- China

- /

- Food and Staples Retail

- /

- SZSE:002264

A Piece Of The Puzzle Missing From New Huadu Technology Co., Ltd.'s (SZSE:002264) Share Price

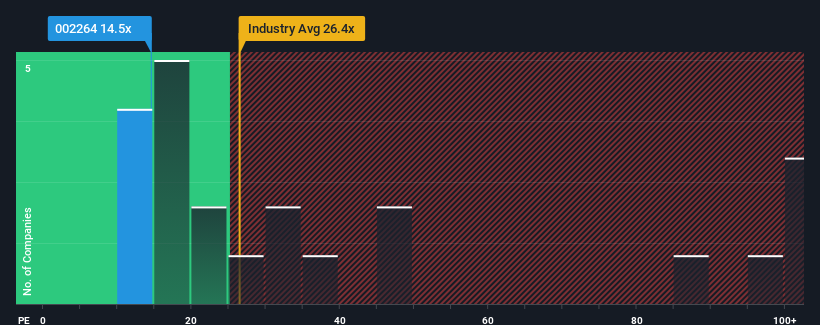

With a price-to-earnings (or "P/E") ratio of 14.5x New Huadu Technology Co., Ltd. (SZSE:002264) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 32x and even P/E's higher than 61x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for New Huadu Technology as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for New Huadu Technology

How Is New Huadu Technology's Growth Trending?

New Huadu Technology's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 194%. The strong recent performance means it was also able to grow EPS by 94% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the one analyst watching the company. That's shaping up to be similar to the 19% per year growth forecast for the broader market.

In light of this, it's peculiar that New Huadu Technology's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of New Huadu Technology's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for New Huadu Technology that you need to be mindful of.

Of course, you might also be able to find a better stock than New Huadu Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if New Huadu Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002264

New Huadu Technology

Engages in the Internet marketing business in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives