- China

- /

- Consumer Services

- /

- SHSE:603377

Eastern Pioneer Driving School Co., Ltd (SHSE:603377) Looks Inexpensive After Falling 41% But Perhaps Not Attractive Enough

Unfortunately for some shareholders, the Eastern Pioneer Driving School Co., Ltd (SHSE:603377) share price has dived 41% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 88% loss during that time.

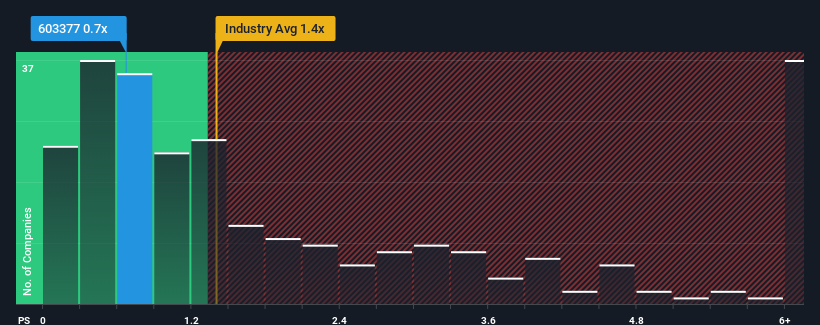

Following the heavy fall in price, Eastern Pioneer Driving School may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Consumer Services industry in China have P/S ratios greater than 3.3x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Eastern Pioneer Driving School

What Does Eastern Pioneer Driving School's P/S Mean For Shareholders?

The recent revenue growth at Eastern Pioneer Driving School would have to be considered satisfactory if not spectacular. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Eastern Pioneer Driving School, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Eastern Pioneer Driving School's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Eastern Pioneer Driving School's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.4% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 33% shows it's noticeably less attractive.

In light of this, it's understandable that Eastern Pioneer Driving School's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Eastern Pioneer Driving School's P/S

Shares in Eastern Pioneer Driving School have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Eastern Pioneer Driving School maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Eastern Pioneer Driving School (of which 1 is a bit concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Pioneer Driving School might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603377

Eastern Pioneer Driving School

Provides motor vehicle and civil aircraft driving training services in China.

Fair value very low.

Market Insights

Community Narratives