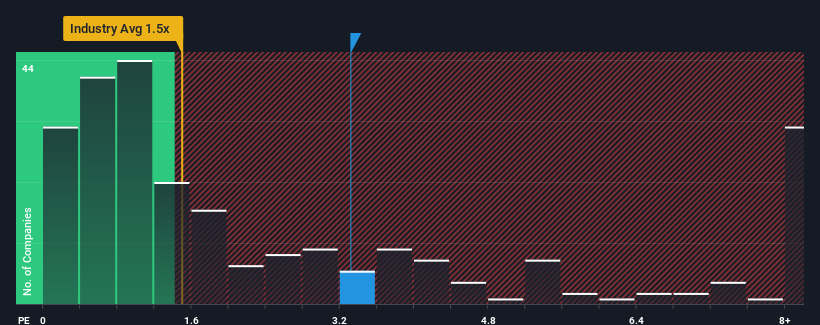

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Xueda (Xiamen) Education Technology Group's P/S ratio of 3.3x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in China is also close to 3.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Xueda (Xiamen) Education Technology Group

How Has Xueda (Xiamen) Education Technology Group Performed Recently?

Recent times have been advantageous for Xueda (Xiamen) Education Technology Group as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xueda (Xiamen) Education Technology Group.How Is Xueda (Xiamen) Education Technology Group's Revenue Growth Trending?

Xueda (Xiamen) Education Technology Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 15% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 23% over the next year. That's shaping up to be materially lower than the 28% growth forecast for the broader industry.

With this information, we find it interesting that Xueda (Xiamen) Education Technology Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Xueda (Xiamen) Education Technology Group's P/S?

Its shares have lifted substantially and now Xueda (Xiamen) Education Technology Group's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Xueda (Xiamen) Education Technology Group's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Xueda (Xiamen) Education Technology Group you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000526

Xueda (Xiamen) Education Technology Group

Xueda (Xiamen) Education Technology Group Co., Ltd.

Excellent balance sheet and good value.

Market Insights

Community Narratives