- China

- /

- Food and Staples Retail

- /

- SHSE:603939

4.9% earnings growth over 1 year has not materialized into gains for Yifeng Pharmacy Chain (SHSE:603939) shareholders over that period

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Yifeng Pharmacy Chain Co., Ltd. (SHSE:603939) share price slid 27% over twelve months. That's disappointing when you consider the market returned 11%. Looking at the longer term, the stock is down 26% over three years.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Yifeng Pharmacy Chain

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Yifeng Pharmacy Chain share price fell, it actually saw its earnings per share (EPS) improve by 4.9%. It could be that the share price was previously over-hyped.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But other metrics might shed some light on why the share price is down.

Yifeng Pharmacy Chain managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

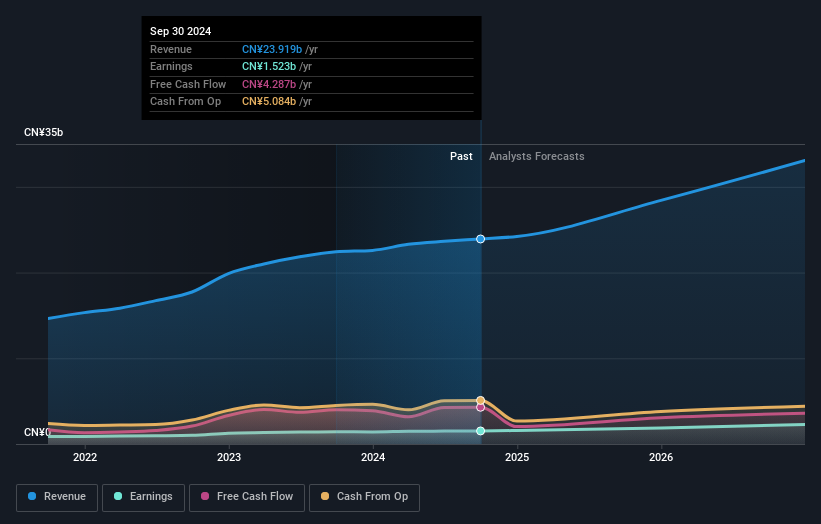

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Yifeng Pharmacy Chain is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Yifeng Pharmacy Chain in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 11% in the last year, Yifeng Pharmacy Chain shareholders lost 26% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 1.5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Yifeng Pharmacy Chain .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603939

Yifeng Pharmacy Chain

Engages in the retail of pharmaceutical products in China.

Undervalued with excellent balance sheet.