As global markets continue their upward trajectory, buoyed by optimism surrounding potential trade deals and AI advancements, small-cap stocks have yet to capture the same momentum as their larger counterparts. Amidst these developments, identifying promising small-cap companies can be a strategic move for investors seeking growth opportunities that align with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Yibin City Commercial Bank | 94.70% | 10.75% | 23.87% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Yalian Machinery (SZSE:001395)

Simply Wall St Value Rating: ★★★★★★

Overview: Yalian Machinery Co., Ltd. specializes in the research, development, production, service, and sale of wood-based panel production lines and supporting equipment with a market capitalization of CN¥4.32 billion.

Operations: Yalian Machinery generates revenue primarily from its production line segment, contributing CN¥656.93 million, followed by reconstruction projects and steel belts with CN¥73.50 million and CN¥42.62 million respectively. The company has a market capitalization of CN¥4.32 billion.

Yalian Machinery, a relatively small player in the machinery industry, recently made waves by completing an IPO worth CNY 416.13 million and joining two major Shenzhen Stock Exchange indices. The company's earnings for the past year show impressive growth, with net income reaching CNY 125.76 million from CNY 65.32 million a year prior and basic earnings per share doubling to CNY 1.92. Despite its illiquid shares, Yalian's debt-free status and high-quality earnings position it well within its sector, outperforming industry averages with a notable 64.9% rise in earnings over the last year.

- Click here and access our complete health analysis report to understand the dynamics of Yalian Machinery.

Assess Yalian Machinery's past performance with our detailed historical performance reports.

Digiwin (SZSE:300378)

Simply Wall St Value Rating: ★★★★★★

Overview: Digiwin Co., Ltd. offers industry-specific software solutions both in Mainland China and internationally, with a market capitalization of CN¥8.88 billion.

Operations: Digiwin generates revenue primarily through its software services segment, which accounts for CN¥2.39 billion.

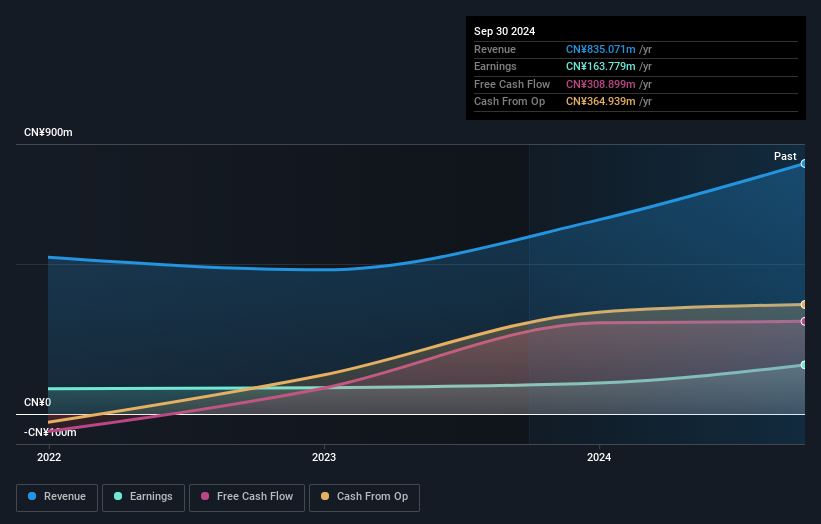

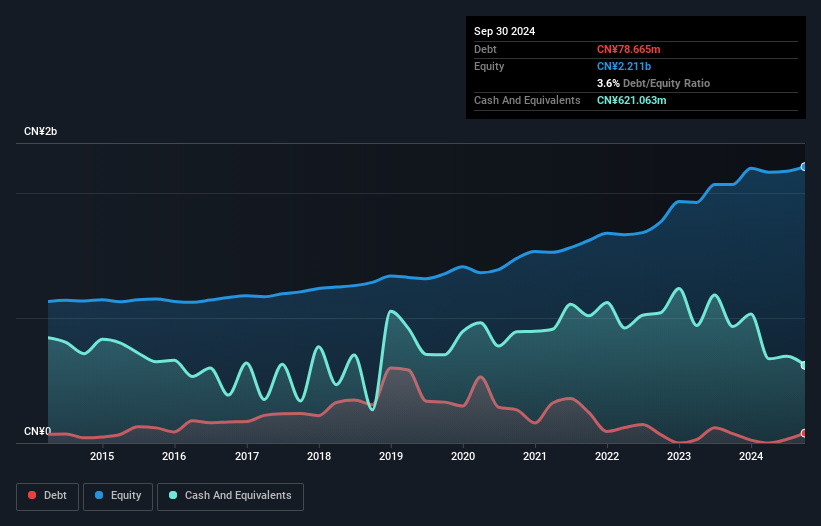

Digiwin, a promising player in the tech space, showcases a mix of strengths and challenges. Over the past year, earnings grew by 12.1%, outpacing the Software industry's -11.2% performance. The debt to equity ratio has impressively decreased from 24.2% to 3.6% over five years, indicating improved financial health. However, its price-to-earnings ratio stands at 58.7x, still below the industry average of 88.7x but not yet free cash flow positive as of recent reports ending September 30, 2024; sales rose to CNY1.57 billion from CNY1.41 billion last year with net income slightly increasing to CNY49 million from CNY48 million previously.

- Unlock comprehensive insights into our analysis of Digiwin stock in this health report.

Examine Digiwin's past performance report to understand how it has performed in the past.

Qingdao KutesmartLtd (SZSE:300840)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qingdao Kutesmart Co., Ltd. is engaged in the manufacturing and selling of men's, women's, and children's wear both within China and internationally, with a market capitalization of CN¥6.83 billion.

Operations: Kutesmart generates revenue primarily from the sale of men's, women's, and children's clothing in domestic and international markets. The company's financial performance is reflected in its market capitalization of CN¥6.83 billion.

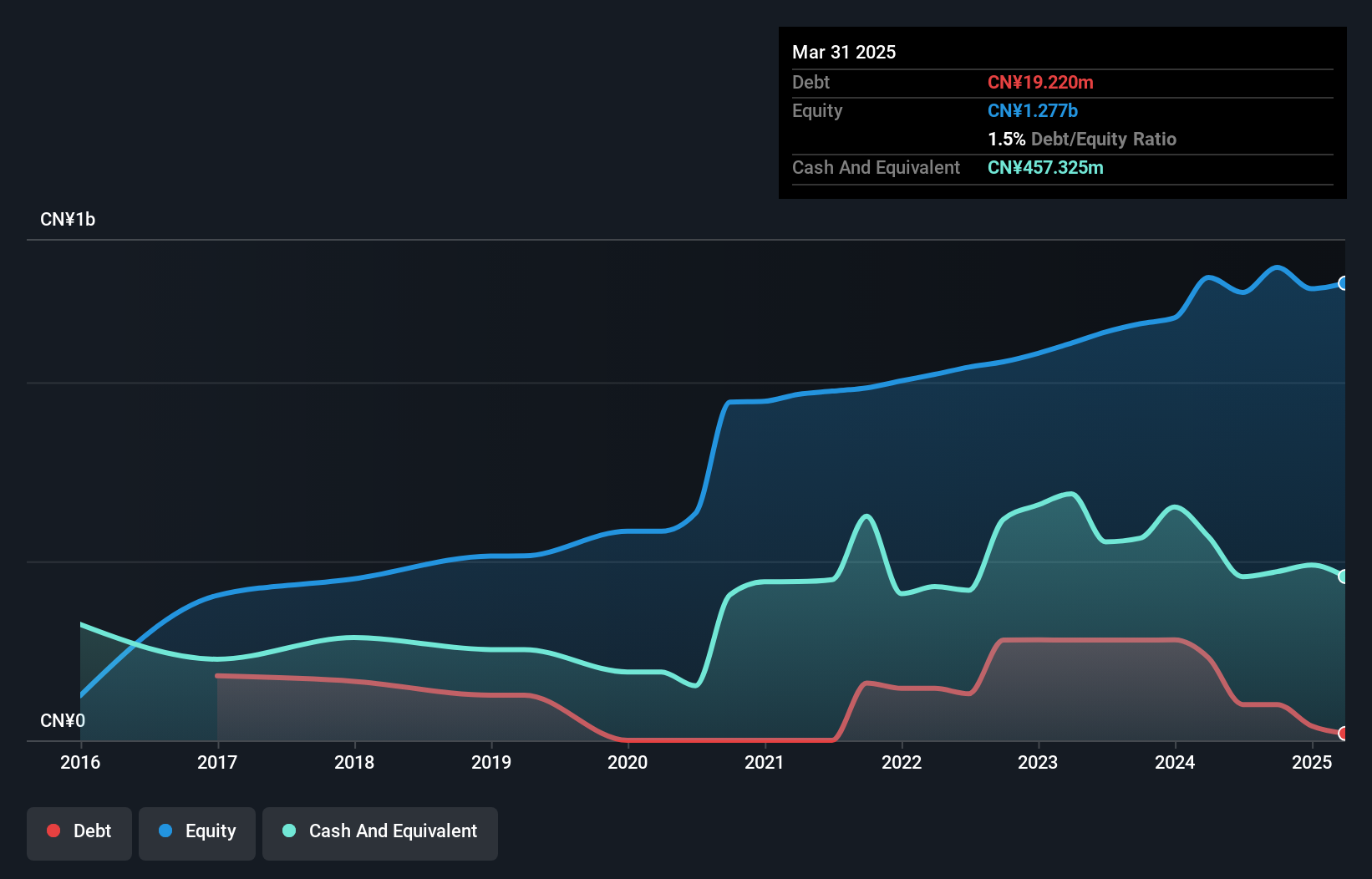

Qingdao Kutesmart Ltd., a smaller player in the luxury sector, has demonstrated impressive earnings growth of 45.9% over the past year, outpacing the industry's modest 1.9%. The company enjoys high-quality earnings and maintains a healthy financial position with more cash than total debt. Despite this strength, its share price has been highly volatile in recent months, which might concern some investors. Levered free cash flow was US$82 million as of late September 2024, suggesting operational efficiency improvements after previous fluctuations. Looking ahead, Qingdao Kutesmart's profitability and robust cash runway suggest potential for sustained performance amidst industry challenges.

Where To Now?

- Reveal the 4666 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001395

Yalian Machinery

Engages in the research, development, production, service, and sale of wood-based panel production lines and supporting equipment.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives