- China

- /

- Food and Staples Retail

- /

- SZSE:002697

Chengdu Hongqi ChainLtd (SZSE:002697) Has More To Do To Multiply In Value Going Forward

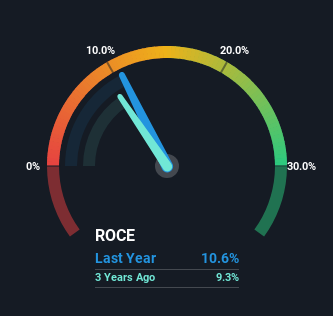

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, the ROCE of Chengdu Hongqi ChainLtd (SZSE:002697) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Chengdu Hongqi ChainLtd, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = CN¥500m ÷ (CN¥8.1b - CN¥3.4b) (Based on the trailing twelve months to June 2024).

Therefore, Chengdu Hongqi ChainLtd has an ROCE of 11%. On its own, that's a standard return, however it's much better than the 6.1% generated by the Consumer Retailing industry.

Check out our latest analysis for Chengdu Hongqi ChainLtd

In the above chart we have measured Chengdu Hongqi ChainLtd's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Chengdu Hongqi ChainLtd .

So How Is Chengdu Hongqi ChainLtd's ROCE Trending?

While the returns on capital are good, they haven't moved much. Over the past five years, ROCE has remained relatively flat at around 11% and the business has deployed 69% more capital into its operations. Since 11% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

On a side note, Chengdu Hongqi ChainLtd's current liabilities are still rather high at 42% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

Our Take On Chengdu Hongqi ChainLtd's ROCE

The main thing to remember is that Chengdu Hongqi ChainLtd has proven its ability to continually reinvest at respectable rates of return. However, despite the favorable fundamentals, the stock has fallen 34% over the last five years, so there might be an opportunity here for astute investors. That's why we think it'd be worthwhile to look further into this stock given the fundamentals are appealing.

Like most companies, Chengdu Hongqi ChainLtd does come with some risks, and we've found 1 warning sign that you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002697

Chengdu Hongqi ChainLtd

Operates a chain of convenience supermarkets in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives