- China

- /

- Consumer Durables

- /

- SZSE:301332

Guangdong Deerma Technology's (SZSE:301332) Shareholders Have More To Worry About Than Only Soft Earnings

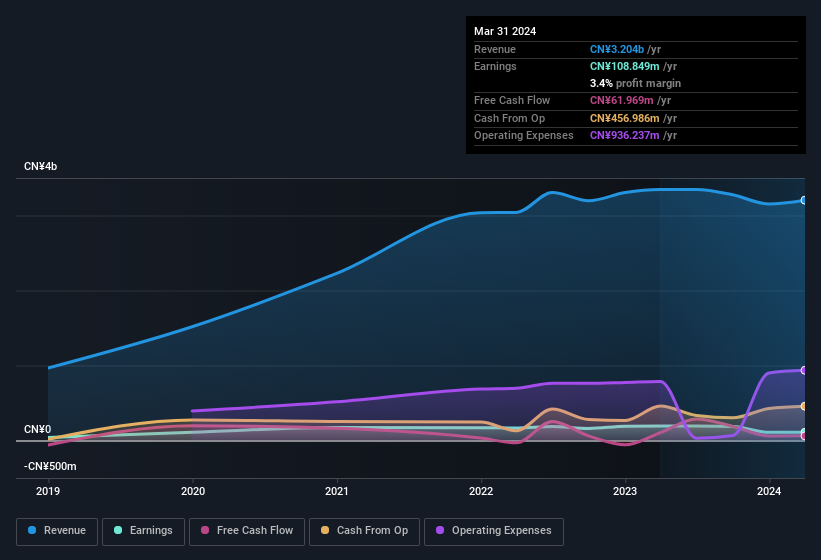

Guangdong Deerma Technology Co., Ltd.'s (SZSE:301332) stock showed strength, with investors undeterred by its weak earnings report. While shareholders may be willing to overlook soft profit numbers, we believe that they should also be taking into account some other factors which may be cause for concern.

Check out our latest analysis for Guangdong Deerma Technology

How Do Unusual Items Influence Profit?

To properly understand Guangdong Deerma Technology's profit results, we need to consider the CN¥21m gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. Guangdong Deerma Technology had a rather significant contribution from unusual items relative to its profit to March 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Guangdong Deerma Technology's Profit Performance

As we discussed above, we think the significant positive unusual item makes Guangdong Deerma Technology's earnings a poor guide to its underlying profitability. For this reason, we think that Guangdong Deerma Technology's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To help with this, we've discovered 4 warning signs (1 is a bit concerning!) that you ought to be aware of before buying any shares in Guangdong Deerma Technology.

This note has only looked at a single factor that sheds light on the nature of Guangdong Deerma Technology's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301332

Guangdong Deerma Technology

Engages in the research, production, and marketing of electrical appliances under the DEERMA brand name in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026