- China

- /

- Consumer Durables

- /

- SZSE:300885

Unveiling Undiscovered Gems With Potential In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets have shown mixed signals with U.S. consumer confidence declining, while major stock indexes experienced moderate gains despite a holiday-shortened week. Amidst these fluctuations, the search for undiscovered gems in the small-cap sector becomes increasingly relevant, as investors look for stocks that exhibit resilience and growth potential even when broader market sentiment is uncertain. Identifying such stocks often involves evaluating their fundamentals and potential to thrive in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Global Infotech (SZSE:300465)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Global Infotech Co., Ltd. offers financial information software products and integrated services in China, with a market capitalization of CN¥8.94 billion.

Operations: Global Infotech generates revenue through financial information software products and integrated services in China. The company has a market capitalization of CN¥8.94 billion.

Global Infotech, a smaller player in the tech sector, has shown resilience by becoming profitable this year. The company's net income for the nine months ended September 2024 was CNY 24.04 million, up from CNY 21.22 million last year, despite a drop in sales to CNY 762.9 million from CNY 885.44 million previously. Its debt to equity ratio rose significantly over five years from 14.9% to 48.6%. Recent activities include completing a share buyback worth CNY 30 million for approximately 0.67% of its shares, suggesting confidence in its valuation amidst fluctuating market conditions and earnings improvements.

- Take a closer look at Global Infotech's potential here in our health report.

Review our historical performance report to gain insights into Global Infotech's's past performance.

Yangzhou Seashine New MaterialsLtd (SZSE:300885)

Simply Wall St Value Rating: ★★★★★★

Overview: Yangzhou Seashine New Materials Co., Ltd. specializes in the design, production, and marketing of various powder metallurgy structural parts in China, with a market cap of CN¥2.85 billion.

Operations: Yangzhou Seashine generates revenue primarily through the sale of powder metallurgy structural parts. The company's cost structure includes expenses related to production and marketing, impacting its profitability. Notably, it has a market capitalization of CN¥2.85 billion.

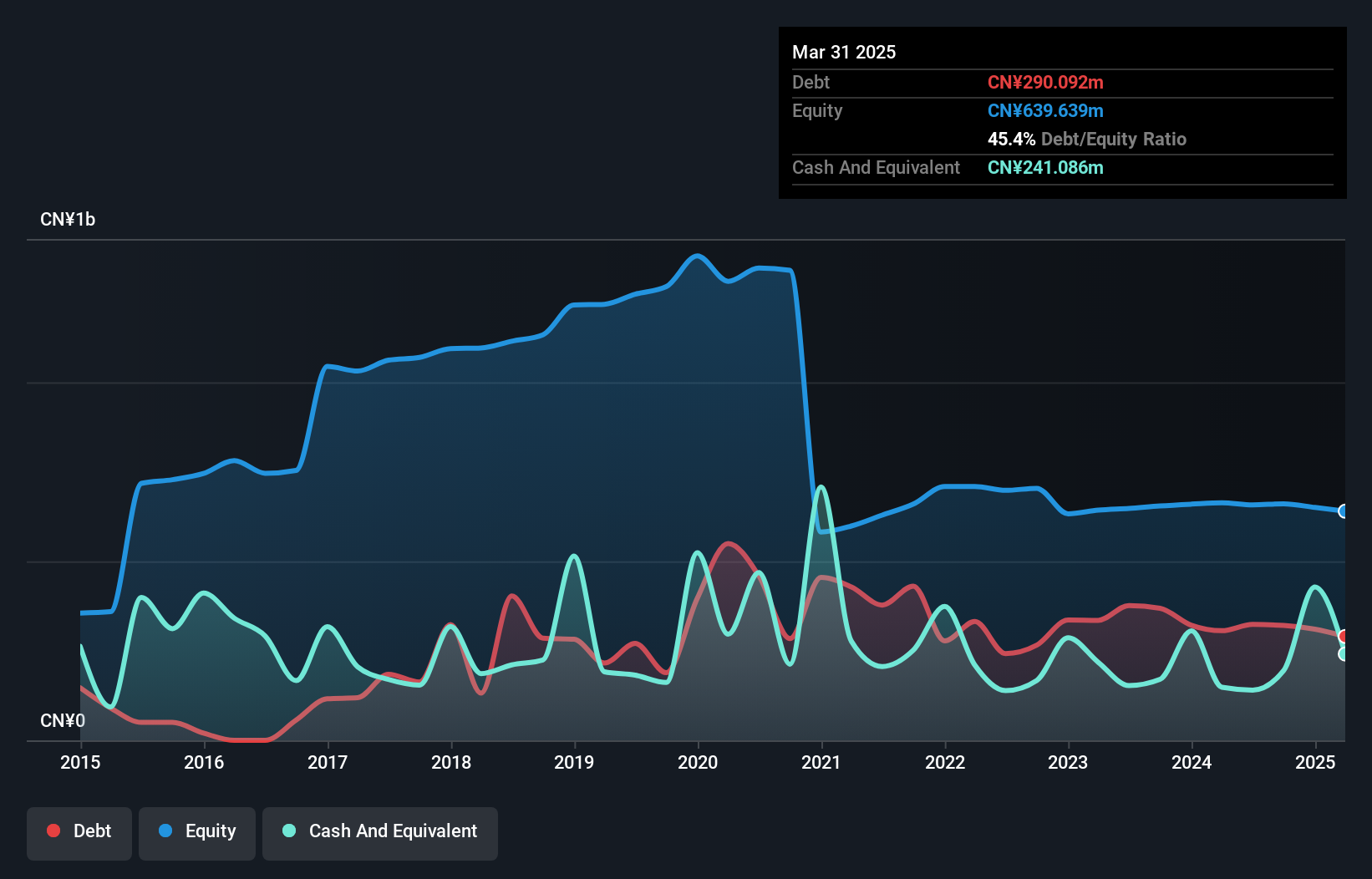

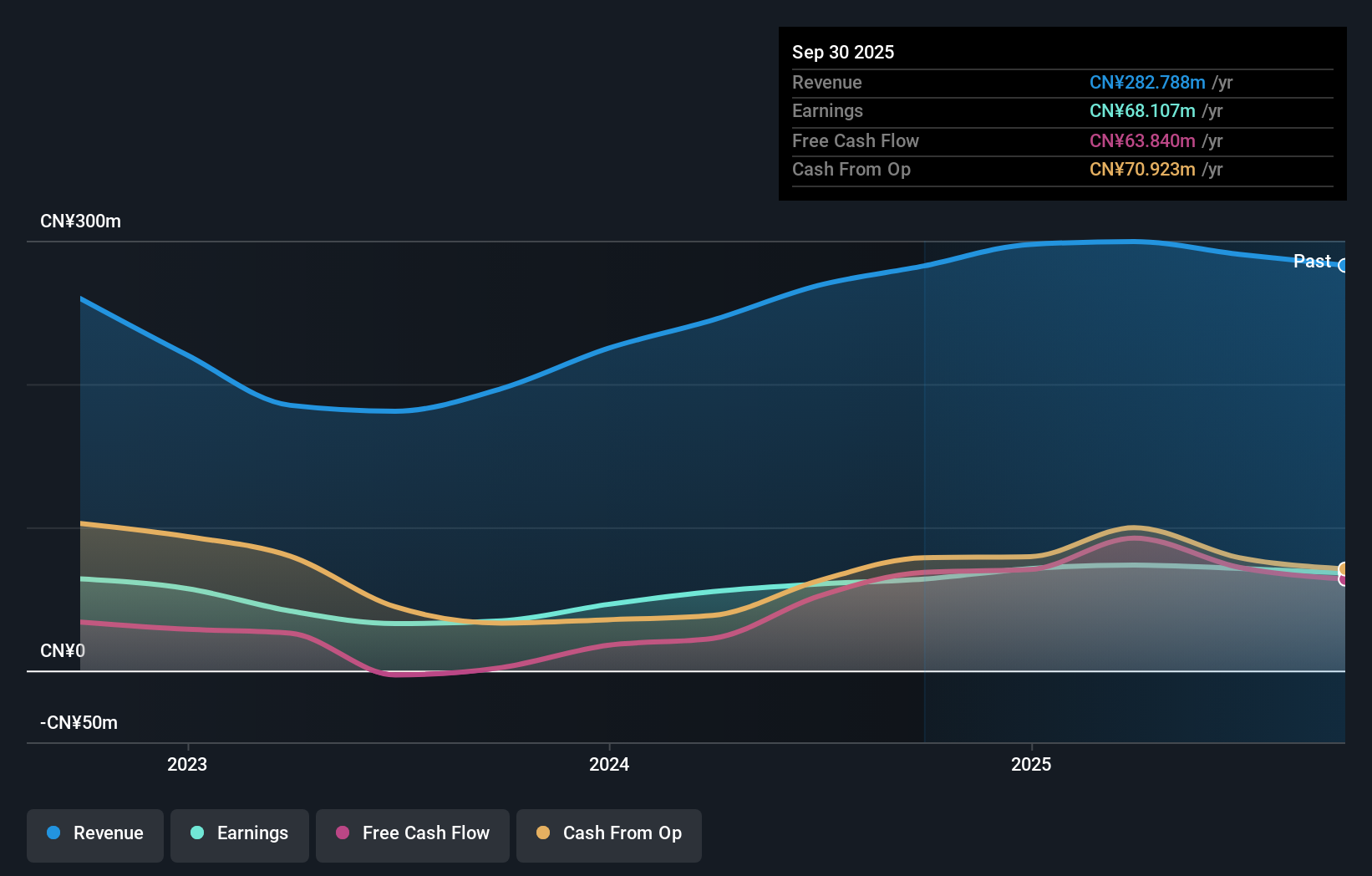

Yangzhou Seashine New Materials, a nimble player in the materials sector, has shown impressive earnings growth of 84% over the past year, outpacing the Consumer Durables industry's -0.2%. With no debt on its books for five years, financial stability seems robust. The company reported revenue of CNY 217.17 million and net income of CNY 45.73 million for the first nine months of 2024, up from CNY 159.59 million and CNY 28.02 million respectively a year prior. Despite past challenges with declining earnings over five years at an annual rate of 9%, recent performance indicates potential resilience and value creation opportunities moving forward.

Create SD Holdings (TSE:3148)

Simply Wall St Value Rating: ★★★★★★

Overview: Create SD Holdings Co., Ltd. operates in Japan through its subsidiaries, focusing on drug stores, dispensing pharmacies, and nursing care businesses with a market cap of ¥181.66 billion.

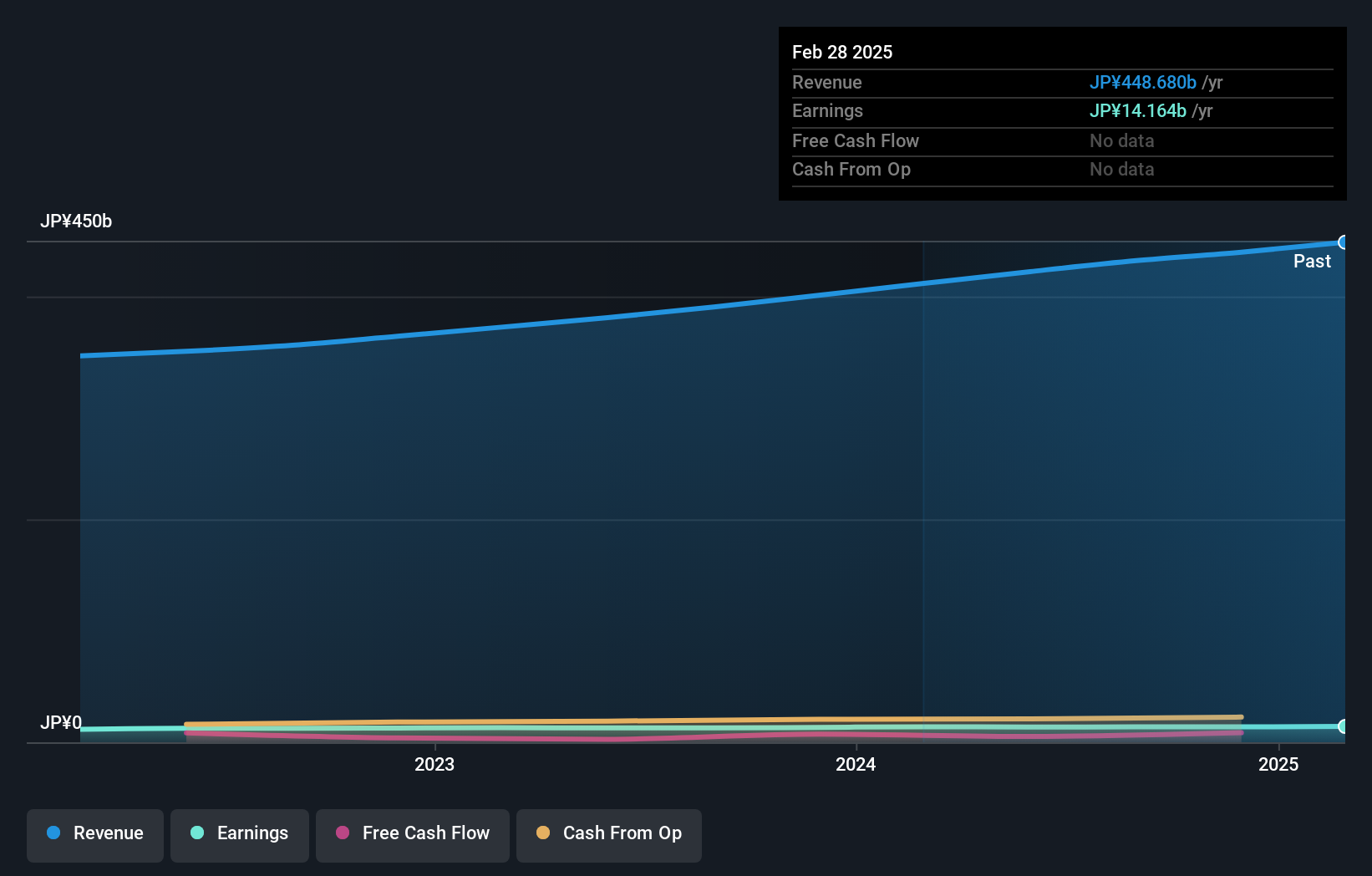

Operations: Create SD Holdings generates revenue primarily from its drug store business, which accounts for ¥432.15 billion. The company focuses on optimizing its cost structure to enhance profitability.

Create SD Holdings, a promising contender in the market, showcases a robust financial profile with its debt-free status and high-quality earnings. Over the past five years, its earnings have grown at an annual rate of 4%, albeit slightly trailing behind the broader Consumer Retailing industry which grew at 11.8% last year. The company sports a favorable price-to-earnings ratio of 13.1x compared to the JP market's 13.7x, suggesting potential undervaluation. Despite shareholder dilution over the past year, Create SD remains free cash flow positive, highlighting its operational efficiency and ability to generate cash without relying on debt financing.

- Click to explore a detailed breakdown of our findings in Create SD Holdings' health report.

Explore historical data to track Create SD Holdings' performance over time in our Past section.

Taking Advantage

- Explore the 4626 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300885

Yangzhou Seashine New MaterialsLtd

Engages in the design, production, and marketing of various powder metallurgy structural parts in China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives