- China

- /

- Food and Staples Retail

- /

- SZSE:301017

Even With A 32% Surge, Cautious Investors Are Not Rewarding ShuYu Civilian Pharmacy Corp., Ltd.'s (SZSE:301017) Performance Completely

ShuYu Civilian Pharmacy Corp., Ltd. (SZSE:301017) shares have continued their recent momentum with a 32% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

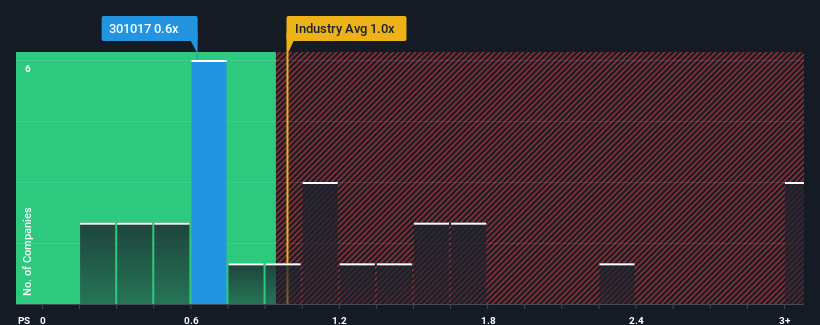

Even after such a large jump in price, you could still be forgiven for feeling indifferent about ShuYu Civilian Pharmacy's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Consumer Retailing industry in China is also close to 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for ShuYu Civilian Pharmacy

What Does ShuYu Civilian Pharmacy's Recent Performance Look Like?

The recent revenue growth at ShuYu Civilian Pharmacy would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on ShuYu Civilian Pharmacy will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ShuYu Civilian Pharmacy's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For ShuYu Civilian Pharmacy?

There's an inherent assumption that a company should be matching the industry for P/S ratios like ShuYu Civilian Pharmacy's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.9% last year. The latest three year period has also seen an excellent 94% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that ShuYu Civilian Pharmacy's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From ShuYu Civilian Pharmacy's P/S?

ShuYu Civilian Pharmacy appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that ShuYu Civilian Pharmacy currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 3 warning signs for ShuYu Civilian Pharmacy that you need to take into consideration.

If these risks are making you reconsider your opinion on ShuYu Civilian Pharmacy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301017

ShuYu Civilian Pharmacy

Operates a chain of pharmaceutical retail stores in China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives