Discovering Hidden Potential: Al Hassan Ghazi Ibrahim Shaker And 2 Other Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate a landscape of cooling inflation and robust bank earnings, small-cap stocks have been capturing attention with notable performances. Amidst this backdrop, identifying companies with strong fundamentals and growth potential becomes crucial for uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Commercial Bank International P.S.C | 0.33% | 5.59% | 28.69% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Al Hassan Ghazi Ibrahim Shaker (SASE:1214)

Simply Wall St Value Rating: ★★★★★☆

Overview: Al Hassan Ghazi Ibrahim Shaker Company, along with its subsidiaries, operates in the trading, wholesale, and maintenance sectors for spare parts, electronic equipment, household equipment, and air-conditioners across Saudi Arabia and Jordan with a market capitalization of SAR1.67 billion.

Operations: The company generates revenue primarily from two segments: Heating, Ventilation and Air-Conditioning Solutions (HVAC) with SAR984.79 million and Home Appliances with SAR388.45 million.

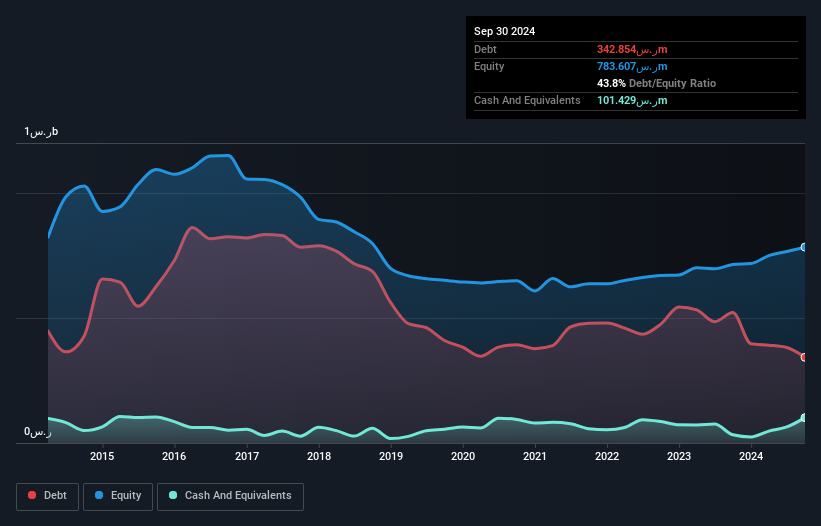

Trading significantly below its estimated fair value, Shaker has shown a robust earnings growth of 31.5% over the past year, outpacing the industry average. Its debt situation has improved with a reduction in the debt-to-equity ratio from 63% to 43.8% over five years, and it maintains satisfactory net debt levels at 30.8%. Recent results highlight sales of SAR 358 million in Q3 compared to SAR 323 million last year, with net income rising slightly to SAR 17.72 million from SAR 16.77 million while basic earnings per share increased to SAR 0.32 from SAR 0.3 one year ago.

- Delve into the full analysis health report here for a deeper understanding of Al Hassan Ghazi Ibrahim Shaker.

Understand Al Hassan Ghazi Ibrahim Shaker's track record by examining our Past report.

Anhui Jiuhuashan Tourism Development (SHSE:603199)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Jiuhuashan Tourism Development Co., Ltd. is engaged in the tourism industry, focusing on the development and management of tourist attractions, with a market cap of CN¥3.97 billion.

Operations: The company generates revenue primarily through its tourism-related activities, focusing on developing and managing tourist attractions. It has a market capitalization of CN¥3.97 billion.

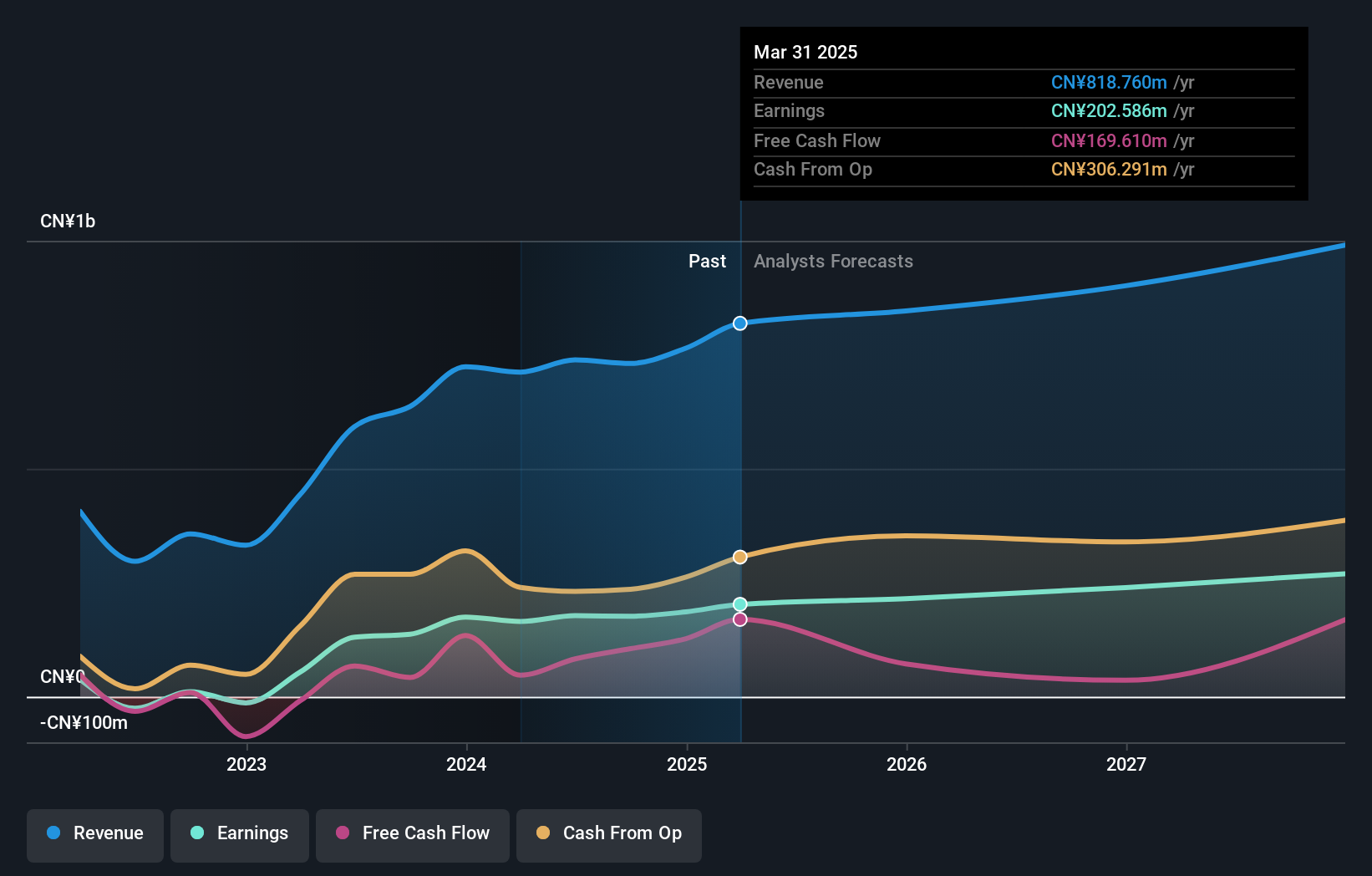

Anhui Jiuhuashan Tourism Development, a smaller player in the tourism sector, shows promising financial health with earnings growth of 28.7% over the past year, outpacing the industry average of -6.9%. The company boasts high-quality earnings and operates debt-free, which eliminates concerns about interest coverage. Trading at a price-to-earnings ratio of 22.5x, it offers good value compared to the broader CN market's 34.8x. Recent reports indicate steady sales growth to CNY 569 million for nine months ending September 2024 and net income rising slightly to CNY 153.59 million, suggesting stable operational performance amidst its competitive landscape.

- Click here to discover the nuances of Anhui Jiuhuashan Tourism Development with our detailed analytical health report.

Learn about Anhui Jiuhuashan Tourism Development's historical performance.

Rechi Precision (TWSE:4532)

Simply Wall St Value Rating: ★★★★★★

Overview: Rechi Precision Co., Ltd. and its subsidiary specialize in the assembly, processing, manufacture, repair, and trading of refrigerant compressors as well as design services globally, with a market cap of approximately NT$13.32 billion.

Operations: Rechi Precision generates revenue primarily from its compressor business, which accounts for NT$42.73 billion. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of converting revenue into actual profit.

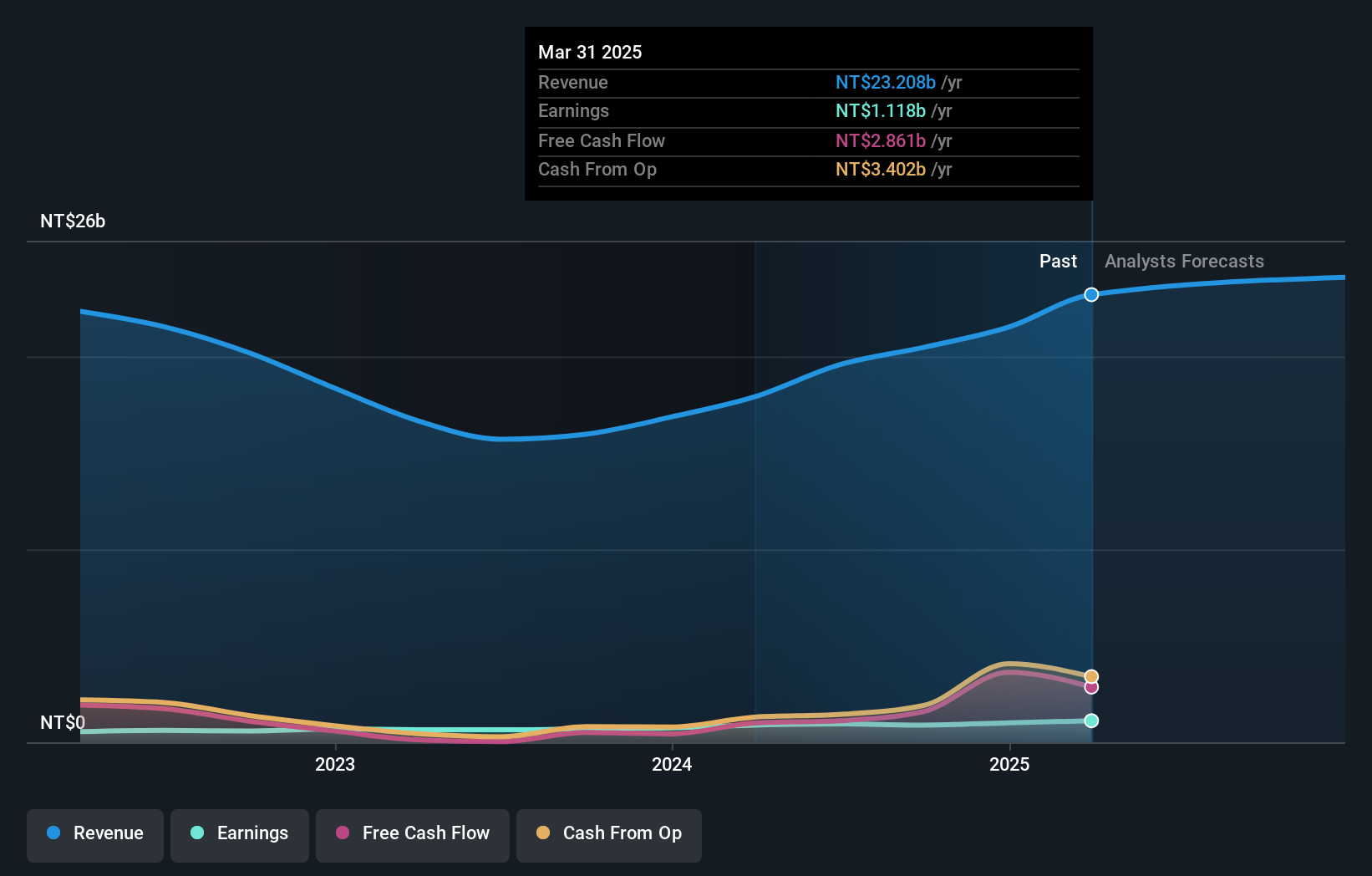

Rechi Precision, a compact player in the machinery sector, has demonstrated notable growth with earnings surging 27.3% over the past year, outpacing its industry peers. Its debt to equity ratio has impressively dropped from 100% to 37.9% over five years, showcasing financial prudence. Trading at a significant discount of 69.5% below estimated fair value suggests potential undervaluation opportunities for investors. Recent sales figures reveal an annual increase of 27.89%, reaching TWD 21.53 billion in revenue for 2024 despite a dip in monthly sales volume by 15%. The company also announced a share buyback plan worth TWD 4,8353 million to bolster shareholder value and confidence through March this year.

- Click to explore a detailed breakdown of our findings in Rechi Precision's health report.

Evaluate Rechi Precision's historical performance by accessing our past performance report.

Make It Happen

- Navigate through the entire inventory of 4655 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4532

Rechi Precision

Together with its subsidiary, engages in the assembly, processing, manufacture, repair, and trading of refrigerant compressors and design services worldwide.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives